Business

14:52, 12-May-2018

US metal tariffs take a toll on local manufacturers

By Hendrik Sybrandy

These are difficult days for a number of US manufacturers who rely on steel and aluminum to make their products.

The Trump administration recently announced tariffs on imported steel and aluminum, which have raised the price of both metals significantly. And many of those manufacturers are not happy.

Qualtek Manufacturing in the US' Colorado Springs is one. It stamps, heat treats and metal finishes a wide array of products for aerospace, medical and firearms companies and many other customers.

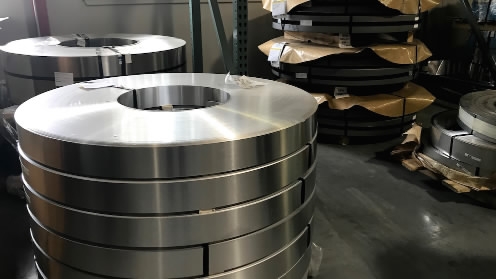

Raw materials and operations at Qualtek Manufacturing in Colorado Springs, Colorado /CGTN Photo

Raw materials and operations at Qualtek Manufacturing in Colorado Springs, Colorado /CGTN Photo

“When people ask us what we do, the common response is we make stuff that you’ll never see but you want to know it’s there and it’s working properly,” said Chris Fagnant, Qualtek Manufacturing’s president.

Seventy Qualtek employees rely on steel and aluminum to do their work. The company buys those metals from US suppliers so you wouldn’t think the new 25-percent tariff on imported steel and 10-percent tariff on imported aluminum would affect them here. Guess again.

“It’s effectively been a tax placed on us to put us at a competitive disadvantage to anyone who’s not stamping inside the United States,” said Troy Roberts, Qualtek’s CEO. Roberts said companies like his are finding that domestically produced raw materials have also become more expensive.

“You know it’s not like iron ore went up or other ingredients went up,” Roberts said. “It’s just now they can raise the price.”

“They (manufacturers) have seen spikes of more than 30 or 40 percent in steel prices,” said Paul Nathanson, spokesman for the Coalition of American Metal Manufacturers and Users. “And also the inability to even get a price quoted.”

Nathanson represents tens of thousands of small and medium-sized manufacturers who are now fighting the tariffs. He said consumers of a range of products that contain steel and aluminum will eventually discover those products are more expensive. But there could be a shorter-range problem.

“This is going to hit the US manufacturing sector immediately,” Nathanson said. “So jobs are going to be lost, good paying manufacturing jobs.”

Trump has imposed 25-percent import tariffs on steels and 15 percent on aluminium, claiming to protect domestic industries. /VCG Photo

Trump has imposed 25-percent import tariffs on steels and 15 percent on aluminium, claiming to protect domestic industries. /VCG Photo

The tariffs were meant to build up the US steel and aluminum industries. But if companies like Qualtek lose business to foreign competitors who are able to buy metals more cheaply, there could be a repeat of 2002 when Nathanson said US steel tariffs cost hundreds of thousands of jobs.

“Some estimates are there’s going to be 18 jobs lost for every one created,” he said. “This is just not the way to grow manufacturing in this country and that’s why we’re speaking up.”

Qualtek had hoped to hire 14 more workers in 2018 and invest 1 million US dollars more in new equipment.

“Right now, we’re freezing everything because we’re going to have to see, can we win business or not,” Roberts said.

The European Union, Canada and Mexico have been given a 30-day exemption from the tariffs. Roberts said the outlook for US manufacturers is very cloudy. It’s not an ideal way, he argued, for businesses like his to operate.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3