Business

12:35, 14-Aug-2018

NIO files for US IPO as NEV battle with Tesla heats up

Updated

12:21, 17-Aug-2018

Nicholas Moore

Chinese new energy vehicle brand NIO has filed for an initial public offering on the New York Stock Exchange, with the automaker looking to build on domestic success and take on its US rival Tesla.

According to a filing submitted Monday to the US Securities and Exchange Commission, the IPO is for up to 1.8 billion US dollars, putting the company into unicorn territory less than two months after it began deliveries of its first road vehicle, the ES8.

The ES8, a seven-seater SUV which retails at around half the price of a Tesla Model X for 448,000 yuan (67,697 US dollars), saw deliveries of 1,331 vehicles in July in China, according to the Chinese Passenger Car Association.

Based on Bloomberg estimates, these figures suggest NIO is already outselling Tesla, which delivers an estimated 800 to 1,000 units per month in China.

NIO saw revenue of 45.99 million yuan (6.95 million US dollars) in the first half of the year, posting a loss of 502.6 million US dollars. The company has been backed by a series of investors including Tencent, and beyond developing its own NEVs is also working on autonomous car technology and swappable battery technology.

In an interview with CNBC at the time of the launch of the ES8, NIO founder Li Bin said, “I think Tesla is our rival in that consumers will choose between our products. But I wouldn't say we are the Chinese Tesla, or they are the American NIO.”

Tesla’s recent sales in China may have taken a minor hit because of recent trade tensions, but plans announced in June for the company’s first “gigafactory” in Shanghai, along with the opening up of China’s auto sector, should see Elon Musk’s company continue to strengthen its presence in the Chinese market.

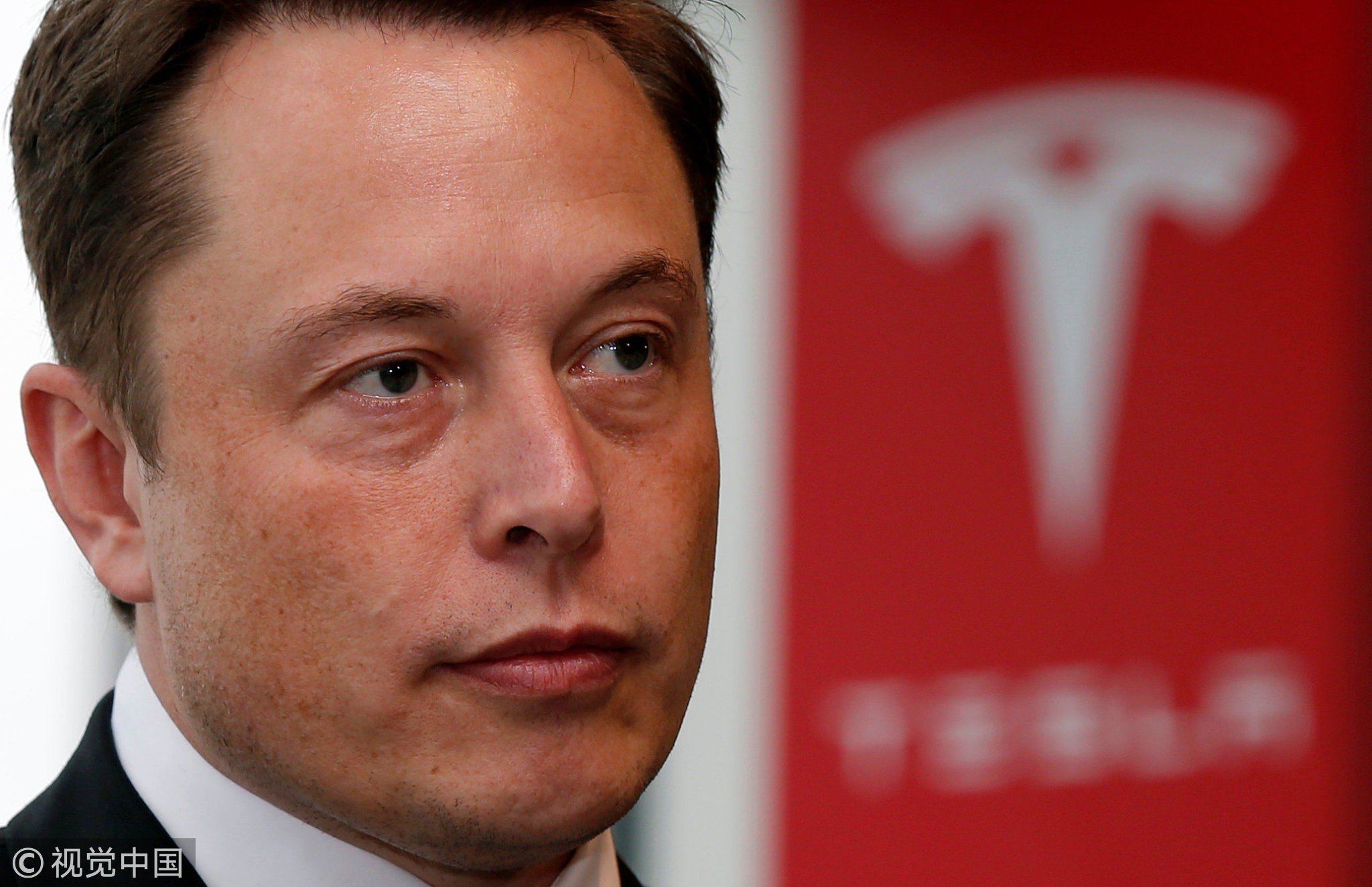

In a blog post published Monday, Tesla founder Elon Musk said "Going back almost two years, the Saudi Arabian sovereign wealth fund has approached me multiple times about taking Tesla private." /VCG Photo

In a blog post published Monday, Tesla founder Elon Musk said "Going back almost two years, the Saudi Arabian sovereign wealth fund has approached me multiple times about taking Tesla private." /VCG Photo

Musk has recently courted controversy by announcing via Twitter plans to take the company private, posting a message on August 8 that said, “Funding secured.”

On Monday, Musk looked to clarify his comments by saying via a blog post that he had recently held talks with representatives of Saudi Arabia’s sovereign wealth fund over securing funding. According to Musk, no deal has been confirmed yet, with details over financing still being discussed.

A later tweet posted by Musk gave further information, with the Tesla founder saying the company was working with Goldman Sachs and Silver Lake as financial advisers “on the proposal to take Tesla private.”

(Top photo: The NIO ES8 on display at the Shanghai Autoshow, April, 2017. /VCG Photo)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3