Business

17:23, 23-Nov-2018

Art of the deal? Chinese firm's $75 mln Michelangelo deal raises eyebrows

Updated

16:40, 26-Nov-2018

Nicholas Moore

A Chinese company that once focused on recycling and selling construction materials has raised eyebrows by agreeing to pay 75 million U.S. dollars on a painting by Michelangelo, months after splashing out 50 million U.S. dollars on a 61,500-carat sapphire.

Yulong Eco-Materials Ltd., a Nasdaq-listed company based in central China's Henan Province, bought "Crucifixion" by the Italian renaissance master earlier this week, according to a statement by the company.

The $75 million fee will be paid through issuing 7.5 million shares at 10 U.S. dollars each, with the deal complete once the 1538 painting is appraised and the purchase receives shareholder approval, according to the company.

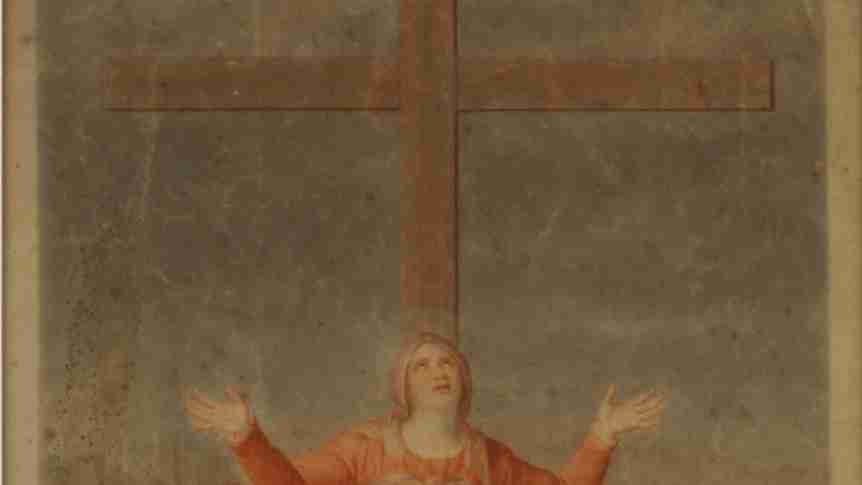

Crucifixion, by Michelangelo (painted circa 1538). /Image via Yulong Eco-Material Ltd.

Crucifixion, by Michelangelo (painted circa 1538). /Image via Yulong Eco-Material Ltd.

The company has a market capitalization of 172.7 million U.S. dollars – only enough to buy two Michelangelo artworks, based on the price of "Crucifixion."

While the company is described as a producer of concrete, bricks and a recycler of construction waste, investors appeared to react positively to the sudden shift towards the high-end art market. Shares in Yulong jumped as high as 47 percent on Monday according to Bloomberg.

The company's purchase of the Millenium Sapphire, which was completed in October, was made through a similar share-sale process. Upon completing that deal, Yulong CEO Hoi Ming Chan said in a statement that the company would look to change its name to Millennium Enterprises Ltd., while relocating its headquarters to New York, spinning off its China businesses and replacing all officers and directors.

Millennium Enterprises Ltd., according to the statement, will focus on taking the sapphire and other fine art products around the world to museums, featuring them in movies and documentaries, and even developing interactive art-related games "much in the same manner as the Pokemon Go craze."

After announcing the purchase of the Michelangelo painting, Yulong's executive chairman Daniel Mckinney said in a statement that the company "has today pioneered this new disruptive business model by the acquisition and securitization of fine art through a Nasdaq-listed security."

The company also said that it would "open the opportunity of shared ownership of its acquired masterpieces to anyone with a brokerage account."

The abrupt turnaround being undertaken by the company comes after profits fell sharply in 2017 when Yulong was focused solely on the construction sector.

Yulong only made 1.90 million U.S. dollars last year according to a company filing, compared to 16.48 million U.S. dollars in 2016.

