Economy

21:38, 11-Feb-2019

With Iran squeezed out, U.S. oil takes on new rivals in Europe

CGTN

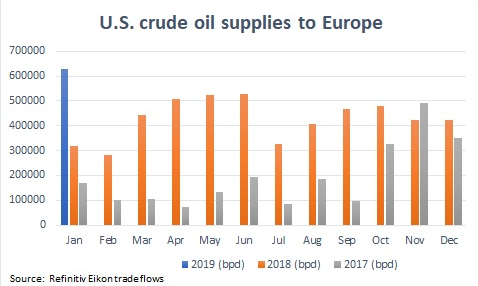

Shipments of U.S. crude into Europe have just hit a new record. January imports were 630,000 barrels per day. In the whole of 2018, U.S. supplies to Europe doubled to 430,000 bpd, according to Refinitiv Eikon flows data. That represented 6 percent of overall imports or equal to the levels of Iranian oil imports to Europe before the United States imposed fresh sanctions on Tehran.

U.S. giant Exxon Mobil and European rival Royal Dutch Shell prepared brochures for oil buyers detailing various U.S. crude grades and why they were suitable to replace part of Asia's long-standing supplies from the Middle East, Africa and Russia.

U.S. supplies to Europe in 2017-2019. /Reuters Graph

U.S. supplies to Europe in 2017-2019. /Reuters Graph

Higher U.S. crude exports have been helped by lower supplies of Iranian and Venezuelan crude, which Washington has put under sanctions, scaring buyers across the world.

“U.S. crude is a real headache. It puts a lot of pressure on regional light grades. In fact, prices for all grades are affected because it is such a significant extra supply,” said a trader with a European trader selling Russian oil.

Pressure will likely only increase as for 2019 U.S. crude oil production is expected to average 12.06 million bpd, up 1.18 million bpd from last year, according to the U.S. government.

Booming U.S. production has prompted OPEC and major non-OPEC producers like Russia to slash output by 3 to 4 percent since 2017 to prop up prices. The pact has helped double prices to 60 U.S. dollars per barrel but at the expense of a market share loss to U.S. firms.

Competition is particularly acute in northwest Europe, where Britain and the Netherlands imported 6.5 and 5.1 million metric tons of U.S. crude in 2018 respectively.

BP takes U.S. oil to its Gelsenkirchen refinery in Germany while Poland's PKN Orlen said in January it would cut Russia's Urals purchases from Kremlin oil major Rosneft by 30 percent and partially replace it with U.S. barrels.

Greece's Hellenic Petroleum added WTI to its list of preferred crude options alongside Urals and CPC as did Turkey's Tupras. In Italy, U.S. oil flows to Kuwait Petroleum's Milazzo refinery and the Swiss Varo Energy's plant.

As the world moves to tighter marine fuel regulations, which will increase demand for light barrels, demand for U.S. oil – which is predominantly light – will only rise.

“I expect U.S. crude to become even more popular in Europe. It seems that whatever is happening to oil markets these days, the U.S. benefits,” said a trader with large European major.

Source(s): Reuters

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3