North America

12:48, 24-May-2019

How will American consumers begin to feel the trade war pinch?

By Yu Jing

When U.S. President Donald Trump decided to slap tariffs on furniture from China, suppliers like Mike Wu, who runs a furniture factory in Foshan City in south China's Guangdong Province, was nonetheless more worried for his American partner.

His factory specialized in producing ready-to-assemble theater seating and airport seating for markets worldwide, with a 10 percent of the market share in the United States. When a 10 percent tariff increase was levied on the seats in May last year, his partner, an American furniture contractor firm, was in a deep panic since Mike was their only supplier.

"We could instead try to sell more to the domestic market, but our American partner had no choice other than paying a higher price," said Mike in an interview with CGTN. He requested not to have his company and his American partner's company named for the fear of any negative market reaction.

Though President Trump repeatedly suggested that higher tariffs on goods from China will have no impact on American firms since they can trade with non-tariffed countries, reality shows that the pain is equal, if not more on American companies.

Since seat manufacturing is a labor-intensive industry, across the world, there are few remaining large-scale factories. "Our competitors are not domestic American factories, but factories from Eastern Europe, Mexico and Turkey," said Mike.

A furniture factory in Guangdong province. /VCG Photo

A furniture factory in Guangdong province. /VCG Photo

This means that when the American furniture contractor tries to look for alternative sourcing, there are not many available options.

"All those seating factories from eastern Europe and South America already have their own contractors in the United States, and thus our American partner cannot easily find a replacement, if they decide to terminate the partnership with us," Mike added.

In the end, the two reached an agreement to share the pain. Mike's company would lower the price of its product for three percent, the American furniture contractor would reduce its profit margin by three percent, and for the rest, the four percent in loss brought by the increased tariff would be passed down to consumers.

If the increase in price is not noticeable after the Trump administration slapped a 10 percent tariff on Chinese imports, it is going to become noticeable once the impact of the 25 percent tariff increase kicks in, said Edward Logan, senior analyst at the GailFosler Group, a strategic advisory service for global business leaders and public policymakers based in New York, in a phone interview with CGTN.

Earlier this month, the Trump administration increased tariffs on 200 billion U.S. dollars' worth of Chinese imports to 25 percent, from the previous 10 percent.

Stocks fell over fears of a trade war, May 6, 2019. /VCG Photo

Stocks fell over fears of a trade war, May 6, 2019. /VCG Photo

Since it usually takes around three weeks to ship goods from China to the United States, American consumers are going to start noticing the price jump in June, at the earliest, Logan said.

In the previous two rounds, it has been primarily agricultural and industrial goods that are hit by the tariff; thus some companies have been trying to shield consumers from the impact of the trade war.

But over time, as intermediate industrial goods are subject to higher tariff and the number of final goods slapped by tariff increased, it becomes impossible to expect companies to absorb the rise in cost without passing it forward to consumers.

The Peterson Institute for International Economics finds that while consumer goods account for only one percent in the first round of tariff increase levied by the Trump administration, in the second round, its percentage rose to 24 percent. In the latest round of tariff hike, about a quarter of the imports hit by the 25 percent tariff are consumer goods.

It is also not as easy for American companies to mitigate the impact of the trade war by looking for alternative sourcing, said Ju Jianshuang, founder of Nantong Jiehao furniture company specialized in bathroom sets and kitchen sets manufacturing.

After the 10 percent tariff hike, his American furniture contractor visited factories in Southeast Asia in hope of shifting the production chain away from China. But they later found out that factories there still had to import most components required in the assembly from China, for instance, painting, hardware, etc.

A man looks at neckties while shopping at a department store in New York City. /VCG Photo

A man looks at neckties while shopping at a department store in New York City. /VCG Photo

Though labor price is lower in Southeast Asian countries, taking into account the cost in material and component parts import, the cost of furniture manufacturing is still 30 percent higher in Southeast Asian countries than China, Ju added.

He said he believed U.S. manufacturers are likely to respond to reduced competition from imports by raising the product price, since "it is the nature of businessmen to do so."

