Analysis

16:21, 07-Mar-2019

Analysis: Who benefits most from China's tax and fee reductions?

Wang Xinyan

China is setting out measures to cut taxes and fees by nearly two trillion yuan (298.31 billion U.S. dollars) to bolster the corporate sector, especially private and small enterprises, demonstrating that the Chinese government is firmly committed to fulfilling its commitment to business and the society.

Said by experts to be "the largest tax and fee reduction in history", the policy instantly ignited social networks in China. "The new taxes and fees reduction measures bring a series of tangible policy sprees for private enterprises," a small business owner said on WeChat.

What does the tax and fee reduction policy convey?

The newly released policy conveys four important signals: First, large-scale tax cuts directly address the pain and difficulties of the entire economy, demonstrating fairness and efficiency; second, inclusive tax cuts let small- and micro-enterprises compete with fewer hindrances; third, the policy significantly reduces the burden of social security contributions for enterprises, especially small- and micro-enterprises; fourth, it pays close attention to implementation to ensure that tax reductions and reductions are implemented, according to a Xinhua report.

The policy has a high reputation from both experts and people from business circles. "I think that tax cuts and fee reductions may already have a strategic position in government behavior, and they are no longer just at the tactical level. It means long-term and stable arrangements," expert Ren Mengshan observed in his analysis on the Beijing News.

VCG Photo.

VCG Photo.

Lei Jun, an NPC deputy and chairman of Xiaomi Technology Co., Ltd., said that the reduction in the value-added tax (VAT) rate has great benefits for manufacturing companies. "We deeply felt the strength of the government's tax cuts and fee reduction."

Who benefits most?

Looking closely at the nearly two trillion yuan tax cuts and fee reduction "dish," VAT reform is undoubtedly the "main dish" and the real economy is the primary service object of this "main dish." According to the Government Work Report, the VAT rate for the manufacturing industry will be lowered from 16 to 13 percent, and the rate for transportation and construction industries will be cut from 10 to nine percent, while ensuring that all industry tax burdens are reduced.

These policies, while reducing the load on the real economy, also provide assistance for supply-side structural reforms and promote high-quality economic development.

Tax cuts and fee reductions will inevitably lead to the cancellation of certain administrative licensing items, even if they are taxes or fees related to administrative licensing matters.

Small- and micro-enterprises – as a new force for development, the main channel of employment, and an important source of innovation – are important beneficiaries of inclusive tax reduction policies.

VCG Photo.

VCG Photo.

"Average broadband service rates for small- and medium-enterprises will be lowered by another 15 percent, and average rates for mobile internet services will be further cut by more than 20 percent" , "[implementing] preferential tax policies such as raising the VAT threshold from 30,000 to 100,000 yuan in monthly sales for small-scale taxpayers," ... these measures from the Government Work Report will further reduce the burden on small and micro enterprises and stimulate market vitality to a greater extent.

The government will also reduce the social security contribution ratio to alleviate pressure on companies.

"As a labor-intensive enterprise, the company's labor costs are comparatively heavy and the need to reduce the social security rate is more urgent," Zhang Xuewu, NPC deputy and chairman of Yanjin Shop Food Co. Ltd, told Xinhua.

His views were echoed by Zhu Jianmin, member of the National Committee of the CPPCC and chairman of the Oak Holdings Group, who said, "Reducing the social security rate is undoubtedly a big benefit for enterprises, which is helpful to enterprises as they go into battle without any burdens and further enhance the sense of gain of enterprises."

How can it be ensured that the reduction measures will be implemented?

Some analysts pointed out that in the context of the intensification of the contradiction between fiscal revenue and expenditure this year, if more tax reductions and reductions are to be implemented, it is necessary for government departments to come up with more practical measures.

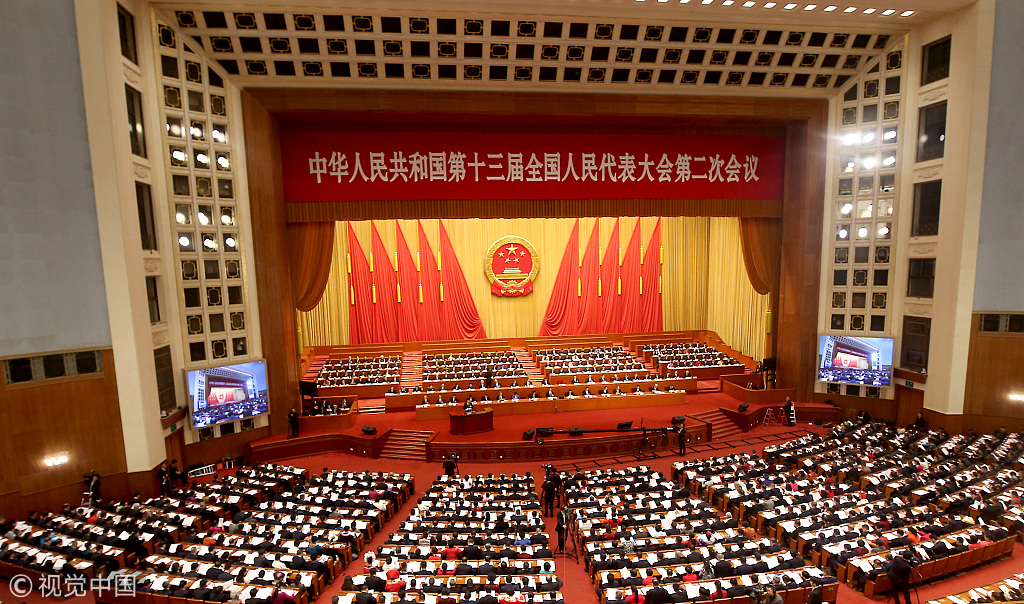

Premier Li Keqiang delivers the government work report at the opening of the National People's Congress (NPC) session at the Great Hall of the People in Beijing on March 5, 2019. /VCG Photo.

Premier Li Keqiang delivers the government work report at the opening of the National People's Congress (NPC) session at the Great Hall of the People in Beijing on March 5, 2019. /VCG Photo.

According to the government work report, the central government should increase revenue and reduce expenditures, increase the profits of certain state-owned financial institutions and central enterprises, reduce general expenditure by more than five percent, and reduce the "three public consumptions" by about three percent. Local governments should also take the initiative to tap the potential, vigorously optimize the expenditure structure, and revitalize various funds and assets through multiple channels. These measures will become an important guarantee for the implementation of tax reduction and fee reduction.

Liu Kun, the Chinese Minister of Finance, said at a press conference on Thursday that tax cuts and fee reductions are the top priority of this year's active fiscal policy. They are a major measure to reduce the burden on enterprises and stimulate market vitality. The major measures have the effect of getting more than one stroke.

The Ministry of Finance will focus on reducing the tax burden of manufacturing and small and micro enterprises by adopting policies of inclusive tax cuts and structural tax cuts, and effectively enhance the sense of gain of enterprises.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3