Economy

07:21, 08-Jun-2019

Trump's tariffs hit America’s poor and working class the hardest

Updated

11:07, 08-Jun-2019

Wang Tianyu

The biggest victims of U.S. President Donald Trump's tariffs won't necessarily be Chinese or Mexicans but poor Americans, who already live close to the financial edge and could have to pay more for everyday purchases.

For many low-income households, tariffs "are a tax on their consumption, and by raising the cost of their consumption, they will likely have to cut back," said Jay Shambaugh, a senior fellow at the Brookings Institution.

01:28

The U.S. boomerangs its tariffs on China and Mexico

Trump last week threatened to impose a five-percent tax on Mexican imports starting on June 10. It would eventually rachet up to 25 percent if Mexico fails to stop the flow of immigrants and asylum-seekers.

The U.S. also hiked Chinese imports tariffs to 25 percent from 10 percent almost a month earlier.

However, rather than force concessions from China and Mexico, the tariffs could boomerang back to U.S. consumers and companies. The taxes could raise the price of fruits and vegetables and disrupt the supply chain for auto parts in ways that could hurt vehicle sales.

A migrant family from Honduras shops at Walmart in Clovis, New Mexico, U.S., June 12, 2018. /VCG Photo

A migrant family from Honduras shops at Walmart in Clovis, New Mexico, U.S., June 12, 2018. /VCG Photo

Executives at Walmart and dollar-store chains, which import much of their merchandise and serve many low-income customers, have warned that tariffs could lead to higher prices.

Macy's is also warning of possible price hikes ahead.

That would be hard on people like Walter Rogers, a 65-year-old American retiree living on a Social Security check he says is about 700 U.S. dollars a month.

"We just got a cost-of-living raise. Now they're going to raise prices?" Rogers said as he walked to Walmart. "Hardly anybody can afford this."

Graphic: Li Wenyi

Graphic: Li Wenyi

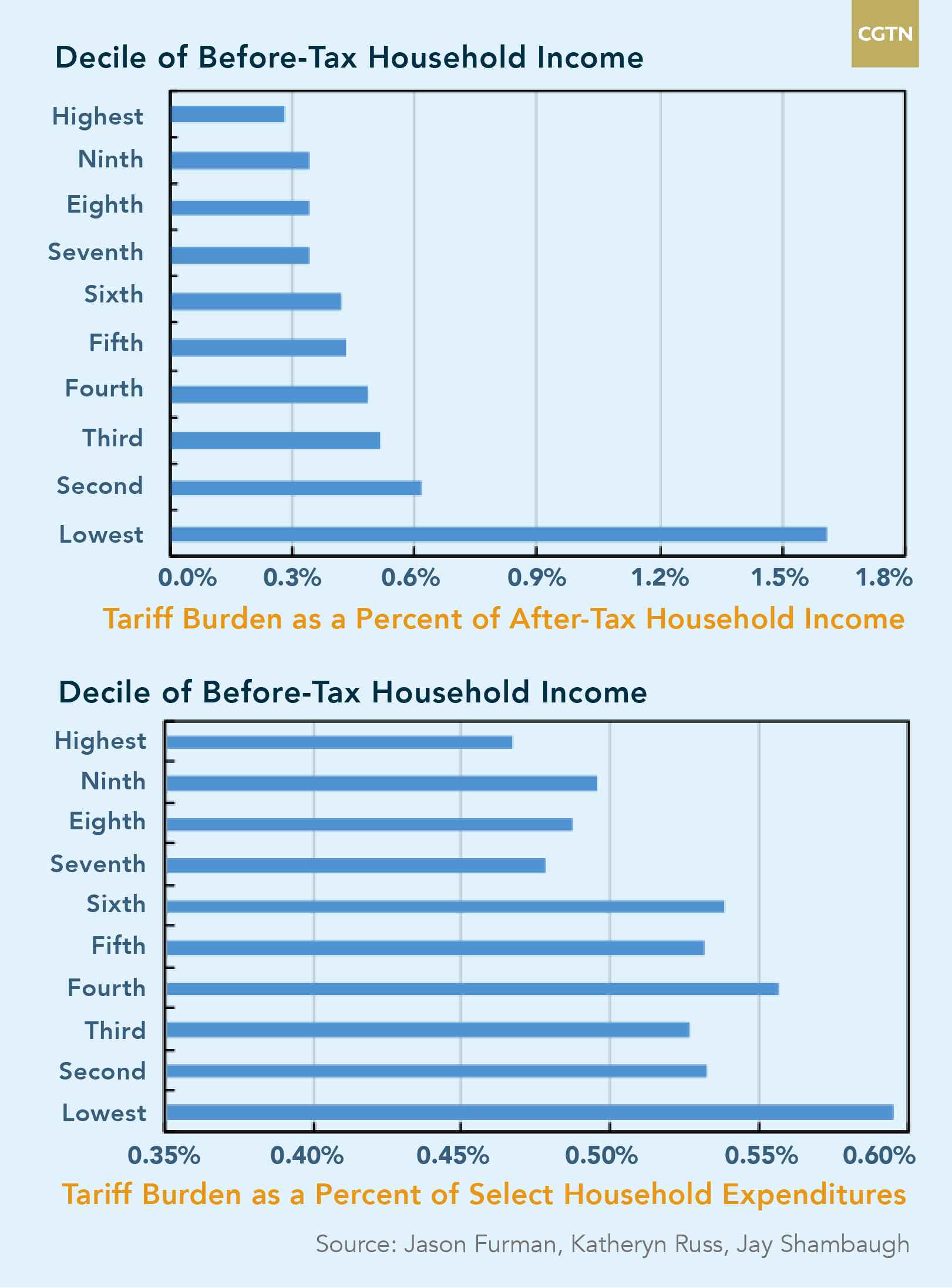

Poor people pay more than rich people

There are two major reasons why the poor face an outsized burden, Shambaugh said.

First, poorer Americans tend to spend all of their income, while wealthier Americans have enough income left over to save and invest. That leaves the poor more exposed to higher prices from import taxes.

Second, the wealthy are more likely to splurge on services such as farm-to-table restaurant meals or gym memberships that are not subject to tariffs at all. But poorer Americans spend a higher percentage of their income on basics such as clothing and groceries that are more likely to be imported and subject to tariffs.

Homeless people at the chapel of Denver Rescue Mission, Denver, Colorado, April 1, 2014. /VCG Photo

Homeless people at the chapel of Denver Rescue Mission, Denver, Colorado, April 1, 2014. /VCG Photo

An administration that may have raised taxes on the bottom 20 percent

Officials within the Trump administration have repeatedly pledged that the middle class and poor would benefit from lower tax rates, but the chief beneficiaries of the overhaul so far have been the wealthy and corporations. Any tax savings realized by the poor could be eaten up by higher prices from tariffs, according to an analysis released this week by the Tax Foundation, a right-of-center think tank in Washington.

Assuming a 25-percent tax on both Chinese and Mexican imports, the bottom fifth of households would probably be worse off under Trump than they were during Barack Obama's presidency, said Kyle Pomerleau, chief economist at the Tax Foundation.

You're looking at an administration that may have raised taxes on the bottom 20 percent and cut taxes for the top one percent.

- Kyle Pomerleau, Chief Economist at the Tax Foundation

(With input from AP)

(Cover: A J.C. Penney store in New York, U.S., November 20, 2017. /VCG Photo)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3