Business

09:34, 05-Dec-2018

U.S. dollar falls on economic growth fears

Updated

08:34, 08-Dec-2018

CGTN

The U.S. dollar slid in late trading on Tuesday, as an inverted U.S. Treasury yield curve sparked general concerns about a slowdown in U.S. economic growth.

The dollar index, which measures the greenback against six major peers, was down 0.07 percent to 96.9680 at 3:00 p.m. (2000 GMT).

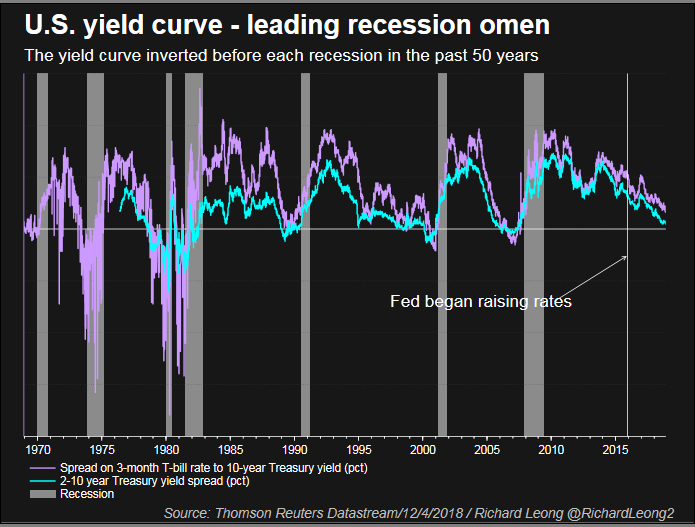

Two-year bond and three-year bond yields surpassed the five-year yield for a second day on Tuesday, according to Reuters data, creating an inversion of the yield spread, which is normally viewed as a precursor of an economic downturn.

The yield curve inverted before each recession in the past 50 years. /Reuters Photo

The yield curve inverted before each recession in the past 50 years. /Reuters Photo

Over the past five decades, an inversion of yield spread between the two-year and 10-year notes appeared ahead of every recession in the United States. Analysts cautioned that the latest inversion between short-dated and long-dated bonds signaled market expectations that U.S. economic growth will slow down.

The recent broad sell-offs in the stock markets have prompted some investors to turn to the comparatively less risky U.S. Treasury bonds and also increased demands for the greenback as a safe-haven currency because of its high liquidity.

However, analysts said as traders grew worried about sagging U.S. growth, longer-dated Treasury bond yields have been sharply weighed down.

In late New York trading, the euro was down to 1.1341 U.S. dollars from 1.1342 U.S. dollars in the previous session, and the British pound was down to 1.2717 U.S. dollars from 1.2726 U.S. dollars in the previous session. The Australian dollar was down to 0.7337 U.S. dollar from 0.7348 U.S. dollar.

The U.S. dollar bought 112.81 Japanese yen, lower than 113.68 Japanese yen of the previous session. The U.S. dollar decreased to 0.9974 Swiss francs from 0.9988 Swiss francs, and it was up to 1.3247 Canadian dollars from 1.3210 Canadian dollars.

Source(s): Xinhua News Agency

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3