Editor's note: Ken Moak taught economic theory, public policy and globalization at the university level for 33 years. He co-authored a book titled "China's Economic Rise and Its Global Impact" in 2015. The article reflects the author's opinion, and not necessarily the views of CGTN.

It was perhaps in recognition of the importance of China-Canada cooperation in promoting economic, financial and geopolitical relations, that led the two heads of government, Canadian Prime Minister Justin Trudeau and Chinese Premier Li Keqiang to form the high-level China-Canada Economic and Financial Strategic Dialogue in 2017.

The high-level dialogue was to hold regular meetings and be chaired by senior officials discussing issues that concern China, Canada, the Asia Pacific and the world, perhaps with the hope of forging closer trade and investment relations.

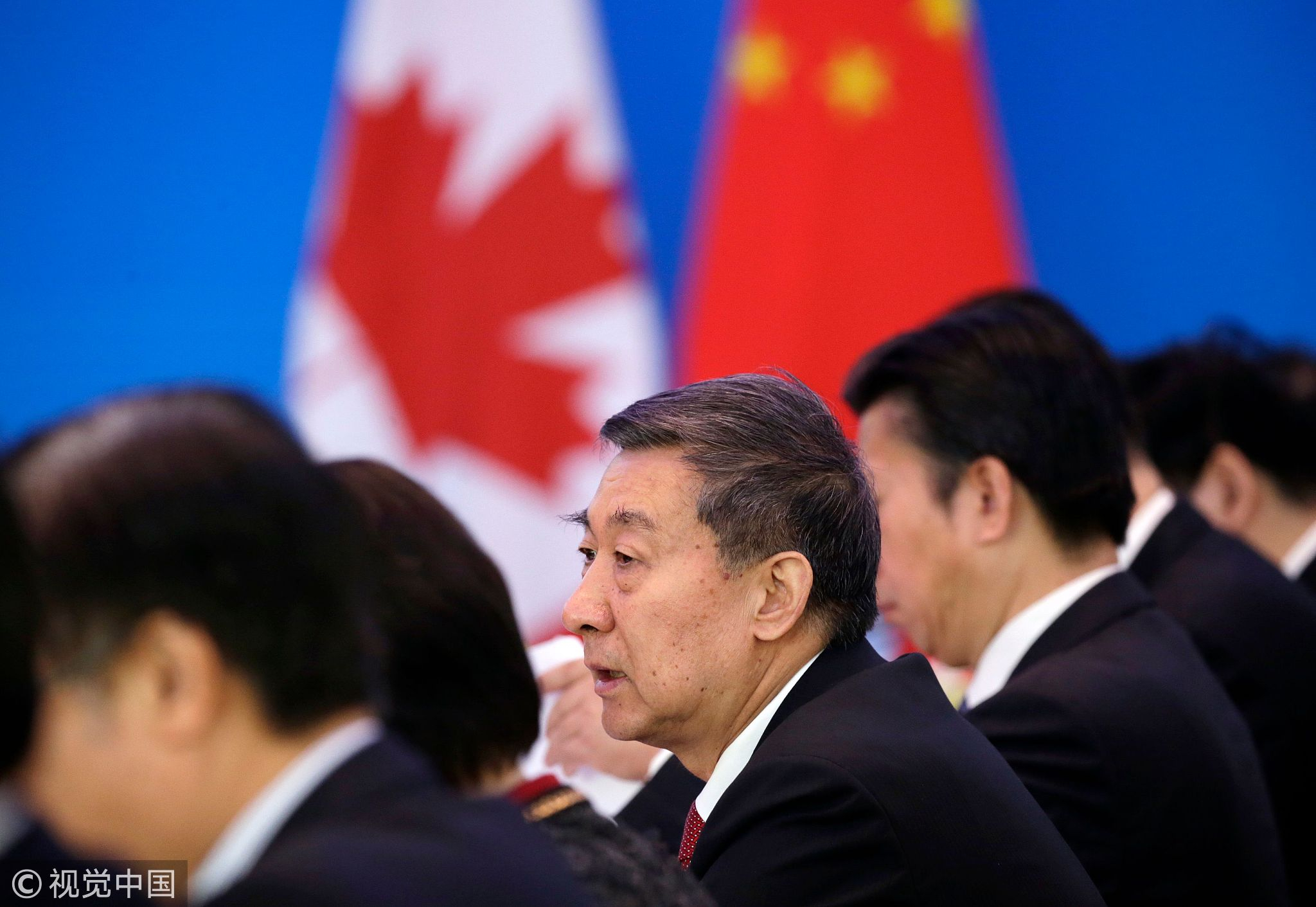

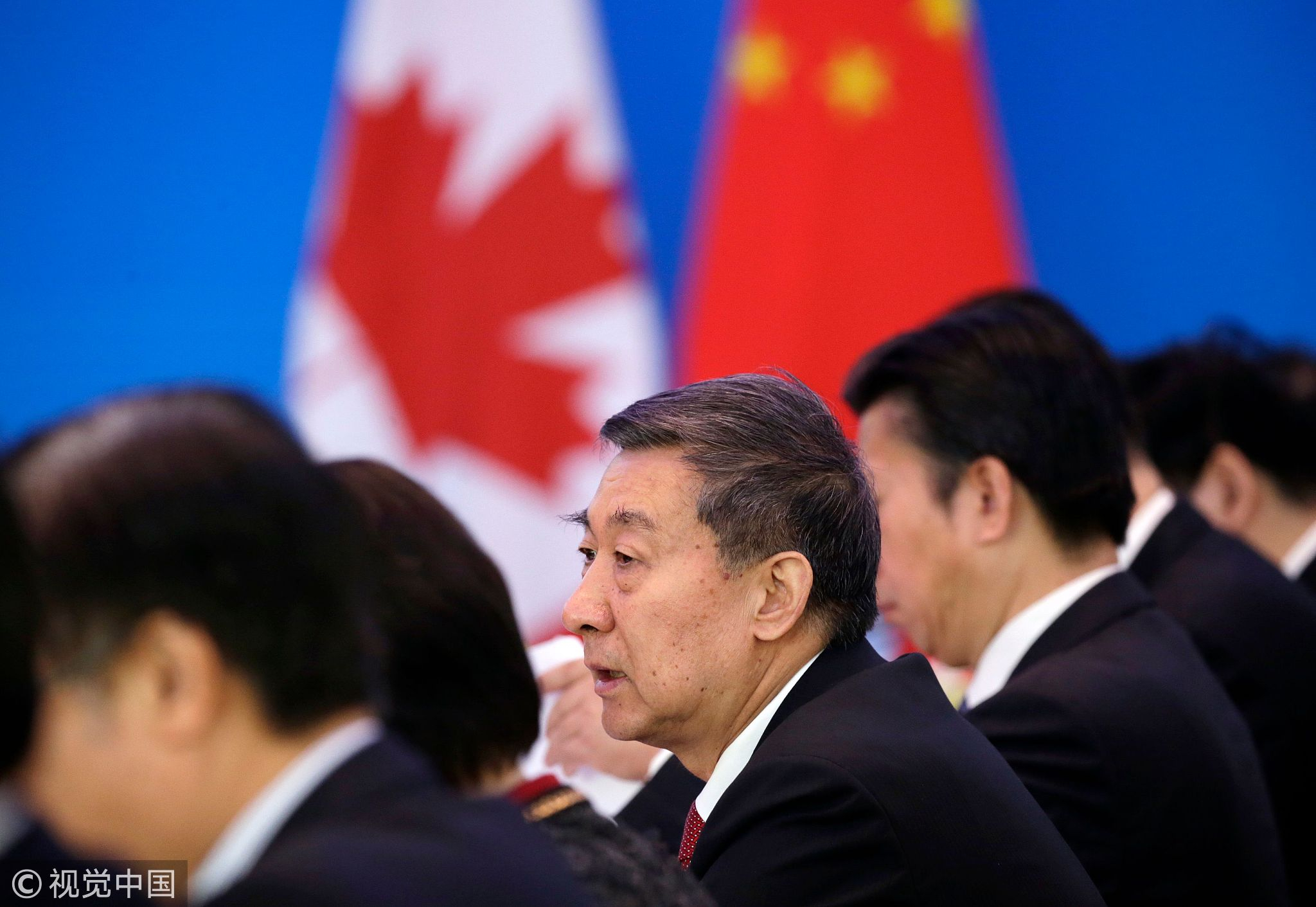

Chinese State Councillor Wang Yong speaks at the first China-Canada Economic and Financial Strategic Dialogue in Beijing, China, November 12, 2018. /VCG Photo

Chinese State Councillor Wang Yong speaks at the first China-Canada Economic and Financial Strategic Dialogue in Beijing, China, November 12, 2018. /VCG Photo

The first round of meetings, held in Beijing on November 12, is to discuss the current world economic, trade, financial and investment systems. Allowing each side to air its views and express how issues could be addressed are important in exploring platforms that could eventually lead to a free trade agreement (FTA) and bilateral investment treaty (BIT).

FTA and BIT are in both countries' national interests

As indicated in my past article, closer trade and investment relations between China and Canada will enhance and sustain both countries' long-term economic growth and stability. Canada is a trading nation in that trade accounts for almost 40 percent of its GDP. But over 75 percent of that is a two-way Canada-US trade.

Putting most of its “eggs in one basket” makes the Canadian economy vulnerable to US economic problems and policies.

For example, the US imposed a 29 percent countervailing duty on Canadian softwood lumber in the 1990s because of complaints from US producers accusing Canada of unfairly subsidizing its industry. That US policy almost crippled the Canadian softwood lumber industry and put forestry-dependent communities on the brink.

