Biz Analysis

14:32, 11-Feb-2019

Yuan rate shows why dovish Fed may eventually benefit the dollar

Jimmy Zhu

Editor's note: Jimmy Zhu is the chief strategist at Fullerton Markets. The article reflects the author's opinion, and not necessarily the views of CGTN.

Following the Spring Festival holiday, the People's Bank of China weakened the yuan daily fixing rate by 0.62 percent, the biggest alteration since July 2018.

Monday's drop in the Chinese currency's reference rate shows that concerns about a weaker U.S. dollar under a less hawkish Fed are not warranted, with an increasing number of central banks now easing monetary policy amid growing pressure on growth outlooks.

Since the Fed accelerated the pace of its rate hikes from early 2017 to the end of 2018, many global central banks have been forced to tighten policy to maintain financial stability amid risks such as FX depreciation.

But the problem is that many of these economies, especially in emerging markets, currently require accommodative monetary policies, as the outlook for growth recovery remains vulnerable.

Manufacturing activity in major Asian and European economies started to deteriorate last year, and relevant indicators show that central banks in these areas have not introduced enough pro-growth measures to counter the slow down.

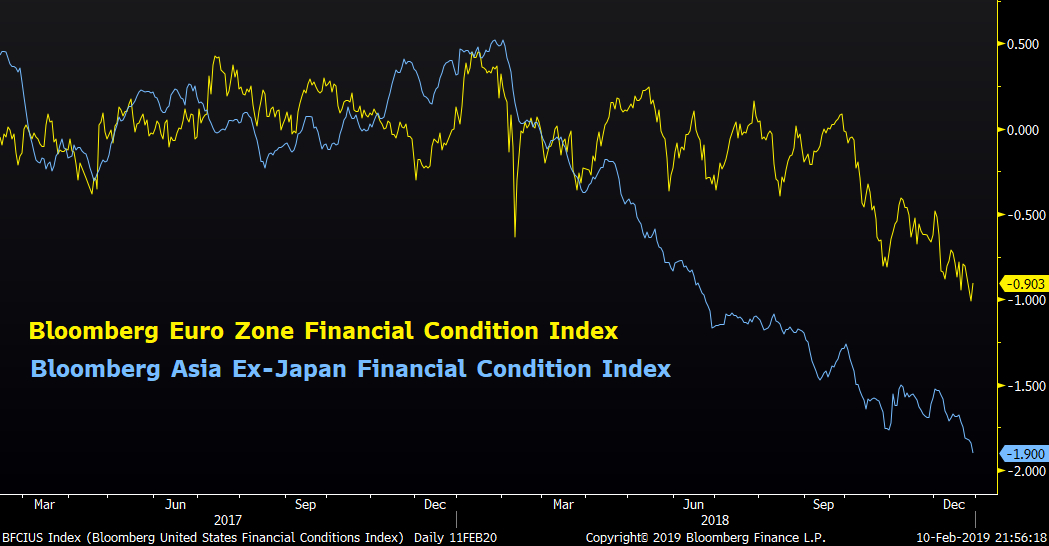

The chart below shows that both Bloomberg financial condition indices for the Eurozone and Asia (excluding Japan) tightened substantially last year, particularly the latter. A drop in the index means financial conditions are tightening.

Source: Bloomberg

Source: Bloomberg

For 2019, things look different. After Fed Chair Jerome Powell said last month the FOMC would keep interest rates at their current level for quite some time, central banks around the world are now busy slashing their economic forecasts and have been looking to make their language more accommodative.

India's central bank cut its policy rate last week, shifting its stance to neutral from calibrated tightening. Growth outlooks have been slashed from the Australian central bank to the European Commission, while the Philippine central bank also hinted last year that there may be some scope to unwind some of its tightening policies.

This synchronized shift by global central banks towards easier monetary policy certainly limits gains in non-dollar currencies, even if the Fed continues to act dovish.

Among all of those central banks, the European central bank's decision has had the biggest impact on the U.S. dollar, with the euro weighting more than 50 percent in the dollar index.

