Business

11:25, 30-Apr-2018

Dawn of a new era? Dual-class shares & biotech IPOs accepted in Hong Kong

CGTN's Liu Jing

Companies with dual-class shareholding structures and biotech firms with no revenues are able to apply for listings on the Hong Kong stock exchange (HKEX) from Monday.

The HKEX hasn't seen such major reforms in 25 years as it aims to lure tech companies.

"After a remarkable four-year journey of careful deliberation, HKEX's new listing regime is finally open for business. We are now at the dawn of an exciting new era for Hong Kong's capital markets," said HKEX Chief Executive Charles Li.

Hong Kong Exchanges and Clearing Ltd Chief Executive Charles Li speaks during a news conference announcing the annual results in Hong Kong, China, March 2, 2016. /VCG Photo

Hong Kong Exchanges and Clearing Ltd Chief Executive Charles Li speaks during a news conference announcing the annual results in Hong Kong, China, March 2, 2016. /VCG Photo

Dual-class shareholding structures accepted

According to the new bourse rules, companies with dual-class shareholding structures should have a minimum market valuation of 40 billion Hong Kong dollars (about 5 billion US dollars) to go public. If the valuation falls below that number, the company needs to have revenues of one billion Hong Kong dollars in its latest fiscal year.

“Under the new rules, there are other ways for shareholders to control a company beyond simple capital injections. For instance, a shareholder’s human capital, such as intellectual property, new business models, or founder’s vision can be considered as acceptable means of acquiring control,” said Li.

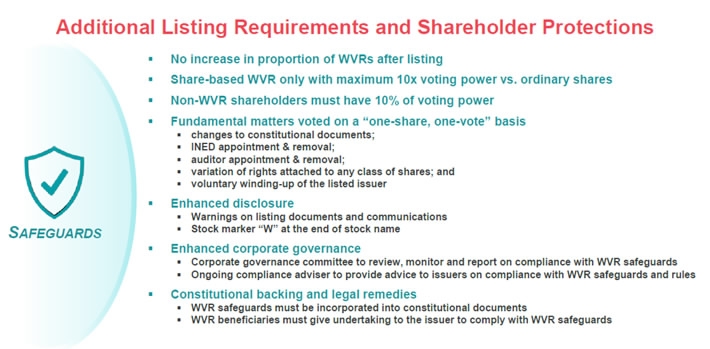

Source: HKEX

Source: HKEX

Biotech firms with no revenue to apply for listing

Many Chinese biotech or genetic companies with no revenue have to go public in the US due to the currently outdated listing rules. Li said that if US-listed companies want to come back, they can consider listing on the Hong Kong bourse.

Biotech companies with no revenue need a certain amount of third-party investment six months before the suggested float date. The companies should have a minimum expected market valuation of 1.5 billion Hong Kong dollars and have engaged in R&D of their core products for at least 12 months.

Source: HKEX

Source: HKEX

“Of course, with great promise comes great risk,” the HKEX chief executive wrote in his blog. “A pharmaceutical firm won’t generate any revenue until it successfully goes through a long process of clinical tests and regulatory approvals.”

He also reiterated that biotech investment is not for the faint-hearted investor.

“Investors should be aware that one clinical test failure could be a major setback for a listed pharmaceutical firm and instantly evaporate much of its market capitalization.”

Source: HKEX

Source: HKEX

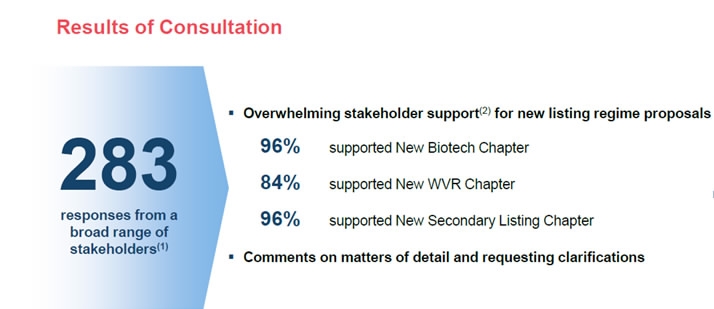

The exchange received a total of 283 responses to the consultation paper from a broad range of respondents representing all stakeholders.

Source: HKEX

Source: HKEX

What the future holds for Hong Kong?

“Basically it will make Hong Kong restore its financial center status as well as boosting China’s international financial status,” CEO of Partners Capital International in Hong Kong Ronald Wan told CGTN.

“People have expected dual-class of share be listing in Hong Kong for a very long time. Companies with dual-class structure went to the US or other overseas market in the past, the new listing rules attracted companies back to Hong Kong."

VCG Photo

VCG Photo

“In addition, we are on the doorstep of the world’s second largest – and arguably most dynamic – global economy with innovative trading connections with Shanghai and Shenzhen that are bringing even more Mainland investor participation to our market,” the HKEX chief executive also wrote this in his blog.

The exchange plans to launch a separate consultation by July 31 on this matter.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3