Biz Analysis

15:47, 06-Mar-2019

NPC’s private sector boost to achieve three goals at once

Updated

16:52, 06-Mar-2019

Jimmy Zhu

Editor's Note: Jimmy Zhu is chief strategist at Fullerton Research. The article reflects the author's opinion, and not necessarily the views of CGTN.

The 2019 government work report set an annual growth target for this year at 6 to 6.5 percent, a more flexible objective offering greater room for more sustainable growth, financial system reform and improvements to monetary efficiency.

The target shows that the priority for this year is not reaching a specific level of growth, with the focus more likely to be on lending greater support to small and medium companies in the private sector.

Meanwhile, China will look to achieve growth in this reasonable range without fueling excessive debt, which is unsustainable and only increases financial risks.

Moreover, this target gives more flexibility for tweaking monetary policy later on if external uncertainties weigh further on the economy, with progress on trade talks still uncertain and increasing signs of a slowdown among major economies.

Monetary measures highlighted in the government work report also made it clear that policies this year will look to continue improving private companies' operating condition by lowering their borrowing costs and providing easier access.

When the People's Bank of China (PBOC) lowered the broad-based RRR at the beginning of this year, it led to speculation that liquidity injections would come at a larger scale this year.

The government report seems to extinguish such doubts, as the report specifically mentioned that further RRR cuts will target smaller banks to help support the private sector.

Part of the thinking behind the past four rounds of targeted RRR cuts was to curb financial risks amid mounting selling off pressure in the yuan and local stocks. Such trends have been successfully reversed, as both the yuan and Chinese stocks are the top performers among their peers so far this year.

A pledge to continue lowering the RRR at a targeted mode clearly shows a determination to boost the private sector as a major policy focus.

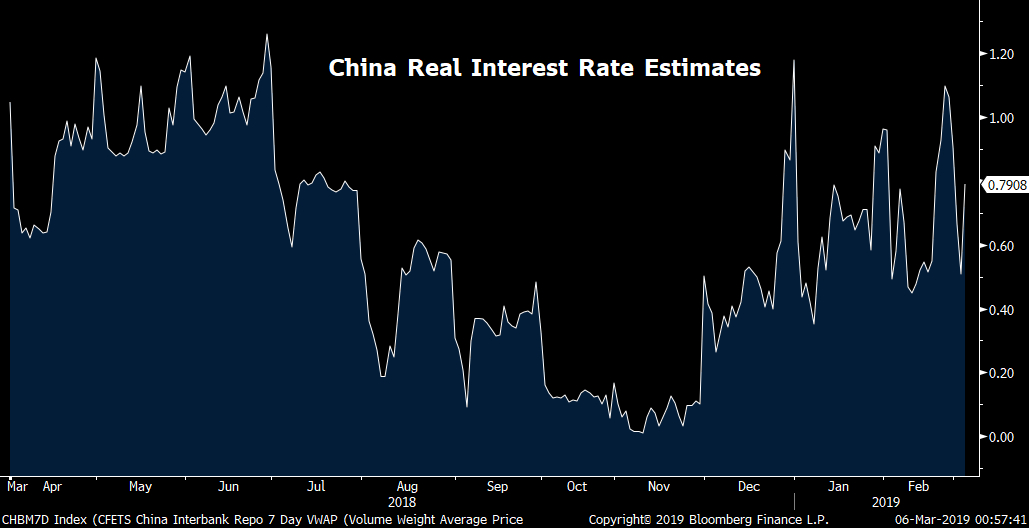

The door is also opened for the central bank to lower interest rates, as the government work report aims to lower real interest rates. As the nation's inflationary pressure has been easing in the last few months, China's real interest rates even increased since November last year, as the chart below shows.

Source: Bloomberg

Source: Bloomberg

If a rate cut is an ideal option, there is still debate about whether or not benchmark rates or market rates should be lowered. Side effects such as yuan or market volatility could be avoided if the PBOC opts to cut benchmark rates.

To prevent abnormal fluctuations in the financial market and keep FX reserves stable, as highlighted in the report, it seems that authorities prefer to make cuts to areas like medium-term lending facility (MLF) and open market operations (OMO) for now.

Market rates are also more relevant to the lending rates that private firms get from financial institutions. In other words, an effort to support private companies' credit conditions would also help to reform China's interest rate system.

Still, we expect the central bank to use the benchmark rate as a policy option in the latter half of the year if the external environment deteriorates or domestic factory inflation continues to decelerate.

Historical data show that targeted measures would benefit the “main street” more than the “wall street,” as funds would be more effectively channeled into the real economy.

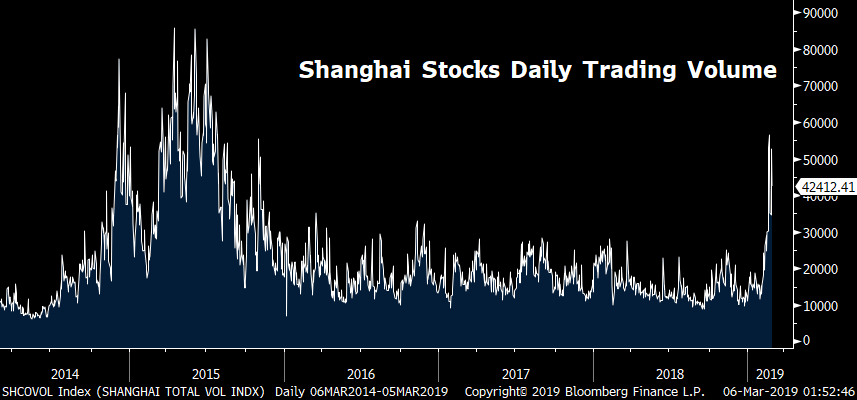

Shanghai stocks' daily trading volumes recently surged to their highest level since 2015, after the central bank initiated broad-based RRR cuts in January. Excessive liquidity usually prefers to move into those stocks which offer higher returns. It was only when stock trading volumes began to shrink from the beginning of 2016 that Chinese economic activity began to recover.

Source: Bloomberg

Source: Bloomberg

A sharp stock market rally will also push fund managers to shift some of their bond portfolio into the stock market, and this could arguably make it harder for private firms to access credit with low borrowing cost.

China's budget deficit is 0.2 percent wider than last year, with greater bond issuance expected to fund infrastructure projects. With an increased supply of bonds theoretically dampening demand, bond prices would come under pressure and push yields higher, increasing the borrowing costs for the private sector.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3