Economy

14:53, 23-Dec-2018

China in 2018: Unswerving support for private sector

Updated

14:29, 26-Dec-2018

CGTN

"On the new journey to complete the building of a moderately prosperous society in all respects and further fully build a modern socialist China, the country's private sector should only grow stronger instead of being weakened, and should march toward a broader stage."—Xi Jinping

As the economy has seen increased downward pressure with overall stability, and some companies have been suffering from operating difficulties, Chinese President Xi Jinping stressed unswerving support for the private sector's development.

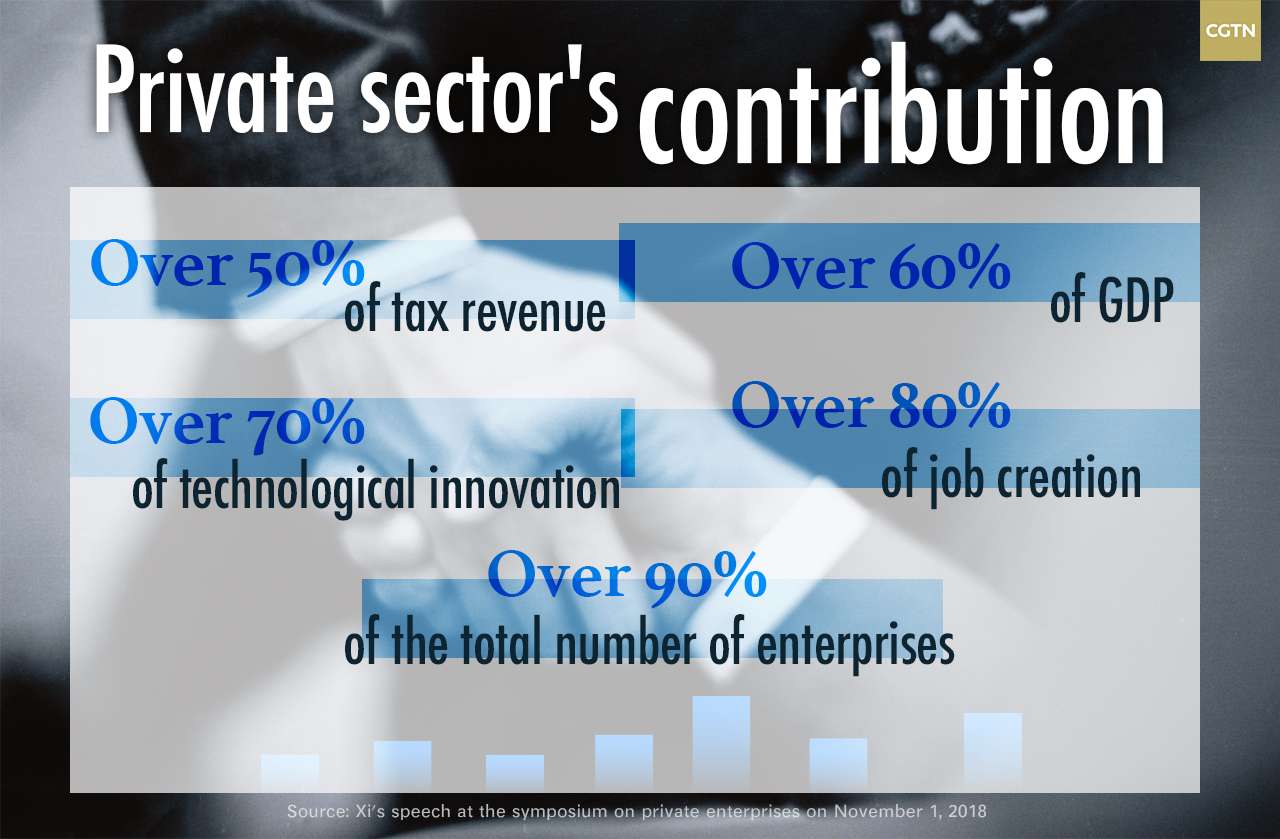

China's private sector has become the main contributor to domestic job creation and technological innovation, an important source of tax revenue, and a significant guide in developing the socialist market economy and exploring the international market.

"Over the past 40 years, the private sector of the economy has become an indispensable force behind China's development," Chinese President Xi Jinping said when presiding over a symposium on private enterprises in November.

To reassure the private sector, Xi demanded measures in six aspects including easing the tax burden, resolving financing problems, encouraging private enterprises to participate in the reform of state-owned enterprises, and ensuring entrepreneurs' personal and property safety.

