Biz Analysis

16:41, 01-Jun-2019

Prolonged inversion in U.S. bond yield curve seen as China releases PMI

Jimmy Zhu

Editor's note: Jimmy Zhu is the chief economist at Fullerton Research. The article reflects the author's opinion, and not necessarily the views of CGTN.

The biggest declines in China's new export orders in almost seven years signal that global growth may slow further in the second half of the year. Without much policy support from major global central banks, U.S. Treasuries' yield curve may further invert, a signal which has been a reliable indicator of past recessions.

China's new export orders fell 2.7 to 46.5 in March, the biggest decline since June 2012. Some market participants attributed the drop to escalating trade tensions between the two largest economies. However, there is other evidence showing that falling export orders are more relevant to weakening global demand. If so, the external outlook could become more challenging, even if progress on trade is made later in the year.

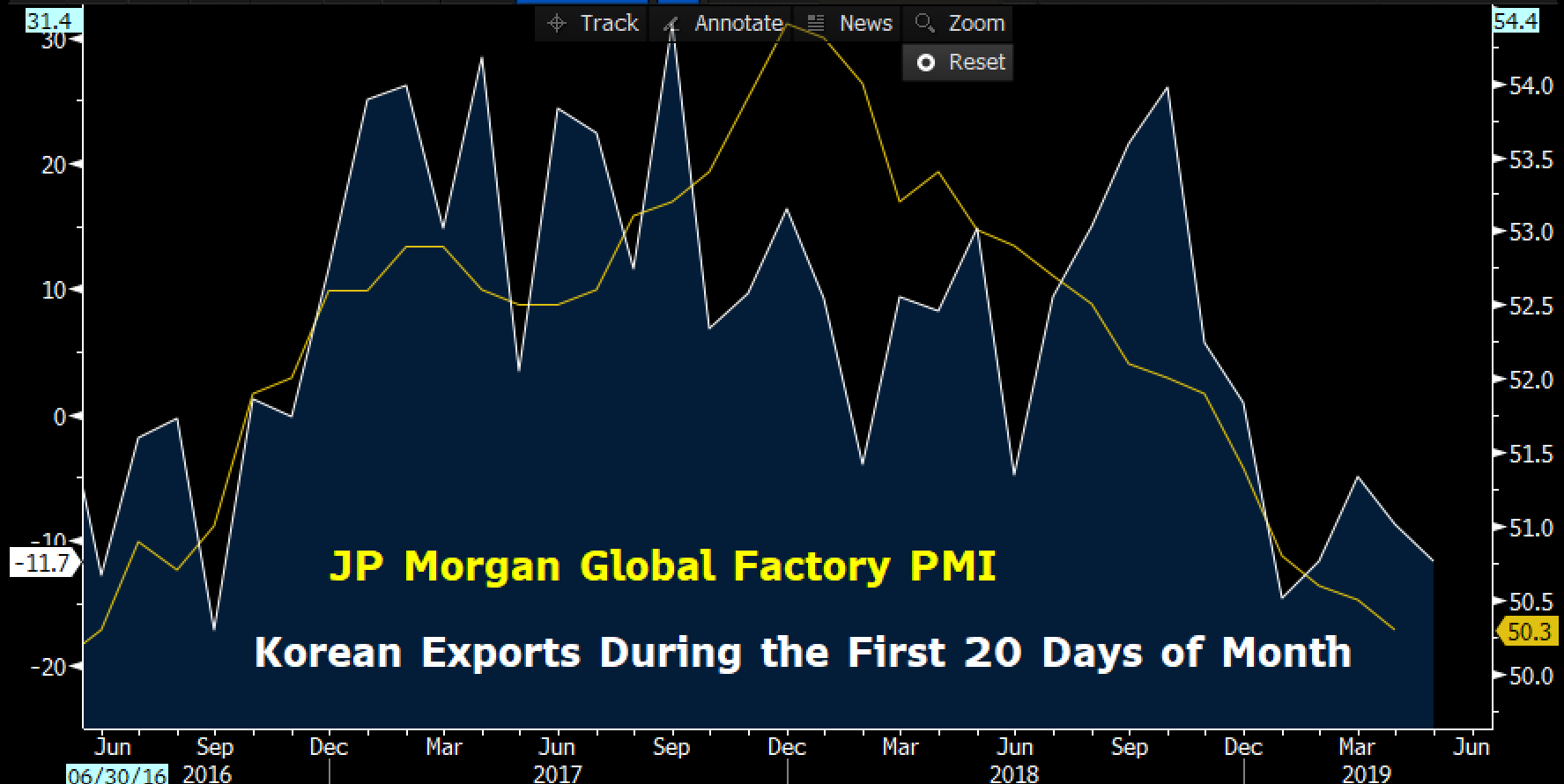

Korean exports during the first 20 days of May, a leading indicator of regional growth, slid 11.7 percent from a year ago, marking a fifth consecutive contraction. The prolonged contraction in Korean exports growth since the beginning of the year only suggests that earlier hopes of a global recovery were overly optimistic.

