Business

09:09, 05-Oct-2018

Wall Street sinks as bond yield climb continues

Updated

09:11, 08-Oct-2018

CGTN

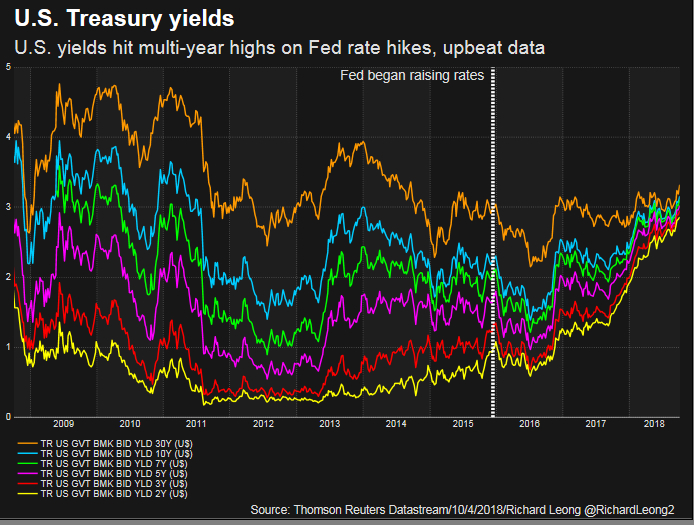

Wall Street stocks stumbled on Thursday as US Treasury yields continued their ascent to multi-year highs on the latest round of strong economic data, building concerns for an acceleration of inflation.

The Dow suffered its first decline in six sessions, while both the S&P and Nasdaq had their worst day since June 25.

The yield on the benchmark 10-year Treasury note climbed to a seven-year high of 3.232 percent, marking its largest daily jump since the 2016 US presidential election. Data on jobless claims and factory orders were the latest in a round of strong economic reports this week, putting the focus squarely on Friday's payrolls report for September.

Reuters Photo

Reuters Photo

"The follow-through on the Treasury rates today, actually the follow-through worldwide on Treasuries, has a big part to do with this," said JJ Kinahan, chief market strategist at TD Ameritrade in Chicago.

"And just in general, so many of these sectors have been so hot it may be time to take a little break," he added.

Financials were one of the few bright spots on Wall Street, rising 0.71 percent. Banks, which typically benefit from rising rates, gained 0.81 percent.

Thursday's data, which showed jobless claims fell to a near 49-year low, followed comments this week from several Federal Reserve officials, including Chairman Jerome Powell, that underscored the strength of the economy.

The Dow Jones Industrial Average fell 200.91 points, or 0.75 percent, to 26,627.48, the S&P 500 lost 23.9 points, or 0.82 percent, to 2,901.61 and the Nasdaq Composite dropped 145.58 points, or 1.81 percent, to 7,879.51.

Equities have struggled over the past year when interest rates climbed faster than investors were anticipating.

Among the biggest drags on the S&P were the so-called FANG group of stocks, which were among shares that helped propel the Nasdaq to its recent record high. Google parent Alphabet Inc sank 2.8 percent and Netflix Inc slumped 3.6 percent.

Apple Inc lost 1.76 percent, and Amazon.com Inc, shed 2.22 percent.

Source(s): Reuters

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3