Business

12:56, 22-Dec-2018

Will gimmicks and in-store robots bring shoppers back to the streets?

Updated

12:32, 25-Dec-2018

By Derek Cai

03:20

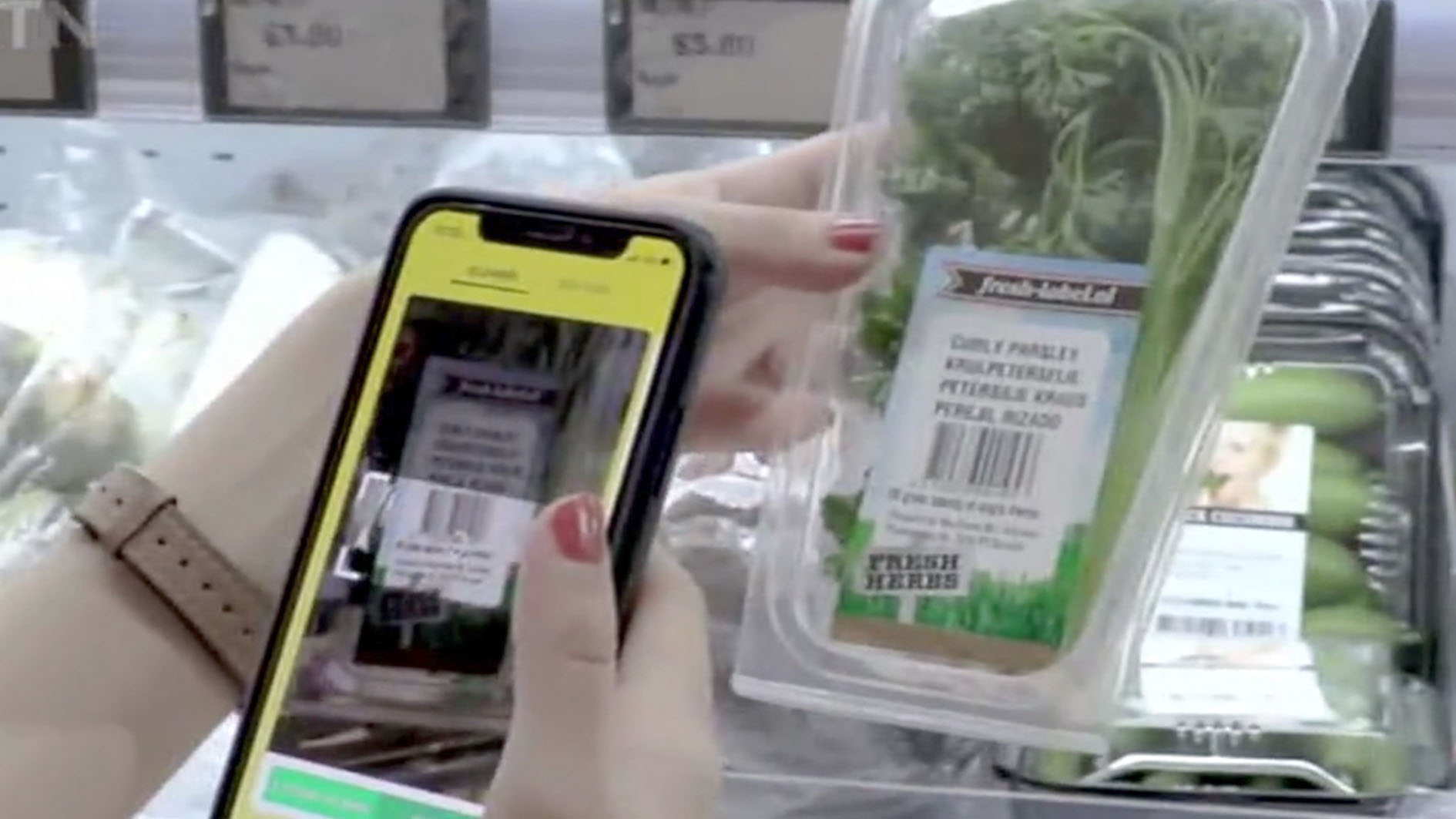

Self-checkout counters, interactive directory screens, robots and ongoing integration between the offline and online shopping experience. The retail scene across the globe is getting a facelift.

As e-commerce companies inch their way into the offline space, one question remains: Is there a vacuum that needs to be filled?