Source: Bloomberg

Source: Bloomberg

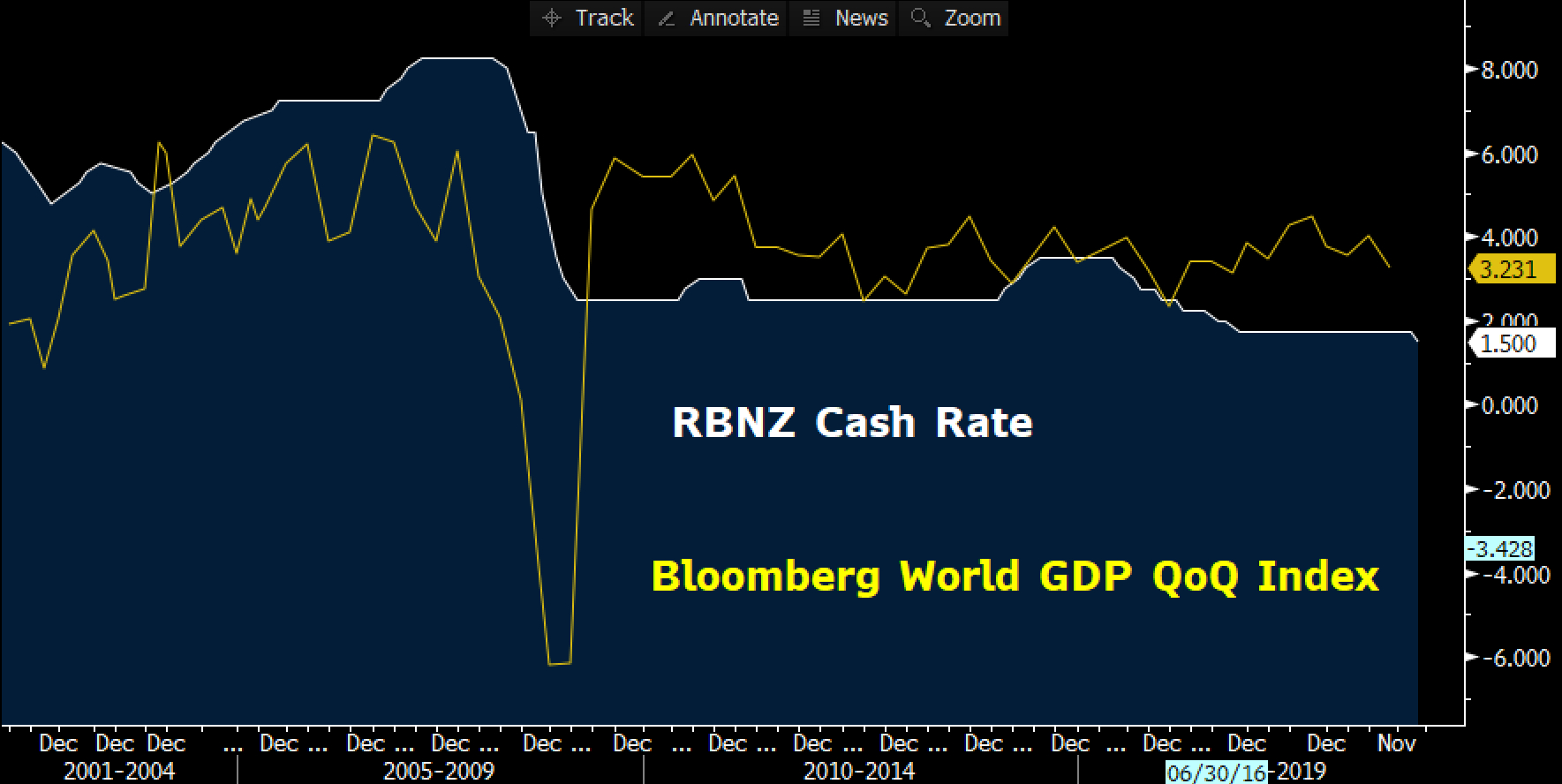

RBNZ has already sensed the bleak global growth outlook. As New Zealand exports large amounts of commodities overseas, the strength of its economy is able to reflect global demand. Hence, its central bank's monetary policy has also been moving in tandem with global growth. The chart below shows that when the RBNZ started cutting benchmark interest rates in the past, global growth rates also lost momentum. For this round, RBNZ announced it would cut its interest rate on May 8, only two days after the U.S. said it planned to increase tariffs on some Chinese products.

Having that said, RBNZ's rate cut decision is mainly because of its concerns on global growth, and didn't include the trade disputes between the two largest economies into its rates decision.

Source: Bloomberg

Source: Bloomberg

The current backdrop of the slowing global economy may offer a clearer signal to the bonds market than stocks. Between 2009 and 2013, pessimistic economic data could become good news to stock markets because traders bet that central banks would step in to bail out the market and inject liquidity.

However, this doesn't look to be the case at this moment, as none of the major central banks are ready to ease policy at this stage. Most of the FOMC members in the Fed prefer to hold interest rates in the coming months, as they predict the current slowing inflation outlook is only