Opinions

16:04, 17-Sep-2018

Opinion: An enigma with no end game

Updated

15:03, 20-Sep-2018

By Einar Tangen

Editor's note: Einar Tangen is a current affairs commentator. The article reflects the author's opinion, and not necessarily the views of CGTN.

Every solution presents a new set of challenges.

Ten years after the Global Financial Crisis (GFC), where are we? And what happens next?

It is often easier to look at an incident in isolation rather than the circumstances which created it, but looking at a tree will not tell you how big the forest is.

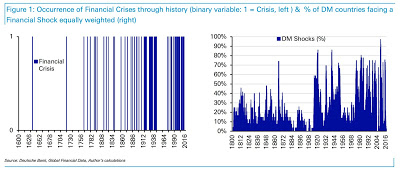

Unfortunately, the Global Financial Crisis is just one tree in an increasingly dense forest of financial crises which have been gaining frequency and far reaching global consequences as the economic and political paradigms continue to evolve, but worryingly out metrics and solutions do not.

*Since the industrial Revolution the world has seen an unprecedented growth in per capita income and standard of living.

*It has also seen dramatic increase in the number and global impact of financial crises

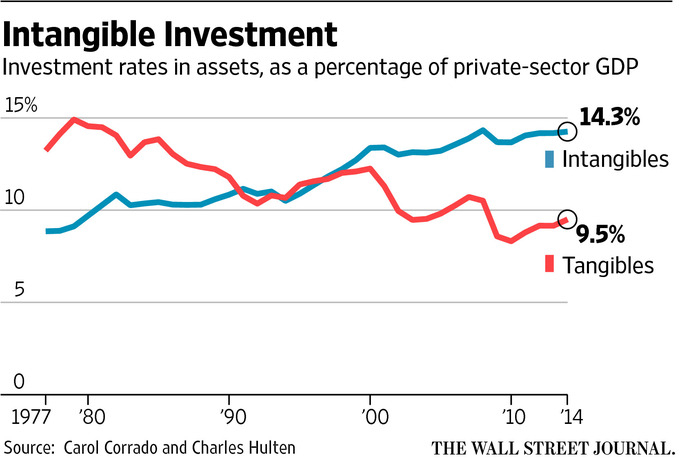

*It has seen a dramatic reversal in the investment rates of tangible vs. intangible assets

According to Leonard Nakamura, an economist at the Federal Reserve Bank of Philadelphia, "Altogether, companies in the US could have more than 8 trillion US dollars in intangible assets, that's nearly half of the combined 17.9 trillion US dollars trillion market capitalization of the S&P 500 index."

"These days, companies put far more money into nonphysical assets, such as customer databases, than they do in building new factories. Companies invested the equivalent of 14 percent of the private sector's gross domestic product in intangibles in 2014, according to a research by economist Carol Corrado. The investment in physical assets was about 10 percent of that sum."

David Post, who leads the Sustainable Accounting Standards Board's (SASB) team of sector analysts, in an interview to Christopher P Skroupa on November 1, 2017 said, "Intangibles have grown from filling 20 percent of corporate balance sheets to 80 percent, due in large part to the expanding nature, and rising importance of intangibles, as represented by intellectual capital vs. bricks-and-mortar, research and development vs. capital spending, services vs. manufacturing, and the list goes on."

This example encapsulates the existence and value of Apple, a trillion dollar company based on 98 percent intangibles, consisting of brand, research and IP, the smartphone giant captured 87 percent of industry profits worldwide in 2018.

*Volatility fueled by a lack of metrics leading to speculation

Classical capitalist economic theory emphasizes the need for transparency of information and understanding of valuation.

Tangible assets fit into this model, land, factories, equipment, inventory, distribution, logistics etc. can be easily understood and valued with the metrics we have, but we lack accurate metrics to value intangible assets like brand, research and IP, making them more or less "pigs in a poke". The result has been a series of speculative bubbles.

*A smaller percentage of

the world, dominated by the west, controls and drives a larger percentage of

its wealth, which is being created in the east.

Half

of world's total wealth is held by 1 percent of the population, including 84

percent of the world's stocks

The US and Europe represent 10 percent of the world's population but hold 60 percent of its wealth. Emerging and developing nations have over 85 percent of the world's population and just under 60 percent of its GDP (PPP).

24-hour nonstop financial markets allow those with money to pursue investment yield around-the-clock, but that also means that investment is being driven at a faster pace by a smaller number of people. These money managers create volatility as they drive prices for equities, companies and assets up and down.

The combination of concentrated wealth, shifting markets and financial opportunism are like titanic plates, which are what is driving political and economic friction.

*What drives our markets has changed

The nature of what drives our economy has changed dramatically from individual necessities like food, water, shelter, clothing, and collective necessities like power, sewers, transportation, education, communication, medicine and child and elder care, to choices, which focus on an artificial layer of our existence, in terms of how we define ourselves, from clothes, shoes, handbags, jewelry and cell phones to jobs, houses and cars.

The

growth of choice as the main economic driver for emerging and developed nations

has created more volatility and is part of the explanation to why intangible

assets now dwarf tangible assets, but choices fickle and has been seen how golden brands have lost their luster overnight due to controversy or perception.

*The domination of the trade dollar has become an economic drag

The US trade dollar dominance has grown beyond its competence; while it facilitates private transactions, it is fracturing national economies. Developing and emerging countries, that are forced to borrow in dollar denominated debt by the credit markets, are then at the mercy of currency devaluations and market volatility; witness, Argentina, Turkey and Ukraine.

*Technology is changing our world and its future

Technology will be responsible for eliminating between 1/3 and 1/2 of existing jobs in the next 12 years. Given the magnitude of these numbers, people should expect political, economic and cultural changes in line with the Industrial Revolution.

*Conclusion

Looking back at the Global Financial Crisis 10 years on, it is tempting to try to explain it in terms of greed and lax regulations, but it is probably more useful to start thinking of it as part of a pattern of increasingly frequent financial crises which have become a norm rather than an exception.

There are many drivers of this new reality and some have been mentioned above, but by no means is it exhaustive, like global warming there are many variables which make up the mad mosaic.

The question, at this point is, what is the best approach to dealing with what is an enigma with no end game. Some say "faith" in the market will solve all, others point to pragmatic planning and action; history seems to be favoring the latter.

This is not to say the future is bleak, to the contrary the future will be influenced by what we do, but that does not include clinging to the old approaches in a hope that it will solve our new challenges.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3