Companies try to assuage fear by saying that U.S. consumers are strong, wages are rising and the labor market is strong, but demand in the market is weaker than most think it is, said Edward Logan, senior analyst at the GailFosler Group. Especially people from the middle class who are price sensitive, they might stop purchasing many items.

Previously during Christmas, American consumers would buy new kitchen sets and sales in the U.S. market would go up dramatically, said Ju. Now, as the tariff kicks in, they probably would not buy new ones anymore.

Even consumer electronics, previously shielded by the Trump administration from tariff increase, are likely to see further pinch if the trade war escalates. In the expanded list of U.S. tariffs on products from China worth 200 billion U.S. dollars, many raw materials used in the production of consumer electronics are included.

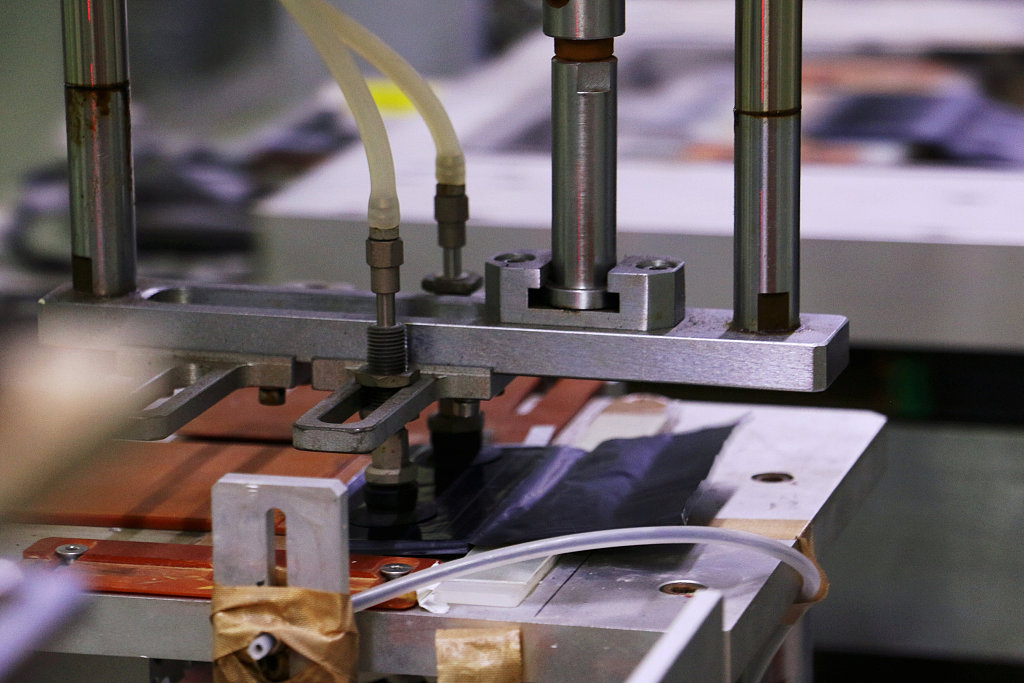

An auto-sealing machine processes a lithium-ion battery for iPhone inside a factory in Dongguan, Guangdong province. /VCG Photo

An auto-sealing machine processes a lithium-ion battery for iPhone inside a factory in Dongguan, Guangdong province. /VCG Photo

A manager at a factory based in Hunan province producing screens for iPhone, who requested to stay anonymous since he is not authorized to speak, said glass, ink and many chemical materials related to the production of iPhone screens are included in the latest list of tariff-targeted goods, leading to a rise in cost.

But that cost increase would unlikely result in a higher price for iPhone since the factory is now in negotiation with Apple and the raw material supplier. All three expressed willingness to bear the increased cost without raising the price on the final product, at least for now.

But for Mike, whose final goods are subject to a 25 percent tariff hike, there is no coping mechanism.

In the furniture industry, that works with a very tight margin, an additional 25 percent of tariff basically means there is no profit anymore, Mike said. For now, he and his American partner agreed to further cut down their profit margin to compensate for the increase in tariff. But still, a price hike is inevitable.

The Trump administration would like to believe that the U.S. side is exempted from the pain brought by the trade war. But in the face of a protracted trade war, the suffering is mutual.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3