temporary. For the ECB, the most it can do is to offer some liquidity to the private sector, a similar program as the PBOC's MLF and SLF. For the BOJ, it doesn't have any intention of tweaking its current monetary policy. And for the PBOC, it will continue to exercise its prudent monetary policy for now, with most people not expecting it to conduct any broad-based easing at this stage.

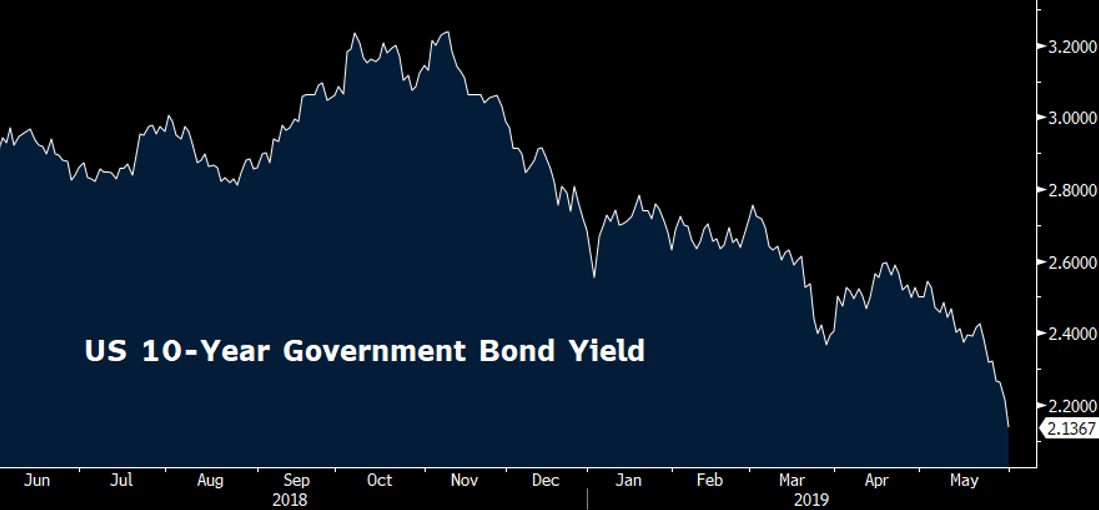

Without major policy assistance from central banks, global stock markets are likely to further retreat before signs of growth stabilization emerge. Thus, flows into safe havens such as U.S. Treasuries may intensify in the coming weeks. U.S. 3-month and 10-year government bond yields have now inverted by 19 bps, the most since May 2007. The yield curve has been inverted since May 23, with little sign of the curve steepening in the near future, which increases the possibility of a recession ahead. If the inversion becomes prolonged, it may attract more inflows into the U.S. bonds market, as traders will be busy rushing into safe-haven assets.

The U.S. 10-year government bond yield has dropped over 50 bps since the beginning of the year to 2.14 percent, approaching 2.0 percent according to the current trend. Further deterioration in global economic data may send the 10-year yield towards 2.0 percent as soon as the next few weeks.

Source: Bloomberg

Source: Bloomberg

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3