Tech & Sci

19:12, 04-Dec-2018

Report: Vast potential for Chinese pharma in African countries

Updated

18:02, 07-Dec-2018

CGTN

The Chinese pharmaceutical sector has tremendous investment opportunities in the manufacturing of affordable, high-quality medicine in a way that would create job opportunities and help develop skills in Africa, a new report released today states.

Poor infrastructure, coupled with a lack of expertise, forces African countries to import around 70 percent of their pharmaceutical products. At present, only 34 of 55 African countries have some level of pharmaceutical production capability.

Nearly half of the continent's population still lacks access to good quality essential medicines, and burgeoning trade deficits make importing medicine extremely unsustainable.

The report, jointly prepared by UNAIDS and the China Chamber of Commerce for Import and Export of Medicines and Health Products (CCCMHPIE), found that 21 African countries already import Chinese health products, including limited Traditional Chinese Medicine (TCM) products, which occupy five percent of the market share at most.

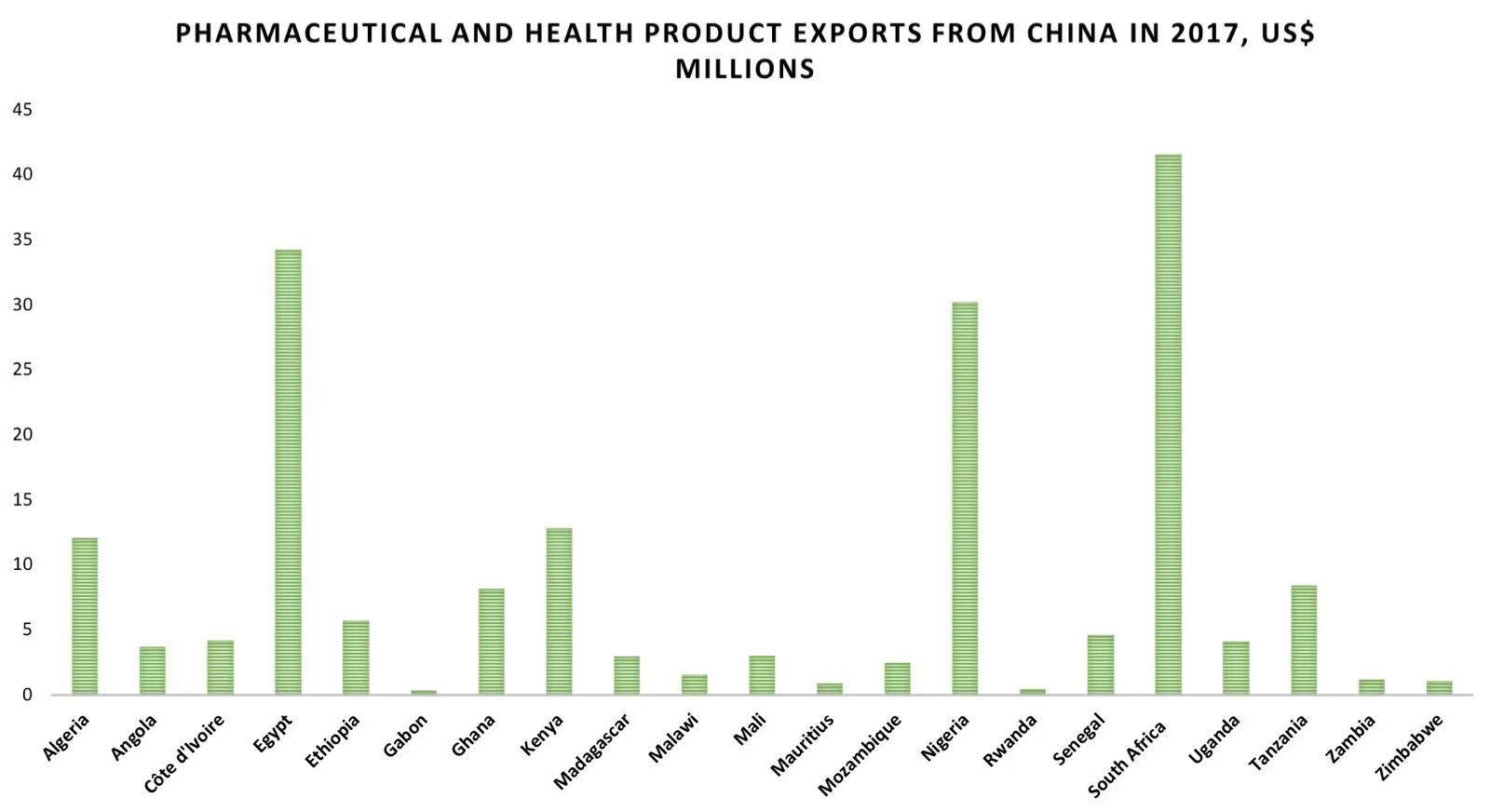

In 2017, South Africa, Egypt and Nigeria – top importers of Chinese pharmaceutical products – imported medicines worth 300 million U.S. dollars each. Drug manufacturing is considered a national priority among 18 of the 21 African countries, but investments remain elusive, the report revealed.

Despite vast opportunities, China's pharma exports to African countries remains low. /UNAIDS-CCCMHPIE Graphics

Despite vast opportunities, China's pharma exports to African countries remains low. /UNAIDS-CCCMHPIE Graphics

Chinese investors should tap into Africa's pharma markets

“Last year, [Senegal] imported a huge 181 million U.S. dollars' worth of pharmaceutical products. With a growing population and the continuing health challenges posed by malaria, HIV, and tuberculosis, the pharmaceutical industry is a growth industry that China can tap into,” Mamdou Ndiaye, the Senegal Ambassador to China, said.

“Of the 181 million, just three percent was from China,” he said, underlining the potential for Chinese companies to explore the pharmaceutical market in African nations.

Explaining the vision behind the report, Amakobe Sande, UNAIDS Country Director and Representative in China, said, “The needs on the continent are very high, including for HIV/AIDS medicines. China is not yet making a mark.

“This is not about favoring Chinese companies, but it is about sharing the health market investment opportunity with them in a way that they might also create much-needed jobs.”

Challenges faced by Chinese investors in African countries

A large number of African countries have fast-tracked the process for international business registration to boost local production of medicine. /UNAIDS-CCCMHPIE Graphics

A large number of African countries have fast-tracked the process for international business registration to boost local production of medicine. /UNAIDS-CCCMHPIE Graphics

Government and donor-purchased medicines that constitute a significant portion of the sales pose a crucial challenge for Chinese companies in understanding African markets, the report claimed.

In four of the surveyed countries, it takes nearly one week to register a business formally. However, in South Africa, Gabon and Zimbabwe, it takes over 40 days.

“There is added complexity if companies want to register new health products. In Ethiopia and Tanzania, it takes less than three months, but in Kenya, Zimbabwe, and Angola, the process takes at least 10 months,” the report maintained.

While Chinese companies have adapted to complex rules in the domestic market, they hesitate to explore the regulatory landscape in African markets.

“A large number of Chinese pharma giants find the business environment in Africa to be weak and risky. The report will help in shifting perceptions to bring in new investors into this sector all across Africa,” said Hannah Ryder, CEO of Development Reimagined, a consulting firm that produced the report.

(Top Photo: A doctor is seen testing a patient's eyesight outside the mobile health train, "Phelophepha," March 6, 2017, in Pienaarsrivier. /VCG Photo)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3