Markets

14:08, 08-Mar-2019

Chinese stocks see biggest fall of 2019 over trade, Eurozone concerns

Updated

15:47, 08-Mar-2019

CGTN

Chinese stocks saw their biggest fall of 2019 on Friday, as concerns about falling trade data and an overheated equities market combined with global worries about the state of the European economy.

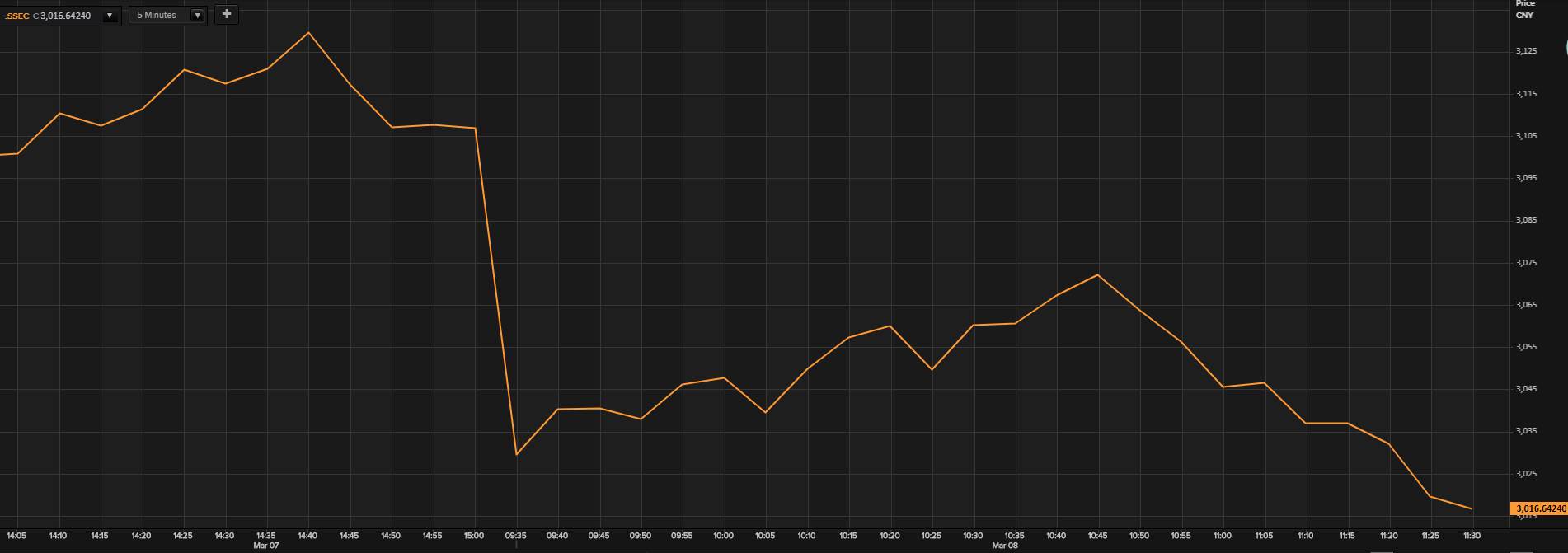

The Shanghai Composite Index, the world's best performing stock market in 2019, fell by 4.40 percent as markets closed.

Friday's slump was the biggest so far this year for the Shanghai Composite Index. /Refinitiv Image.

Friday's slump was the biggest so far this year for the Shanghai Composite Index. /Refinitiv Image.

The sentiment in Asian markets was negative on Friday morning before trading began, after Thursday saw European Central Bank (ECB) Chief Mario Draghi announce a U-turn on monetary easing, reflecting growing unease over European economic activity just months after the end of years of quantitative easing was announced.

The ECB will provide easier, cheaper access to credit for Eurozone banks, with further increases to interest rates ruled out for 2019. GDP growth estimates for the year ahead have been lowered to 1.1 percent for the Eurozone, with Germany and Italy struggling in particular.

The Eurozone is one of China's most important trading partners, and slowdowns in manufacturing, consumption and growth will be a major cause of concern for Chinese exporters.

Those concerns were compounded on Friday by very disappointing Chinese export data for February. Exports tumbled 16.6 percent year-on-year in yuan terms, while imports fell by 0.3 percent.

Mario Draghi's decision on Thursday was a return to a policy first introduced during the financial crisis. /VCG Photo

Mario Draghi's decision on Thursday was a return to a policy first introduced during the financial crisis. /VCG Photo

The first week of February saw the week-long Spring Festival national holiday, a period that usually affects data as businesses and factories close down production. However, the drop from January's figures – which saw exports up 13.9 percent and imports climb 2.9 percent – is the biggest in three years.

The stock market rally since the start of the year followed a torrid 2018, but this latest flurry of investment is at odds with 2019's disappointing economic data.

With the Shanghai Composite up by more than 26 percent in just three months, there are fears that the bull-run is out of control and overheating. Friday saw Citic Securities – China's leading brokerage – give shares of People's Insurance Company of China (PICC) a “sell” rating, describing the company as “significantly overvalued.”

Investors took note and sold, pushing PIGC down to the 10 percent daily limit, with the selloff spreading to other equities over concerns that they too were “overvalued”.

Chinese mainland markets were among Friday's worst performers, but the negative sentiment was also lingering over Japan and Hong Kong, with the Nikkei down 2.01 percent and the Hang Seng falling 1.91 percent.

Thursday trading saw wider selloffs in Europe and the U.S., with the gloomy global outlook pushing London's FTSE 100 down 0.53 percent and the Dow Jones falling 0.78 percent.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3