Business

13:45, 13-Aug-2018

Russia vows to reduce reliance on 'risky' US dollar in wake of sanctions

Updated

13:26, 16-Aug-2018

Nicholas Moore

00:38

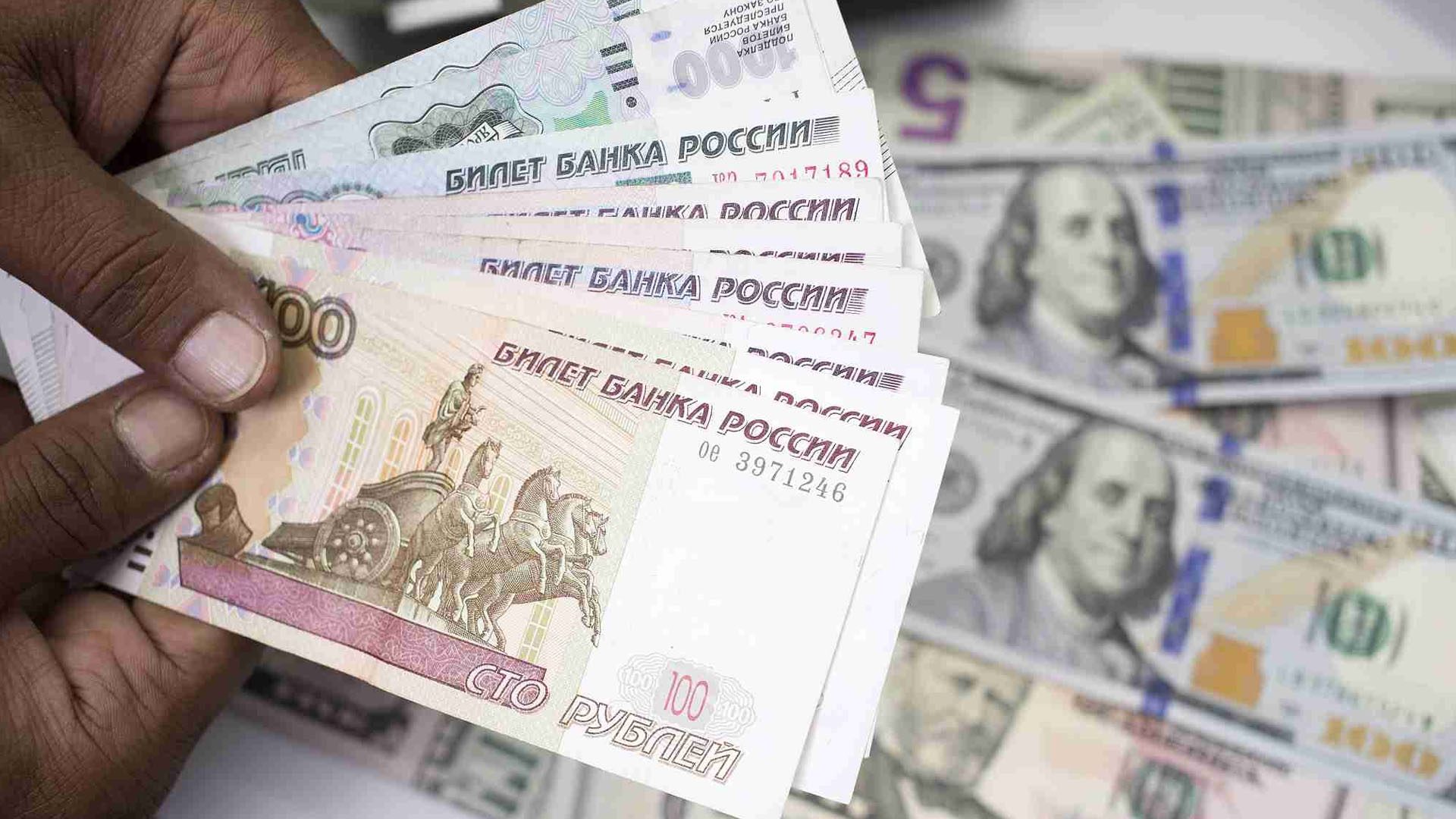

In the wake of further US sanctions, Russia will look to reduce its reliance on the US dollar – “a risky tool for payments” – by selling off US securities and looking to other international currencies, Finance Minister Anton Siluanov confirmed on Sunday.

In a television interview with Rossiya 1, Siluanov also described US sanctions on Moscow as “unpleasant, but not fatal.”

Russia has already drastically reduced its US Treasury holdings this year, cutting its reserves from 96.1 billion US dollars to 14.9 billion dollars between March and May, according to a report released last month by the US Treasury department.

Siluanov signaled that this cut in US assets would continue, telling Rossiya 1 “we have reduced our investments to the American economy and American securities to the minimal level and will continue to diminish them.”

Describing the US dollar as a “risky tool for payments,” Siluanov did not rule out dropping the US currency in international trade of goods including oil. “We will stop using the US dollar and will use our national currency, other currencies, including the European currency. So, as a matter of fact, these restrictions [US sanctions] will backfire at the Americans," he said.

Russian Finance Minister Anton Siluanov. /VCG Photo

Russian Finance Minister Anton Siluanov. /VCG Photo

“We are using other currencies more and more, first of all, the ruble, the euro, the Chinese yuan, etc.”

Intensified US sanctions were placed on Moscow last Wednesday, after Washington accused Russia of being behind the UK Novichok nerve agent incident earlier this year. Senior State Department officials said the first phase of the sanctions will ban the granting of licenses to sell "all national-security sensitive goods or technologies" to Russia.

A second phase of “more draconian measures” could come into place after three months if Russia fails to provide “reliable assurances” that it will no longer engage in chemical weapons use and allows on-site inspections by the United Nations or other internationally recognized impartial observers.

On Thursday, the Russian Foreign Ministry said it was working on countermeasures to the sanctions, while a Kremlin statement released Friday described the US move as “illegitimate” from the point of view of international law.

The ruble fell one percent in the wake of the latest round of US sanctions, and amid concerns in emerging markets following the collapse of the Turkish lira on Friday, Siluanov looked to reassure Russians over any concerns about inflation.

“In the long run, inflation may go up to three percent, or even more. But, in any case, it will stay within the corridor set by the government and the Central Bank. That is why we see no risks of inflation hikes. Inflation is under control.”

Siluanov, who is also First Deputy Prime Minister, also voiced support for any Russian banks affected by US sanctions, saying “the Central Bank will always support with its liquidity any bank should it happen to find itself in such a difficult situation. The Central Bank has enough reserves, ruble liquidity.”

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3