Opinion

16:31, 06-Jun-2019

The irony of tariffs

Ken Moak

Editor’s note: Ken Moak, who taught economic theory, public policy and globalization at the university level for 33 years, co-authored a book titled "China's Economic Rise and Its Global Impact" in 2015. The article reflects the author's opinion, and not necessarily the views of CGTN.

Tariffs were meant to protect import-substitute industries, particularly the newly established or “infant” ones, economic diversification, and national defense, because they are excise taxes on imports, thereby discouraging businesses and consumers from buying foreign goods. The theory was that the excise taxes be paid by importers, who in turn would pass them on to businesses and consumers in the form of higher production costs and consumer prices.

However, history has shown that tariffs have the opposite effect, making economic problems worse instead of better. For example, the 1930 U.S. Tariff Act, also known as the Smoot-Hawley Tariff, was meant to protect manufacturers and farmers. Instead, it exacerbated the Great Depression, culminating in worsening their economic and financial plights.

Impact of the Smoot-Hawley Tariff

The outcome was not surprising because the Smoot-Hawley Tariff invited retaliation before it was signed into law by then President Herbert Hoover in June 1930. According to a 2008 report by The Economist, 23 trading partners sent protest notes to the president in 1929, warning him of retaliatory measures if it passes.

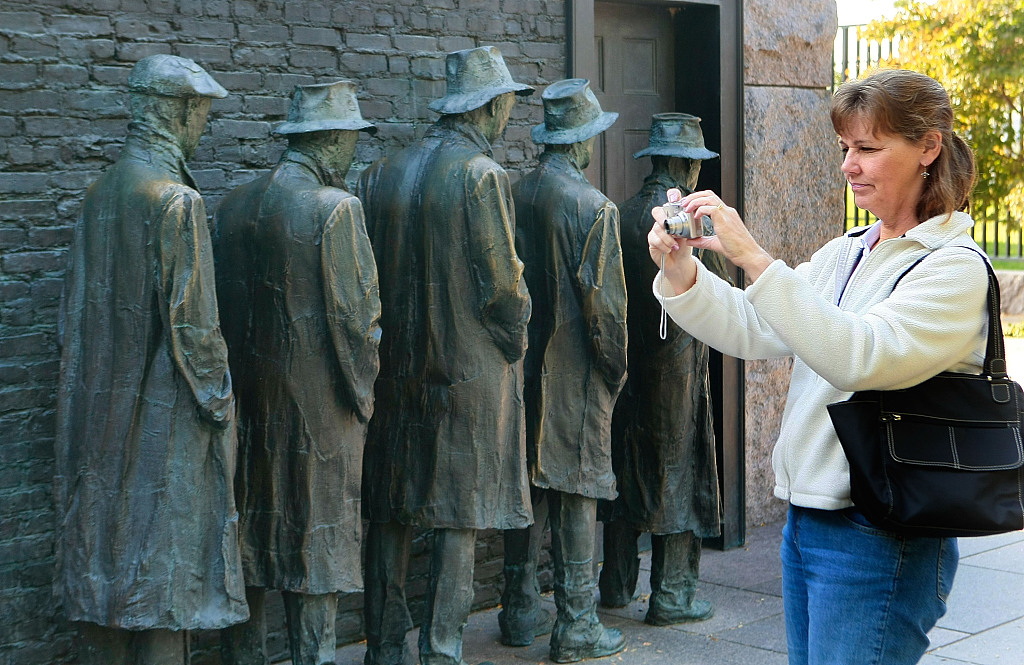

A tourist takes pictures near life-size bronze statues depicting men standing in a line during the Great Depression at the Franklin Delano Roosevelt Memorial, Oct. 21, 2008, Washington, DC. /VCG Photo

A tourist takes pictures near life-size bronze statues depicting men standing in a line during the Great Depression at the Franklin Delano Roosevelt Memorial, Oct. 21, 2008, Washington, DC. /VCG Photo

The warning was ignored, but retaliation by trade partners was quick and damaging, effectively blocking U.S. products from entering the markets of trade partners. With domestic demand already declining, dramatic falls in exports further reduced the GDP of all nations, leading to the Great Depression.