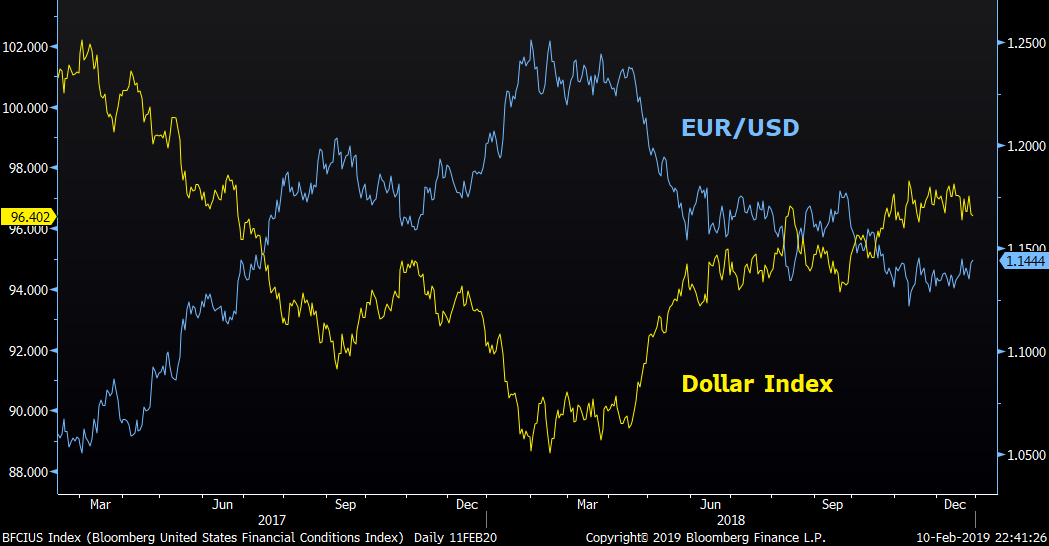

The chart below shows an inverse correlation between the dollar index and EUR/USD has been close to 100 percent in the past two years.

This trend also shows why the lack of fluctuations in the EUR/USD since last November has been a major factor behind the tight trading range for the dollar index, despite U.S.-China trade tensions, the US government shutdown and corporates earnings dominating news headlines.

Source: Bloomberg

Source: Bloomberg

The PBOC's yuan adjustment on Monday is also a response to last week's slump in the EUR/USD, when the European currency fell 1.2 percent in its biggest decline since August last year.

The correlation between the RMB fixing rate and EUR/USD stood at 0.894 in the past 12 months. If the correlation of the two persists, the dark outlook for the Eurozone economy may put further pressure on the Chinese yuan.

Eurozone PPI data for December, which was released last week, fell 0.8 percent on a monthly basis, its biggest decline in three years. The region's manufacturing PMI also dropped for a sixth consecutive month in January.

A slowdown in economic activity may increase the likelihood of the ECB adjusting its QE unwinding program in the latter half of the year, a move which would likely depress the value of the euro against the U.S. dollar.

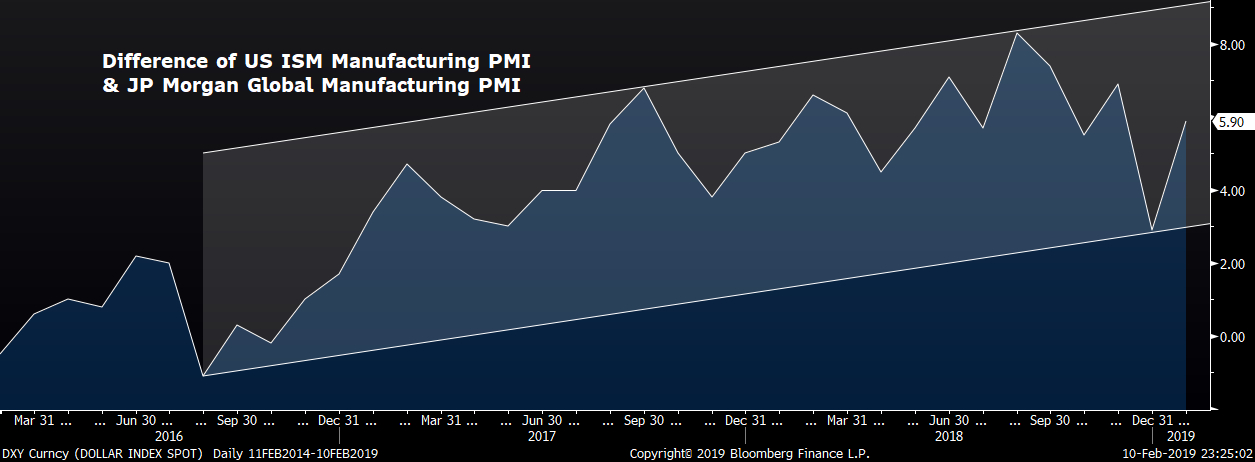

The U.S. economy is still outperforming many other major economies, a trend reflected in its manufacturing activity. The difference between the US ISM Manufacturing PMI and JP Morgan Global Manufacturing PMI has been trending higher, with the latest gap at 5.9.

If global central banks continue to set monetary policy based on their domestic economic conditions, U.S. policy may be still one of the tightest versus others.

Source: Bloomberg

Source: Bloomberg

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3