Transport

22:23, 07-Jun-2018

Uphill battle for SE Asia’s new ride-hailing players

By Barnaby Lo

02:18

When your city’s metro transit breaks down as often as it does in Manila, you’re bound to look for alternatives.

For Filipinos who could afford it, the answer used to be Uber.

“I used to have to lug my things around looking for cabs,” says Alexis Dulce, a professional makeup artist and hairstylist.

“I can’t tell you how much more convenient it is to have a car pick you up at your doorstep,” Dulce told CGTN.

Not long after US-based Uber jumpstarted the Philippines’ ride-sharing industry, Grab, which serves primarily the Southeast Asian market, joined the fray. For a while, Uber dominated the market; even though it suffered setbacks, including a 1.7 million-US-dollar fine for allowing its partners to drive without accreditation from the land transportation bureau.

In March, Uber announced it was selling its Southeast Asian business to Grab. All over the region, there was fear of a looming monopoly. Government competition watchdogs in the Philippines and Singapore flagged the merger.

July 22, 2016: A Grab taxi traversing the busy streets of metro Manila, Philippines. /VCG Photo

July 22, 2016: A Grab taxi traversing the busy streets of metro Manila, Philippines. /VCG Photo

Dulce says she felt the quality of the service has deteriorated.

“One time I saw my Grab driver drive past me, and he wouldn’t cancel the trip. He was waiting for me to do it.”

Dulce’s complaints against Grab are not isolated; in fact, mounting protests against the company’s peak hour fares prompted Philippine authorities to limit the company’s surge pricing to twice its normal fare.

The government also allowed a handful of new players to enter the market, one of which is Owto. Paolo Libertad, Owto’s chief operating officer and a former Uber partner-driver, says his company aims to bring back what he describes as the “premium service” Uber once offered.

“We want to go back to the times when Uber was just starting here in the Philippines, when drivers made their riders feel like they're top priority when they’re inside their cabin. Not like what’s happening right now, where drivers are mad whenever they have to drive their passengers to a very far destination, whenever the fare’s very cheap,” Libertad told CGTN. “It’s something that we are focusing on – the overall customer experience.”

Foreign investors have also shown interest. Indonesian-owned Go-Jek reportedly wants a share of the Philippine ride-hailing market. Boxing icon Floyd Mayweather has invested in a local firm called U-Hop. In other Southeast Asian countries, Grab also appears to have more competitors now.

A passenger takes a ride on a Go-Jek motorcycle taxi in Jakarta, Indonesia, May 24, 2018. Indonesian ride-hailing app Go-Jek said on May 24 it would expand into Vietnam, Thailand, Singapore and the Philippines as it takes on regional rival Grab in the fast-growing Southeast Asian market. /VCG Photo

A passenger takes a ride on a Go-Jek motorcycle taxi in Jakarta, Indonesia, May 24, 2018. Indonesian ride-hailing app Go-Jek said on May 24 it would expand into Vietnam, Thailand, Singapore and the Philippines as it takes on regional rival Grab in the fast-growing Southeast Asian market. /VCG Photo

But the Philippine Competition Commission says Grab, with about 93 percent of all registered ride-sharing vehicles, continues to dominate the Philippine market.

Jerimie Tableza tried driving for U-Hope briefly, but he says he earned next to nothing.

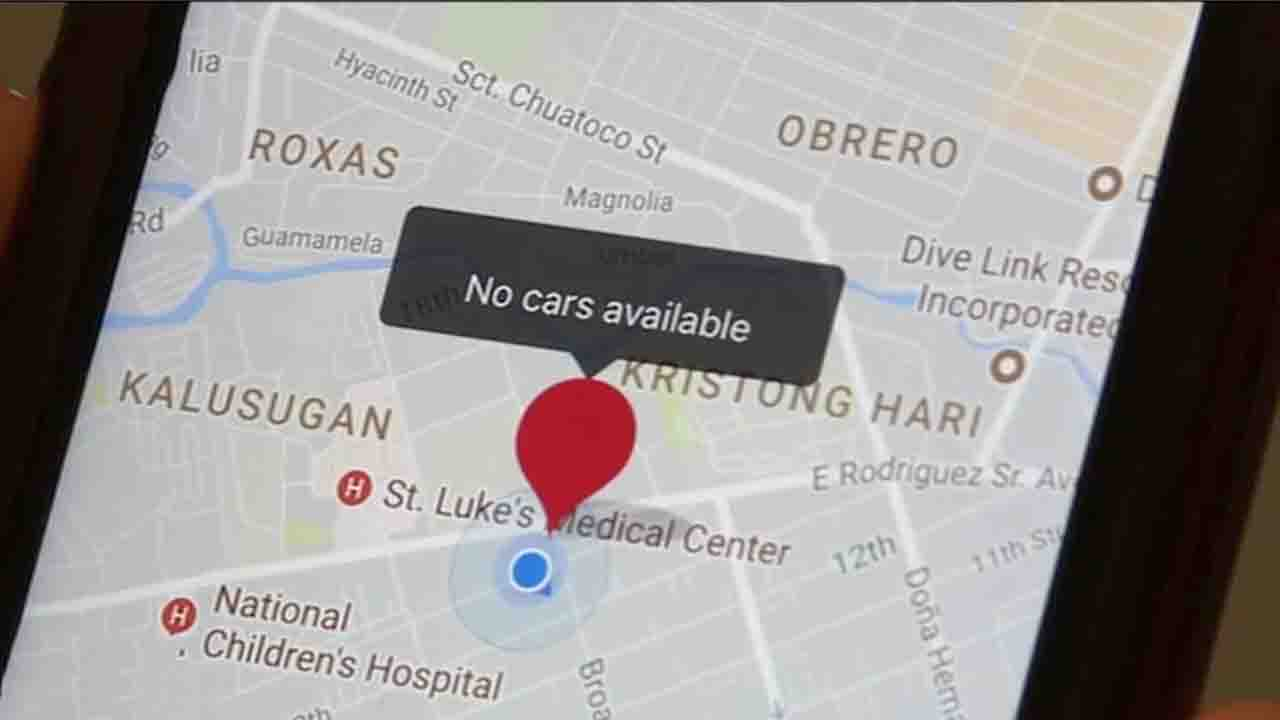

“I couldn’t get bookings because the app would show passengers that there were no drivers available even when I was actually nearby,” Tableza said.

He needed to be able to make loan payments for his vehicle, however, so he switched to another app-based transport service, Transportify. This time around, the job is not to move people around the city, but to deliver goods.

Tableza says he’s now actually making money.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3