The paradox of tariffs

The “paradox” of trade barriers was perhaps the reason why the U.S.-led allied powers convened the 1944 Bretton Wood Conference in which they agreed on the free or freer flow of goods and capital between international borders. That policy, in large part, contributed to global economic growth because unfettered trade increased economies of scale by taking advantage of each country's comparative advantage.

However, the U.S.-originated 2008 financial crisis created a prolonged period of economic stagnation or slow growth. Adding to the problem was America's (and perhaps the EU and Japan as well) decisions to relocate manufacturing abroad and automate jobs at home. The policies hollowing out manufacturing and reducing job opportunities give rise to protectionism and populism on both sides of the Atlantic and allow history to repeat itself.

U.S. President Donald Trump is arguably the leading, if not the only, proponent of using tariffs to bring back manufacturing and defuse immigration. Accusing friends and foes of “eating America's lunch,” he imposed tariffs on 250 billion U.S. dollars' worth of Chinese imports as well as on those of allies.

Trump's latest use of tariffs is the threat of imposing 5 percent duty each month to a maximum of 25 percent by October on all Mexican goods in June if Mexico does not prevent Central American migrants from crossing its border into the United States.

However, for similar reasons as those discredited Smoot-Hawley, Trump's tariff policies might sink the global economy into another recession.

The reason behind the theory is really simple: Tariffs distort the allocation of resources, goods production, and distribution, culminating in higher production costs and consumer prices. Having the iPhone produced entirely in the U.S., for example, could raise its average price to 2,000 U.S. dollars, according to a report by the Foundation for Economic Education (FEE) from September 13, 2018.

Apple company logos are reflected on the glass window outside an Apple store in Shanghai, Jan. 3, 2019. /VCG Photo

Apple company logos are reflected on the glass window outside an Apple store in Shanghai, Jan. 3, 2019. /VCG Photo

The FEE report thus supported the policy of taking advantage of each country's comparative advantage to lead to huge increases in economies of scale. For example, Chinese workers enjoy a manufacturing comparative cost advantage because of relatively lower wages, well-educated labor force, and infrastructure system. The U.S., on the hand, has a comparative advantage in product design and development because of its advanced technology.

Taking advantage of each country's comparative advantage has reduced the cost of producing the iPhone and kept its average price at around 650 U.S. dollars. The Apple iPhone is the rule rather than the exception because most U.S. consumer goods produced in China use the same model.

Tariffs do disrupt the supply chain because they are meant to reduce the quantity demanded for imports, culminating in diseconomies of scale or increasing production costs and higher consumer prices, leading to lower investment spending.

Consumption and investment account for over 80 percent of U.S. GDP, explaining why in a recent forecast of Federal Open Market Committee, it predicts that the economy would fall from 3 percent to 2.1 percent, 1.9 percent, and 1.8 percent respectively in 2019, 2020 and 2021.

In this regard, there is no reason to believe that tariffs would bring back manufacturing to the United States. It could indeed be argued that more U.S. firms might be looking overseas to invest, China in particular because of its increasingly huge affluent market and manufacturing comparative advantage.

Neither would tariffs on all Mexican products be able to stop the flow of “illegal” Latin American immigrants from seeking a better life in the U.S. The opposite might be true, in that imposing a maximum of 25-percent duty on all its goods could cripple Mexico's economy. Should this occur, the number of “economic refugees” would increase dramatically because Mexicans will join Central American migrants to cross the U.S.-Mexico border.

Besides, humans have been migrating to other lands in search of a better life since their conception. With little or no hope at their place of birth, migrants risked danger and even their lives to travel elsewhere in the hope of securing a better life or simply just to survive.

Indeed, the major reason why Europeans colonized and settled in the Americas and other regions around the world was to escape hardship and persecution in their home countries. Turning away people for doing the same is not only inhumane and hypocritical but might not be stoppable, at least not by imposing tariffs on Mexican goods.

There lies the irony of tariff: instead of protecting the economy and stemming the flow of “illegal” immigrants, the trade barriers did exactly the opposite.

Trump should rescind his counterproductive tariff policies to avoid ending up like Smoot and Hawley who lost the 1932 election probably because of what their Act did. Trump's tariff policies seem to have similar adverse effects on the economy and possibly increase the “illegal” immigration.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com.)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3