Business

17:19, 11-May-2018

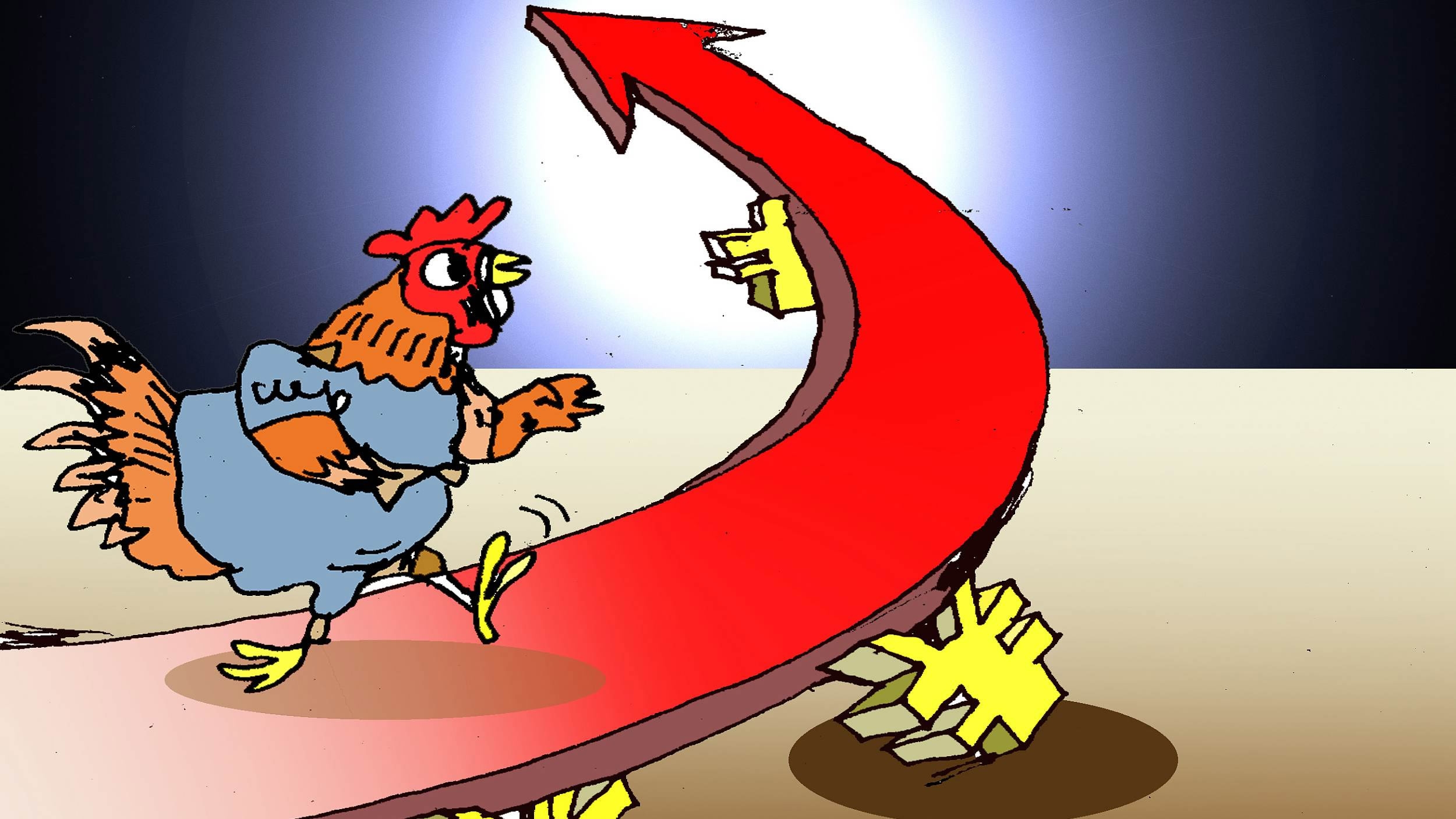

Is this the beginning of the end of structured products in China?

CGTN

Structured funds, referred to as “spread bets on steroids” by a UK finance official, once were star performers in China as the stock market rallied in 2014-15 before the turbulence. The size of such products has been shrinking, down 38 percent year on year in 2018, according to Wind Information.

Now with the new asset management rules in place, does this mean the beginning of the end of the structured products in China?

What is a structured fund?

Designed to facilitate highly customized risk-return objectives, structured funds use leverage to magnify returns in a bull market.

Most structured funds in China are equity-linked. Such a fund is usually divided into two tranches, the low-risk A tranche mainly invested in fixed-income products; and the B tranche tracking performance of an equity asset, such as the CSI 300 Index, within predefined parameters and often with a measure of protection.

Unlike those B tranche punters, A tranche investors are risk-averse.

Once the net asset value (NAV) per investment unit of the B tranche falls below a certain threshold, 0.25 yuan for most funds, the protection term under the fund will be triggered and the B tranche will be restructured by cutting short the total investment units and keeping the NAV at one yuan.

In this case, A tranche investors will most likely cash out the additional units they receive from the above process.

Fund managers, in anticipation of such redemptions, have to slash their positions in constituent stocks of the indices they track, which is likely to trigger a sell-off, knocking billions of yuan off the markets, according to a report of Haitong Securities.

Emergence and decline of structured product in China

Structured products began to appear in the Chinese retail market in the early 2007, and peaked before the 2015 stock market rout.

The August market crash sent indices plummeting, and the meltdown prompted Chinese securities regulators to suspend approvals of structured products citing the reason of “complexity”.

Last year in May, the two main bourses in China released guidance on structured fund, setting a higher bar for investors wishing to buy structured funds.

One year after the guidance was announced, the size of such funds have shrunken 38 percent from 212.25 billion yuan to 131.58 billion yuan, according to Wind Information.

In late April, China’s central bank unveiled far-reaching asset management rules, the latest in the country’s efforts to reduce leverage in financial markets. And the new regulations prohibit a mutual fund from issuing any structured products, which is seen by industry insiders as a signal of structured products disappearing after the transition period for the rules ends at the end of 2020.

Even so, fund houses did not plan to liquidate the structured products immediately, but waiting for the regulators’ instructions on how to deal with the existing ones.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3