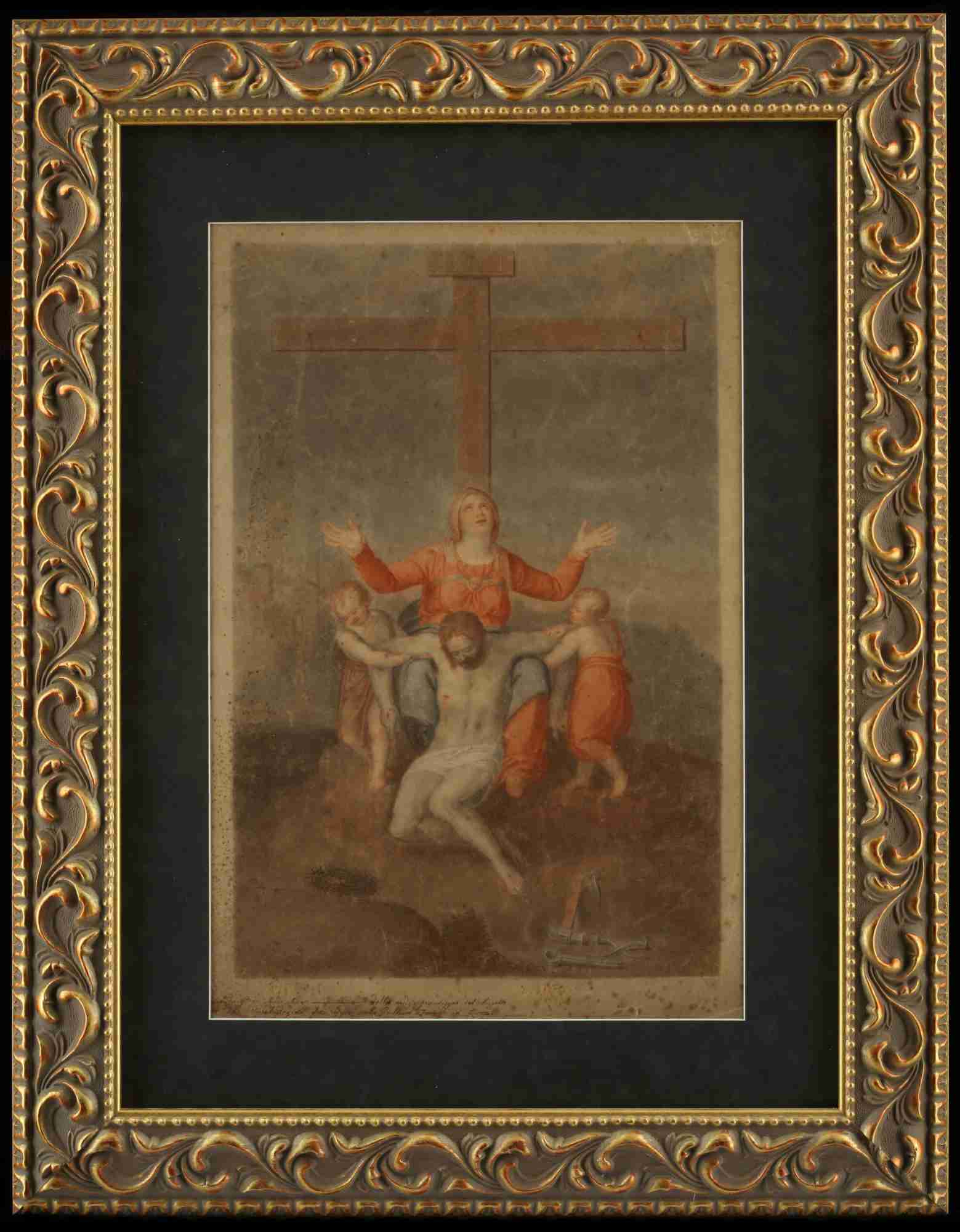

Art collector Liu Yiqian holds the $36.3 million Ming Dynasty "chicken cup" in July 2014. /VCG Photo

Art collector Liu Yiqian holds the $36.3 million Ming Dynasty "chicken cup" in July 2014. /VCG Photo

China has produced a series of major art investors in recent years, many of whom emerged from sectors with no relation to contemporary paintings or antiques.

Billionaire Liu Yiqian made his fortune from stock investing and pharmaceuticals, and in 2014 announced his presence on the global art stage by spending 281.24 million Hong Kong dollars (36.3 million U.S. dollars) on a Ming Dynasty “chicken cup,” sparking controversy by drinking from it in front of the media.

Liu has since gone on to spend hundreds of millions of dollars on Chinese and Western art, including 170 million U.S. dollars on Modigliani's Nu Couché (1917-18) in 2015. Liu now owns two of Shanghai's most prominent art galleries, Long Museum Pudong and Long Museum West Bund.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3