Opinion

21:44, 10-Mar-2019

Deficit financing sustaining rather than crippling Chinese economy

Ken Moak

Editor's Note: Ken Moak, who taught economic theory, public policy and globalization at the university level for 33 years, is the co-author of a book titled "China's Economic Rise and Its Global Impact" in 2015. The article reflects the author's opinion, and not necessarily the views of CGTN.

For over 30 years, the mainstream Western media, analysts and scholars have been sounding the China debt alarm, telling the world that its economy is collapsing under "a pile of debts."

The Institute for International Finance (IIF) estimates the Chinese total debt GDP ratio at 299 percent in 2018, breaking down at approximately 50 percent, 70 percent, 49 percent, and 130 percent for government, financial corporations, household, and non-financial corporations respectively.

Whatever the figure, China's debt might be a reason why the country was able to sustain long-term high economic growth rates. Critics were wrong in predicting China's huge 2008 stimulus package of around 580 billion U.S. dollars financed by debts would cripple the economy.

The opposite, in fact, was true, reversing economic growth from 6.5 percent to 9.2 percent year-on-year in 2009, culminating in tripling the country's 2008 GDP of 4.6 trillion U.S. dollars to 13.6 trillion in 2018, according to World Bank figures.

Since then, the government has consistently practiced counter-cyclical fiscal and monetary policies, and deficit financing during periods of economic slowdowns.

At this year's Two Sessions, authorities announced huge increases in government spending and making available funds to encourage and stimulate private small- and medium-sized enterprises as a way to counter downward pressures in part from weak external demand.

Members of the media and delegates leave the Great Hall of the People after the opening of the second session of the 13th National People's Congress in Beijing, China, March 5, 2019. /VCG Photo

Members of the media and delegates leave the Great Hall of the People after the opening of the second session of the 13th National People's Congress in Beijing, China, March 5, 2019. /VCG Photo

One could argue that counter-cyclical policies focusing on domestic demand and emphasizing innovative growth are an appropriate and effective way of enhancing and sustaining China's long-term economic growth and stability.

Reducing taxes, as the government announced in this year's Two Sessions, could boost consumption, particularly when the younger generation (i.e. millennials) is increasingly opting for a more luxurious lifestyle than their parents.

Unleashing the purchasing power of China's increasingly affluent huge domestic market of almost 1.4 billion people would generate enormous economies of scale, thereby increasing the country's competitiveness in the foreign market.

Further, realizing the full potential of the domestic market could wean China's dependence on the U.S. and other developed countries. A market with almost 1.4 billion people is bigger than the combined economies of Europe and North America.

Focusing on innovation with government financial support could make China a high technology hub. It should be clear by now that the West, the U.S. in particular, will do whatever it takes to stifle China's innovative growth in light of its policies towards Huawei and other Chinese technology firms.

Moreover, the composition and nature of China's debts are conducive to economic growth. Of the public debt GDP ratio of 50 percent, two-thirds is attributed to local government loan guarantees to the private-public partnership (PPP) infrastructure and housing construction projects.

In the PPP projects, the private partner puts up the capital and local governments pledge land as their share of capitalization. In the event of payment default, local governments take over the projects.

The housing units are either sold or turned into social housing, earning the local governments profits and improving social stability. Roads are tolled, generating revenues to repay the loans. In short, the assets built by the debts have economic and social values, not a waste of money as the critics assumed.

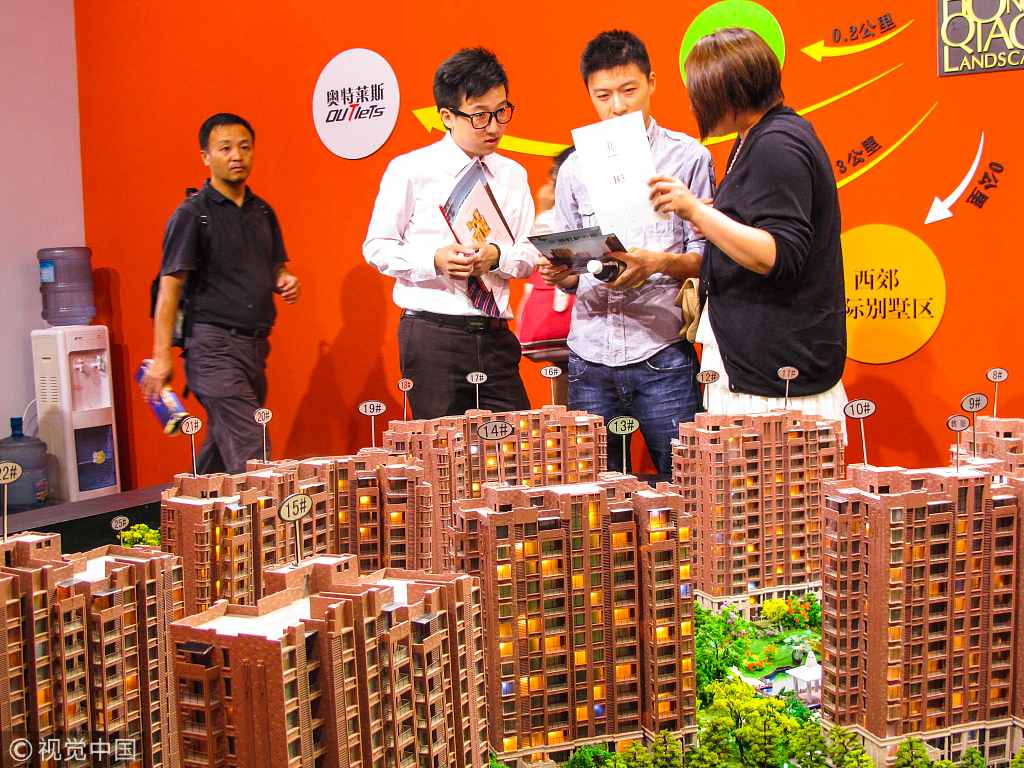

A mock-up of residential and office buildings. /VCG Photo

A mock-up of residential and office buildings. /VCG Photo

Rather than "drowning in a sea of debts," local governments, in fact, are protecting the people's interests.

Household debts are largely mortgage loans that, according to government statistics, account for less than half of the value.

Unlike in the West, buying a home is a “family affair" whereby family members pitch in to help a young couple with the down payment and monthly mortgage payments if required, suggesting the chances of home foreclosure are low.

Financial corporation debts are largely attributed to China's shadow banking system which includes insurance, mortgage, and other non-commercial banking businesses. They are, for the most part, subsidiaries of state-owned commercial banks using shadow banks as a vehicle for wealth management programs.

The U.S. credit rating agency Moody's claimed China's shadow banking is the world's fastest-growing with its share of GDP being around 80 percent. But the number is pale compared to the West's, including the U.S. which stood at over 150 percent of GDP, according to Bloomberg.

The speculation that shadow banking in China could fuel housing and financial bubbles is just that, speculation. For reasons cited earlier, a housing bubble is not imminent. While some state-owned enterprises might be losing money, as a group they seemed to be doing well, raking in nearly 500 billion U.S. dollars in profits, a year-on-year increase of 12.9 percent in 2018.

Further, China's financial system is the biggest in the world, having accumulated over 36 trillion U.S. dollars in assets and deposits of over 26 trillion U.S. dollars.

China's government debt management method is not perfect and has indeed made costly mistakes. But the government learned from the mistakes, taking actions to curb over-borrowing and lending, culminating in non-performing loans to around 1.7 percent, in line with, if not better than, that of the West.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3