Opinions

19:31, 14-Aug-2018

Opinion: What is driving foreign investors’ confidence in China?

Updated

18:36, 17-Aug-2018

Cheng Dawei

Editor's note: Cheng Dawei is a professor at the School of Economics, Renmin University of China. The article was first published on China Plus on August 14. The article reflects the author's opinion, and not necessarily the views of CGTN.

A month before the Office of the US Trade Representative released its Section 301 investigation report in March of this year and provoked the current US-China trade war, the 2018 China Business Climate Survey Report was released by the American Chamber of Commerce in China.

It showed that in 2017, 73 percent of US companies achieved profitability in China, and 74 percent of its members plan to expand investment in China in 2018, which is the highest percentage in recent years.

The survey also showed about 60 percent of its member companies regard China as one of the top three investment destinations, and 46 percent of respondents believe that in the next three years, China will further open its market to foreign investment.

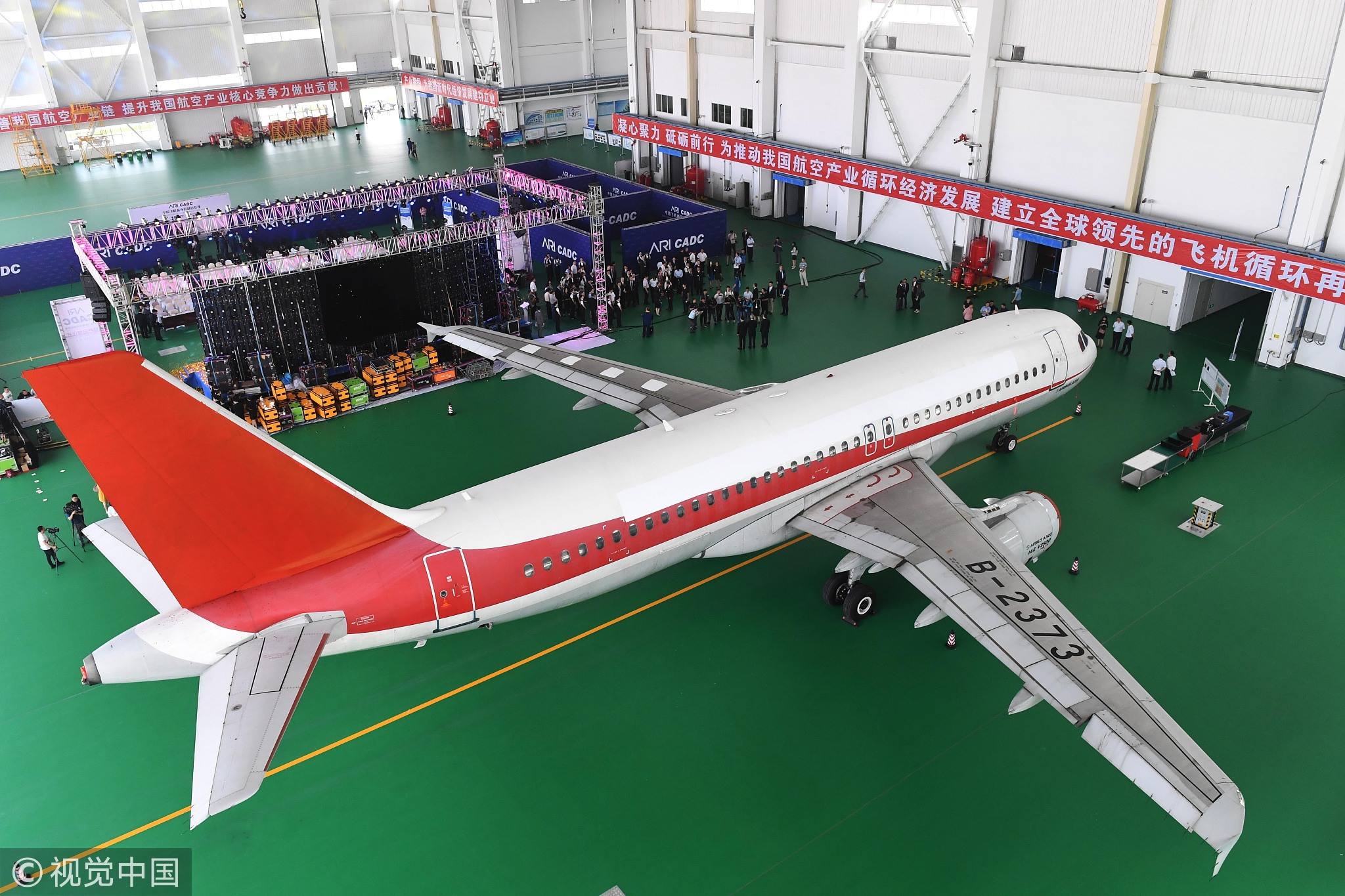

VCG Photo.

VCG Photo.

Another 62 percent of respondents believe that the transparency of Chinese government policy and communication has improved in the past five years. The survey report shows that most of the US companies in China are optimistic about the Chinese market.

According to the Chinese Ministry of Commerce, in the first half of this year, 29,591 new foreign-invested companies were established in China, a year-on-year increase of 96.6 percent. The actual use of foreign capital was 68.32 billion US dollars, a year-on-year increase of 4.1 percent. Among the major sources of investment, actual US investment in China increased by 29.1 percent year-on-year.

Although the impact of the Sino-US trade war on foreign investment in China will not be known for some time, this set of data shows that even with the looming negative impact from a trade war, foreigners investing in China remain confident. Exploring the reasons, this confidence can be summarized in five different ways.

First of all, China has the opportunity to grow both in production and consumption. It's predicted the global middle class will reach 4.9 billion people by 2030, two-thirds of whom will be concentrated in Asia, and predominantly in China.

The opportunity for the integration of production and consumption will first be reflected in the openness of the Chinese market, which will attract more multinational companies to conduct business in China.

VCG Photo.

VCG Photo.

China will contribute to world economic growth with the positioning of a major consumer economy; and, along with the new technological revolution that brings about a new lifestyle, China's emerging middle class has a relatively high acceptance of new products.

