Business

21:58, 06-Oct-2018

Debunking China Myths: Is China continuing a consumption upgrade or experiencing a consumption downgrade?

Updated

21:14, 09-Oct-2018

By CGTN's Global Business

04:56

Consumption upgrade or downgrade? The issue has been debated for weeks on Chinese social networks and in the media. It's all started with the ups and downs of the instant noodle.

The instant noodle sector enjoyed exponential growth thanks to huge demand for convenience food in an increasingly fast-paced society. However, the market lost momentum in 2011 and sales continued to slide over the next five years.

Last year, the instant noodle has returned to growth again. The market has piqued public attention this year after the sector's two dominant players, Master Kong and Uni-President, posted better-than-expected half-year financial reports.

02:06

The instant noodle isn't alone. Chinese relish producer Fuling Zhacai and inexpensive wine producer Niulanshan also posted surprisingly good financial results. Relish, inexpensive wine and instant noodles have conquered Chinese social networks.

Either consumption upgrade or downgrade is an attitude towards spending

The dramatic increase in so-called low-end products, the rise of e-commerce platforms like Pinduoduo for low-priced products, and the booming sharing economy are all labeled as the proof of consumption downgrade.

The Commerce Ministry spokesman Gao Feng denied that public's opinion. "We believe consumption downgrade is biased. Some high-quality consumer goods are selling well, which reflects the trend of the improvement in consumption."

Gao Feng, spokesman for Chinese Commerce Ministry /CGTN screenshot

Gao Feng, spokesman for Chinese Commerce Ministry /CGTN screenshot

"Pinduoduo focuses on the third-and fourth-tier cities where people's incomes are not so high. Even without Pinduoduo, their consumption demands have existed. So Pinduoduo just moved the demands from offline to online," said Professor Liu Chunsheng from Central University of Finance and Economics, stressing that the rise of Pinduoduo does not mean there is a consumption downgrade.

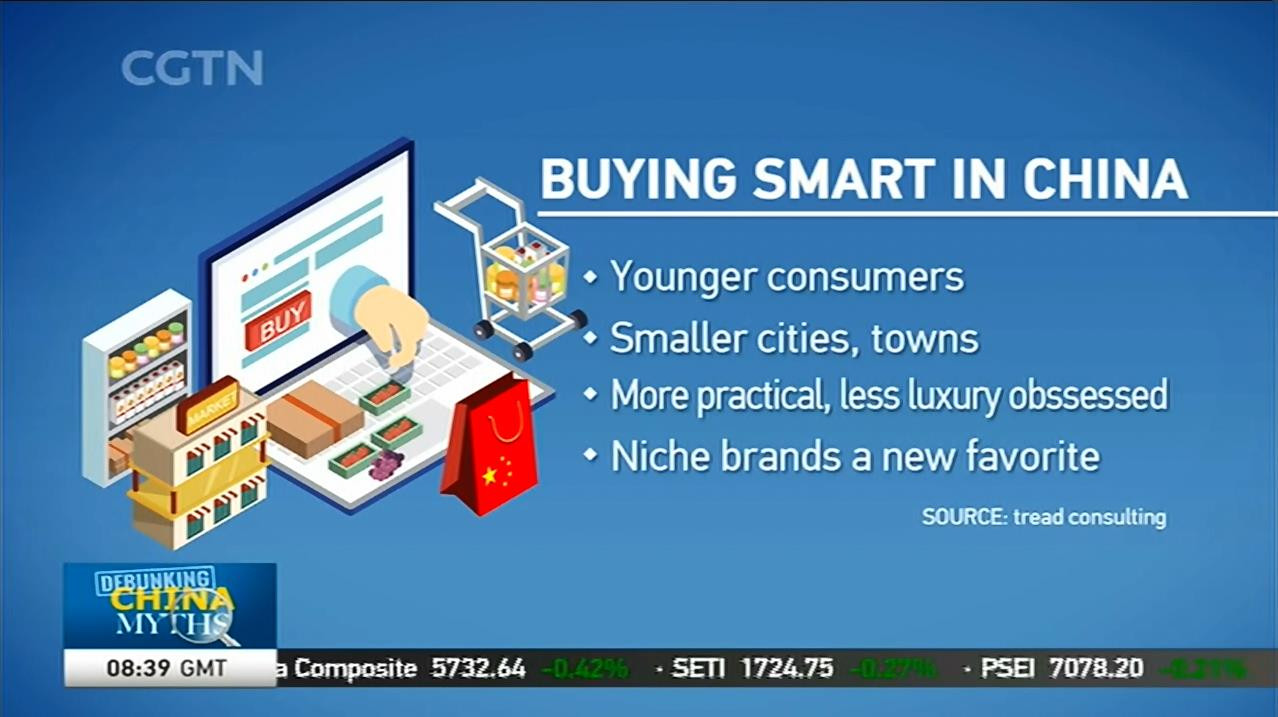

In fact, the overall income in recent years has not changed much, which means either consumption upgrade or downgrade is an attitude towards spending, based on a report from the consulting firm, Tread Consulting.

The consulting firm concluded that Chinese people feel they have less money to buy big goods because they have started to overspend on services, education and health – that gives them an illusion of being less well off.

02:30

Chinese consumers now care more about value

The slowdown in retail sales isn't equivalent to a consumption downgrade. To take Master Kong for an example, the leading instant noodles brand saw a 24-percent slip in sales of its low-end noodles but a 15-percent jump in its high-end products during the first half of this year.

The consumption upgrade story remains intact, according to Xu Sitao, chief economist and partner at Deloitte China. "I think the best example is if you look at the auto market. China is the biggest auto market in the world. Average unit price of car is still going up. So consumers are still trying to upgrade themselves [with] whether bigger vehicles or utility vehicles."

Xu Sitao, chief economist and partner at Deloitte China /CGTN screenshot

Xu Sitao, chief economist and partner at Deloitte China /CGTN screenshot

Chinese consumers are spending less on food and beverages but more on culture, entertainment, sports and travel. Official figures show domestic travelers jumped 11 percent in the first half this year, while the box office in cinemas rocked 18 percent more.

"If you look at outbound travel tourists, there seems to be higher percentage of consumers going for more bespoke arrangements and adventure travels," Xu added.

04:19

Young consumers mean the future of consumption

Tread's report indicated that young consumers in small cities and towns are the main force behind the consumption boom in China.

"There are so many trends, some are interesting and others are conflicting. But one distinct trend is really young consumers," Xu echoed.

The Commerce Ministry spokesman said recently that "In our next plan, we will expand consumption of services, develop medium and high-end consumption, upgrade consumption channels, and improve the environment for consumption."

"The government is on the right track. I do think China can do more. And the policy framework definitely can be more pro-consumption," Xu forecasted. In the meantime, he advised that lowering tariffs would be the "best policy" to boost consumption. “Right now, in China, the average tariff is about nine percent. It's still quite high. So there is really a lot of room for reducing tariffs," he told CGTN.

Tread Consulting also reported that Chinese are still price-sensitive as they have become more practical, ditching the luxury part of the experience for useful and quality products and services, and consumption in China will get increasingly personal and sentimental to relieve the stress and anxiety of living in big cities.

Xu agreed to sort of advice that consumer product companies should maintain brand integrity, work harder to understand consumers and renew their strategies.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3