Chinese President Xi Jinping presides over a symposium on private enterprises at the Great Hall of the People, Beijing, China, on November 1, 2018. /Xinhua Photo

Chinese President Xi Jinping presides over a symposium on private enterprises at the Great Hall of the People, Beijing, China, on November 1, 2018. /Xinhua Photo

Corporation tax cuts announced this year are set to reduce the burden on private enterprises by more than 1.3 trillion yuan (187 billion U.S. dollars), according to the Ministry of Finance.

Mixed ownership reform, which aims to merge SOE equity with private sector investment and management, is progressing and vital to improving the efficiency and competitiveness of state-owned assets.

Cuts to red tape in the private sector this year will see measures including the launch of an online trademark database, reinforced protection of intellectual property rights, and a nationwide move to cut the time it takes to set up and register a new business to only 8.5 working days by 2019.

Economic situation

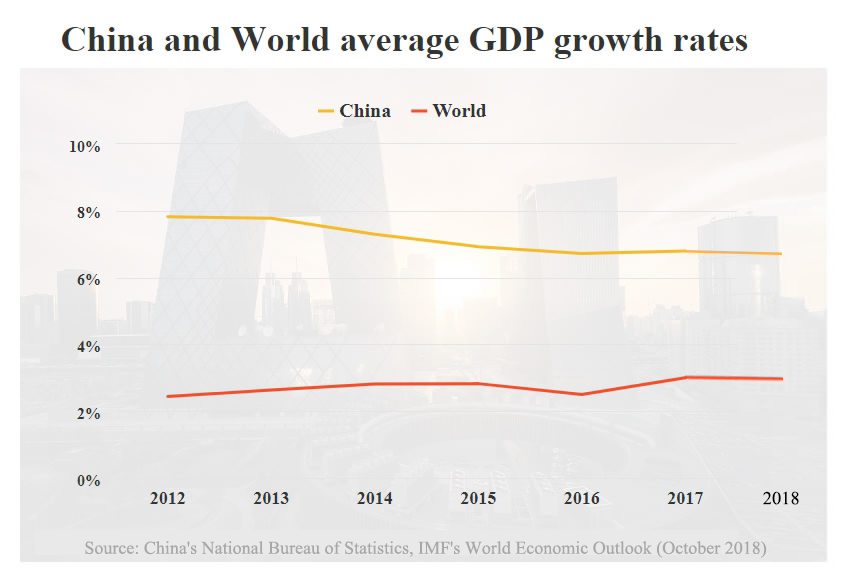

The World Bank projected China's GDP growth to be 6.5 percent in 2018 in a Thursday report. Despite downward pressure, China's economic growth has maintained its momentum at a high level among the world's economies and contributed nearly 30 percent to world economic growth.

"As for current circumstances, China has no need to worry about the slower growth because it's quite competitive compared with other countries," said John Litwack, the World Bank's lead economist for China.

However, Litwack noted that a deceleration in global demand and higher US tariffs would negatively affect net exports and that higher investor uncertainty and slower credit growth were also expected to weigh on investment, which means China is still facing challenges in terms of controlling risks in trade and the financial sectors.

This year witnessed a good start to the "three tough battles," namely, preventing financial risks, reducing poverty and tackling pollution, according to a statement following the conclusion of the closed-door Central Economic Work Conference.

China gave additional support to small businesses and allocated public spending for healthcare, education and social protection, which would create jobs, deliver higher-quality public services, and provide better support to vulnerable families, according to World Bank senior economist Elitza Mileva.

China also introduced tax incentives to stimulate consumption. The threshold of personal income tax was raised from 3,500 yuan (508 U.S. dollars) to 5,000 yuan (725 U.S. dollars) from October 1, with authorities confirming plans to integrate local and national tax offices and unify tax collection procedures.

The State Administration of Taxation said in November that one month after the income tax reform, the tax burden on individuals had been reduced by 31.6 billion yuan (4.59 billion U.S. dollars).

Further policies

Imported cars at Qingdao Qianwan Bonded Port on May 23, 2018. /VCG Photo

Imported cars at Qingdao Qianwan Bonded Port on May 23, 2018. /VCG Photo

As for the auto sector, China in April announced that equity caps on JVs would be phased out, with caps removed for commercial car producers by 2020 and limits on passenger vehicle makers ending by 2022.

Foreign carmakers will be able to enter more than two JVs with a domestic partner.

The 50-percent equity cap on the NEV sector will be removed from the end of 2018.

U.S. NEV giant Tesla became the first foreign automaker to set up a wholly-owned subsidiary in May, with plans to establish a “gigafactory” in Shanghai and begin production next year.

Tariffs on imported vehicles were reduced to 15 percent from July 1, while tariffs on components were reduced to six percent.

(CGTN's Yao Nian, Nick Moore contributed to the story.)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3