Canadian government statistics showed two-way bilateral trade and investment between China and Canada are respectively 94.5 billion Canadian dollars (71.41 billion US dollars) and 15.9 billion Canadian dollars (12.01 billion US dollars) in 2017.

Canadian Prime Minister Justin Trudeau takes part in a business roundtable in Beijing, China, December 5, 2017. /VCG Photo

Canadian Prime Minister Justin Trudeau takes part in a business roundtable in Beijing, China, December 5, 2017. /VCG Photo

And Chinese direct investment (FDI) in Canada was only 6.8 billion Canadian dollars (5.14 billion US dollars) representing 2.5 percent of total Chinese FDI of 270 billion Canadian dollars (210.8 US dollars) in the same year, according to the University of Alberta's China Institute.

Given the relatively low trade and investment figures, there is considerable room for expansion in both trade and investment between China and Canada.

Petro China's 3.8-billion-Canadian-dollar (2.87 billion US dollars) investment in a multinational consortium to build a 40-billion-Canadian-dollar (around 30.2 billion US dollars) liquefied natural gas refinery in Canada's westernmost province of British Columbia could be a sign that better Canada-China relations might be looming.

China has “deep” pockets with over 3 trillion US dollars in foreign reserves and many times that in bank deposits, which could be invested in Canada's resources, high technology, manufacturing, services and infrastructure projects.

On trade, Canada is selling more oil, lumber and other products to China, making the China-Canada two-way trade goal of exceeding 100 billion Canadian dollars (around 75.5 billion US dollars) by 2020 highly probable.

Chinese State Councilor and Foreign Minister Wang Yi and Canadian Foreign Minister Chrystia Freeland attend a bilateral meeting on the sidelines of the ASEAN Foreign Ministers' Meeting in Singapore, August 3, 2018. /VCG Photo

Chinese State Councilor and Foreign Minister Wang Yi and Canadian Foreign Minister Chrystia Freeland attend a bilateral meeting on the sidelines of the ASEAN Foreign Ministers' Meeting in Singapore, August 3, 2018. /VCG Photo

According to the British Columbia Forestry Council, China could replace the US as Canada's biggest lumber buyer within a few years if the present trend continues. Given Canada's vast amount of farmland, it could also guarantee China's feed and food security.

Forging a close trade and investment relationship with China would also increase Canada's leverage in dealing with its southern neighbor. For example, without a pipeline and limited storage facilities, the bulk of Canadian oil is sold to the US at a discount, between 10 and 15 Canadian dollars (7.50-11.30 US dollars) less than the world price.

The China-Canada FTA and BIT are thus good for both countries, particularly Canada because of its relatively small domestic market and heavy reliance on the US for trade and investment.

Domestic politics and ideology got in the way

The Canadian government particularly under the Liberal Party has always wanted closer economic and financial relations with China. Pierre Eliot Trudeau, the current prime minister's father, established diplomatic relations between the two countries in the 1970s.

His successors, Jean Chretien, and Paul Martin made attempts to encourage Canadian companies to do business with China.

Unfortunately, the Liberal government was defeated by Stephen Harper's Conservative Party in 2006. Harper made a “U-turn” on Canada's China policies, vowing not to sell Canadian values for the "almighty dollar.” His successor, Andrew Scheer, promises not to seek an FTA with China if the Conservatives win the 2019 election.

Further, Canada's three major newspapers – Vancouver Sun, The Globe and Mail, and National Post – are overwhelmingly anti-China. For example, The Globe and Mail reported prominently on the front page a few years ago that the Chinese are “buying up” Canada's farmlands.

Canadian milk and milk products are seen in a grocery store in Caledon, Canada, on September 4, 2018. /VCG Photo.

Canadian milk and milk products are seen in a grocery store in Caledon, Canada, on September 4, 2018. /VCG Photo.

In reality, it was a couple of Chinese buyers who bought farms in the interior province of Saskatchewan as an investment. The local communities, in fact, welcomed the investment because the lands were abandoned by the owners.

Other anti-China groups join in. Stephanie Carver, a former national security analyst, commented in an October CBC television program that Chinese state-owned enterprises' investment poses a security threat to Canada without saying why. It does not matter that SOE investment was only 2 percent of total Chinese investment in Canada in 2017, according to the University of Alberta.

A comment

The majority of Canadians seem to oppose any close economic or financial relationship with China. A 2017 Canadian NANOS Research Poll found that 66 percent, 81 percent and 88 percent, respectively, want “human rights” provisions written in an FTA, oppose Chinese SOEs taking over Canadian firms and are uncomfortable with Chinese invest in the oil sands.

The strong opposition to Chinese trade and investment is the result of “subjective” media reporting, portraying China as a “repressive communist dictatorship” suppressing human rights and threatening Canadian “values and security.”

To that end, while a China-Canada FTA and BIT could be a long way off, the first round of meetings under the high-level dialogue framework could be the first step of a long journey in realizing them.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com)