The Japanese Chamber of Commerce and Industry in China mentioned in its White Paper on the Chinese Economy and Japanese Enterprises 2018 that Japanese companies have increased their investment in the robotics and component parts industries, and their investment in services and retail industries has also increased.

This suggests investment by Japanese companies in China has shifted from export-oriented to domestic sales in China.

Second, China's industrial chain advantage can provide complete support for the production of foreign-funded companies. China's advantage comes from a high level of industrialization, large-scale production capacity, complete infrastructure, a strong industrial support system and a robust labor force.

The diversity of China's industrial chain is more likely to attract foreign investment. For example, with cigarette lighters, China can meet the needs of the world market with low prices, relying on plastic shells, steel shells, flints and other related industries.

VCG Photo.

VCG Photo.

Third, China's production capacity and innovation in developed countries can complement each other. Companies or individuals in developed countries have strong innovation capabilities. However, from basic research to applied research, then to commercialization and mass production, it is a long chain.

China's large-scale production capacity and large market attract innovative companies to China, which will help foster advanced technological developments to be commercialized quickly, and at minimal cost.

Fourth, although the impact of the trade war is yet to be assessed, overall, a moderate recovery in the world economy will provide the favorable external conditions for China to attract foreign investment. Since last year, global GDP has achieved an average growth of 3.8 percent. The International Monetary Fund predicts that the global economic growth rate this year will be 3.9 percent.

Fifth, China continues to increase its opening up to the outside world. On July 28, China's "Special Management Measures for Foreign Investment Access (Negative List) (2018 Edition)" came into effect. In terms of foreign investment restrictions, the negative list for the 2018 edition was reduced by 15 items, opening up various fields.

For example, in the financial sector, the restrictions on foreign-invested shares in the banking sector were abolished. In 2021, restrictions on all foreign capital ratios in the financial sector will be lifted.

In the manufacturing sector and the auto industry, the restrictions on foreign-owned shares of special vehicles and new energy vehicles were canceled. And in 2020 and 2022 respectively, the foreign-investment ratio of commercial vehicles and passenger vehicles will be lifted.

As long as China's economy operates smoothly, its huge market and good industry-wide support will continue to attract foreign investment. There is no reason for people to doubt China's ability to attract foreign investment because of a trade war.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3