Business

12:11, 01-Aug-2018

Will car sharing dominate the future of shared mobility?

Updated

11:42, 04-Aug-2018

CGTN‘s Yan Qiong

As the concept of shared mobility is gaining traction in China, a slew of players have rushed to embrace new business areas, such as ride hailing and car sharing.

Compared to ride hailing, the car-sharing service market is still small in China. But will this change in the near future?

Consultancy firm Roland Berger expected China’s car sharing fleet to have a 45% of annual growth until 2025.

On the demand side, a recent survey from AlixPartners found that 19% of consumers expected to order more rides, while only 3% said they’ll increase car-sharing.

Currently there were more than 40 car sharing operators in China, mainly in tier one and two cities, and more than 90% of them are local players.

Gao Yu, CEO of Pand-auto, the third largest car-sharing operator in China after GoFun and EvCard, told CGTN that her company has cooperated with Baidu to launch shared self-driving vehicles equipped with Apollo platform. She believed that autonomous driving can help increase the efficiency of fleet management.

Pand-auto launches its shared self-driving vehicles equipped with Baidu’s Apollo platform in Silicon Valley, California, US, January 5, 2018. /Photo provided by Pand-auto.

Pand-auto launches its shared self-driving vehicles equipped with Baidu’s Apollo platform in Silicon Valley, California, US, January 5, 2018. /Photo provided by Pand-auto.

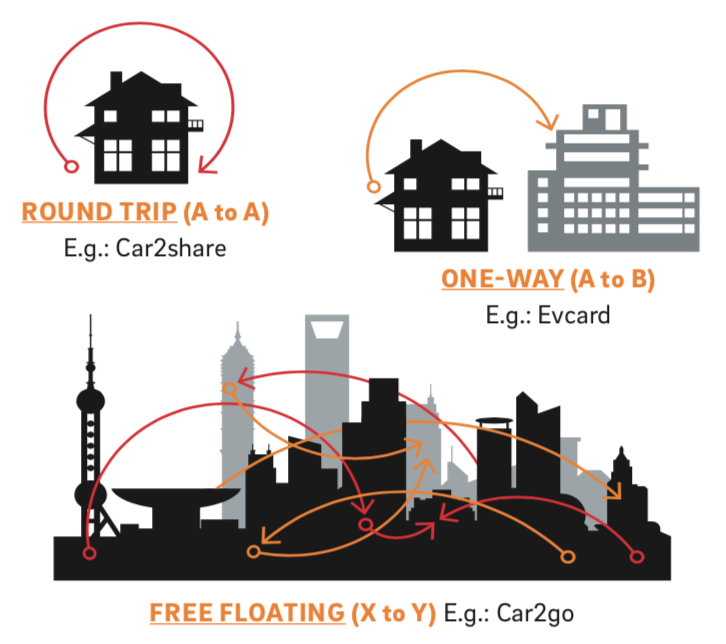

Pand-auto, a Chongqing-based electric car-sharing platform, uses a free-floating arrangement which allows users to make one-way trips, and doesn’t require them to return cars to a specific location. Besides free-floating models, there are mainly three car sharing models in China.

Roland Berger's Photo

Roland Berger's Photo

Only Daimler and BMW as international OEMs have set up car sharing businesses in China, Damiler’s car2share and car2go and BMW’s ReachNow.

Other international brands such as GM, Volkswagen and Renault-Nissan-Mitsubishi, are also keen on tapping into the Chinese car-sharing market.

Facing fierce competition, the car sharing business hasn't reached its break-even point in China.

They ran into issues like high initial investment, high maintenance costs, low utilization rate, and price pressure which resulted from the availability of alternative affordable and convenient mobility solutions (e.g. bike-sharing, ride hailing).

The future of transportation means mastering apps and customer service, but care sharing customers have commonly complained that apps are slow, take too long to locate a car, and give wrong directions.

Despite these challenges, the niche market has gained strong support form the government.

In June 2017, China's National Development and Reform Commission (NDRC) released a guideline for the development and promotion of the sharing economy, which is expected to account for more than 10% of China’s GDP by 2020.

Before autonomous driving could fundamentally revolutionize transport and people’s lives, car sharing will be an integral part of the shared-mobility ecosystem in China in the near future. But for these businesses to take off, car sharing operators will have to win investment battles for large customers and find ways to achieve payback in the Chinese market by lowering operational costs.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3