Opinions

16:10, 11-Aug-2018

Opinion: Collaboration, a solution for Turkish economic crisis

Updated

15:46, 14-Aug-2018

CGTN

01:41

Editor's note: This article is based on an interview with Liu Baocheng, a professor at the University of International Business and Economics in China.

The value of the Turkish lira has plunged as its exchange rate against the US dollar has fallen more than 30 percent since the beginning of this year.

Turkey's official statistics show that the country's consumer price index rose 15.85 percent in July, a record high in nearly 14 years. Moreover, the current account deficit in Turkey in the first half of this year has also increased significantly compared with the same period last year.

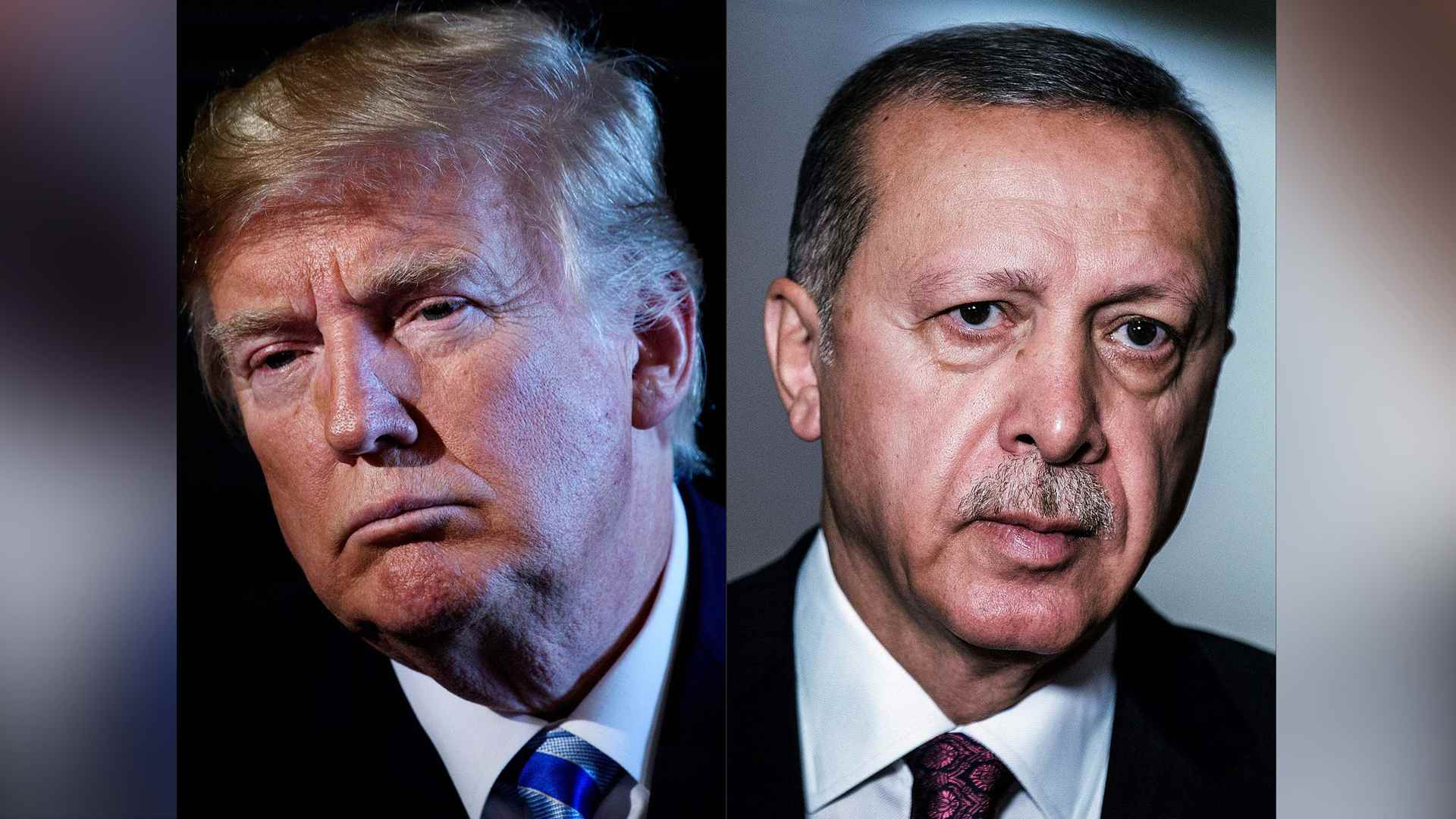

The direct trigger of the depreciation of the Turkish currency is obviously due to the doubling of the US tariffs authorized by President Trump on Turkish steel and aluminum imports of 50 percent and 20 percent, respectively. Trump’s decision has made Europe react negatively in selling lira as “the European banks, particularly from Italy, France and Spain hold virtually more than 40 percent of debt in Turkey,” said Liu Baocheng, a professor at University of International Business and Economics in China.

Liu also added that the high level of inflation and debt Turkey is experiencing has also contributed to the stagnant domestic economy.

Turkish President Tayyip Erdogan is stuck in the dilemma of whether to lower interest rates as by doing so, banks are able to offer loans, thus, adding incentives to the economy.

The Turkish lira on August 1 slumped to record lows of 5.0 against the dollar as the US hit Turkey's justice and interior ministers with sanctions over the case of an American pastor on trial for terror-related charges. / VCG Photo

The Turkish lira on August 1 slumped to record lows of 5.0 against the dollar as the US hit Turkey's justice and interior ministers with sanctions over the case of an American pastor on trial for terror-related charges. / VCG Photo

However, such a method would also bring three disadvantages. Lowering the interest rate might result in even higher inflation, further lowering of the exchange rate and destruction of the independence of the Turkish currency system as well as massive outflow of Turkish capital.

“I think the president has shown a tough attitude to counter the retaliation against the US’ trade embargo instead of seeking for a global relief,” Liu pointed out.

In fact, instead of spewing political and religious rhetoric, constructive solutions can be found if Erdogan could approach the IMF and collaborate with other nations.

Political contact has also led to the monetary tension in Turkey.

According to Liu, "Trump only wants to win a short-term political victory by cutting deals with the rest of the world, particularly the identified major trading partners."

In aiming for zero trade deficit and the appeasement of hawks, Trump is pushing for the isolation of the US.

"They don't even have any big vision for what is going to be next for the US in terms of economic strategy. And they are really defying the entire multilateral trading system," said Liu, adding that actions in favor of unilateralism are very risky.

However, Liu notes that Trump has been selective in considering the degree and nature of trade disputes with the rest of the world.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3