All across the shelves, the main selling point now is a “unique shopping experience.” But against such an intangible and incalculable concept, companies have had to hunker down on what they believe customers want.

Honestbee is a three-year-old digital startup based in Singapore. It started by providing personal shoppers to customers, and was hitherto an online-only business. In October, the company ventured into the offline space, introducing a physical grocery store called Habitat. Customers pay via the Honestbee app on their phone.

Habitat, a tech-enabled supermarket newly opened by e-commerce company Honestbee / CGTN Photo

Habitat, a tech-enabled supermarket newly opened by e-commerce company Honestbee / CGTN Photo

“I think companies want to be able to reach out to their customers and customers live online and they live offline. We live in the physical world. I think it's the job of every company to be able to reach out and get to their customers across all channels,” said Joel Sng, the company's founder and CEO.

Industry experts say the concept of new retail will breathe life back into a lackluster brick and mortar retail industry in Southeast Asia. But are these retailers in letting the wish be the father of the thought?

In the United States, the champion of e-commerce retail, Amazon, in January introduced Amazon Go, a supermarket with no checkout operators. Cameras and electronic sensors identify and track the items each customer selects, and bills their credit card when they leave the store. Lines formed around the block outside of the store in Seattle even before the doors were opened to the public.

A little closer to home, Alibaba's chain of new retail supermarket in China, Hema, is also a national success. Since 2016, the Chinese e-commerce giant opened 64 Hema stores in 14 cities. Users can buy groceries online, which are delivered to their homes within 30 minutes. They can also shop at the physical stores and have them delivered to their doorsteps.

Alibaba's Taobao sets up its first physical store in Singapore at NomadX. / CGTN Photo

Alibaba's Taobao sets up its first physical store in Singapore at NomadX. / CGTN Photo

In Southeast Asia, however, the e-commerce industry is still fledgling. Some experts believe that the industry still has some runway left before venturing into the new retail concept.

In Singapore, convenience remains a top priority for consumers, though some are not opposed to visiting physical stores just to see what all the new retail fuss is about.

“Gimmicks won't bring me back to the stores, I think. I only go to a physical store if I need to see and touch something, but even that is debatable. We buy all sorts of things online now because of the free return clauses,” said 33-year-old Mabel Wong, an international relations specialist.

“If I'm in the vicinity, I may pop in to [a physical store] take a look. But I won't make the trip down specially. I go to the store to touch and try, but it's cheaper online, I'll grab that, especially if I'm not in desperate need of that stuff,” said Samantha Lim, 33, a marketing executive at Carousell, an e-commerce company in the country.

According to a 2018 research by auditing firm KPMG on the global consumer and retail industry, customer experience in the retail sector is more important than ever as retailers are striving to differentiate themselves in a challenging and crowded market.

“The rise of a conscious customer will continue as consumers base their buying decisions on many factors beyond price. These new consumers, led and influenced by millennials, are exerting influence on retailers and forcing them to take action,” the report wrote.

E-commerce in Asia Pacific accounted for 12.1 percent of retail sales between 2016 and 2017. Experts say that new retail is a way for e-commerce companies to tap into the percentage of shopping that still happens offline.

Even traditional stores are trying to cash in on the new retail hype. Property developer CapitaLand, which owns 19 shopping malls in Singapore, in November introduced NomadX in its first foray into the new retail market. The developer's deputy managing director, Chris Chong, told CGTN that it wants to create a community of shoppers and retailers through a unique blend of physical and digital shopping experiences.

The multi-label concept store, which has 17 retailers under its belt, currently houses things like interactive directories and product walls, smart mirrors, and a cashless payment system. Chong said that in the process of on-boarding retailers, they found a lot of interest from online-only brands. Five of the 17 retailers only had an online presence before setting up shop in NomadX.

Interactive directories provide more information about products in NomadX. / CGTN Photo

Interactive directories provide more information about products in NomadX. / CGTN Photo

“These retailers, like Taobao, find that coming from online to offline, they're able to reach out to a different group of shoppers that previously they may not have been able to get based on a purely online platform,” he added.

While the increasingly experience-oriented retail industry can ride the waves of technological advancement, the jury is still out on whether this rising tide will lift all boats. At least for now, the inclusion of AI and smart tech in new retail seems to shave off large sections of the public less acquainted with technology.

But it is clear that in this age where multiple industries are threatened by technology disruptions, if you don't move fast, you don't move at all.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3