Opinions

13:57, 21-Nov-2018

Opinion: Has China employed 'debt diplomacy' in Maldives?

Updated

13:38, 24-Nov-2018

By Feng Da Hsuan and Liang Haiming

Editor's Note: Feng Da Hsuan is chief adviser of the China Silk Road iValley Research Institute and former vice president of research at the University of Texas, Dallas. Liang Haiming is chairman of the China Silk Road iValley Research Institute and a visiting scholar at Princeton University. The article reflects the authors' opinion, and not necessarily the views of CGTN.

The issue of whether China has instigated so-called "debt diplomacy" through the Belt and Road Initiative (BRI) has recently received significant international comment.

For example, according to the newly elected president of the island nation in the Indian Ocean, Ibrahim Mohamed Solih, the answer is a definite yes.

In his inauguration speech last Saturday (November 17), he claimed that China's investment in the Maldives has significantly increased the country's debt and that its state treasury has been “ransacked” by China. He concluded that the Maldives is now facing a serious debt crisis.

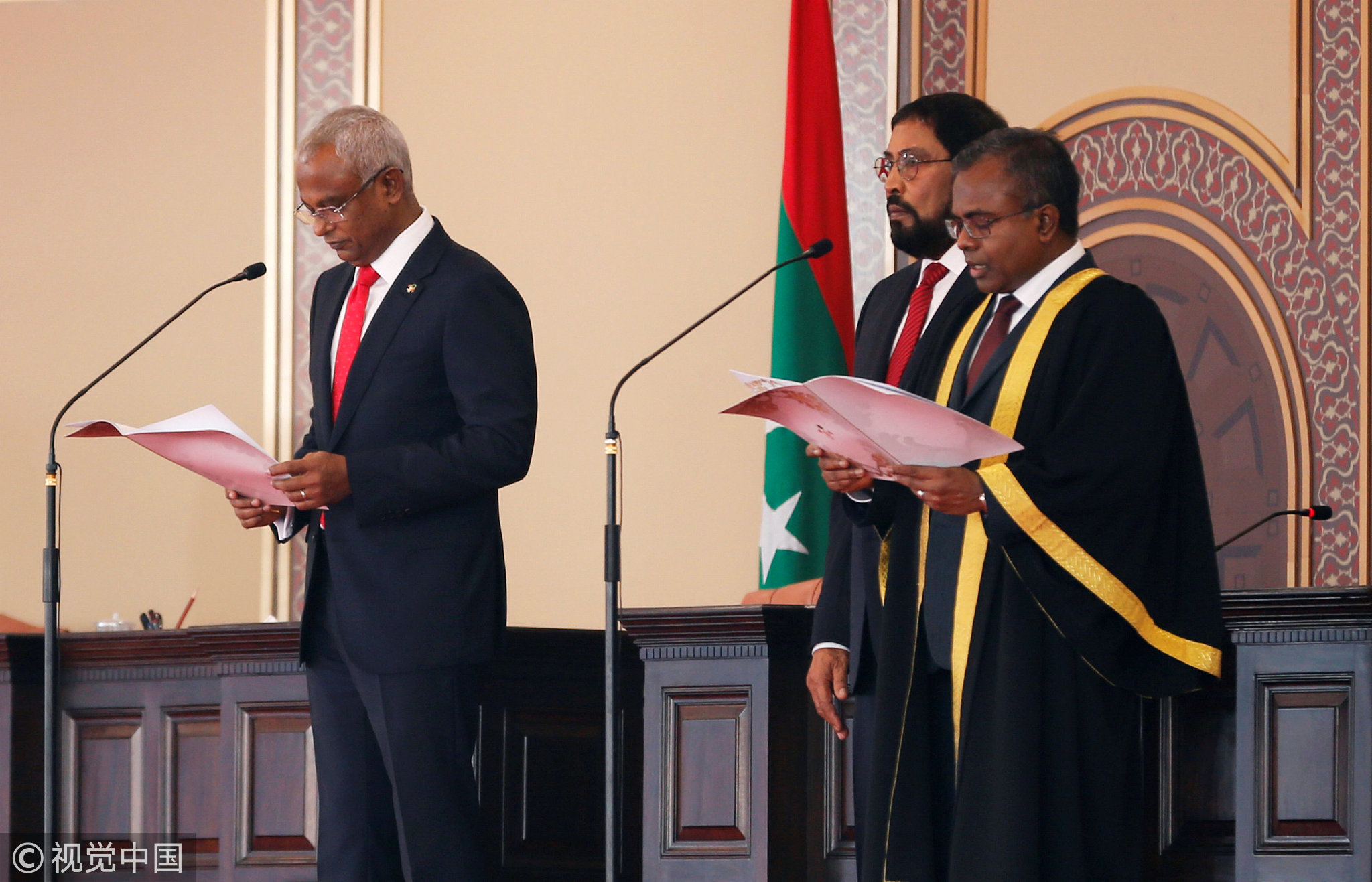

Maldives' President-elect Ibrahim Mohamed Solih (L) takes the oath of office before Chief Justice Ahmed Abdulla Didi (R) in Male, the Maldives, November 17, 2018. /VCG Photo

Maldives' President-elect Ibrahim Mohamed Solih (L) takes the oath of office before Chief Justice Ahmed Abdulla Didi (R) in Male, the Maldives, November 17, 2018. /VCG Photo

A nation's debt problem should and must be a mathematical problem. International and trustworthy financial data must have the final word. Indeed, public debates should be based entirely on such data.

To this end, for fairness, the data we shall use in this article are those not from China which will not have the reality or even the perception of conflict of interest.

What are the current Maldives debts? In his inaugural speech, it is intriguing that Solih presented no data to support his claims. To clarify the situation, we will base our discussions only on openly published data by the United States Central Intelligence Agency (CIA) and the International Monetary Fund (IMF).

According to CIA data, in 2017, the Maldives' national debt accounted for 68.1 percent of its GDP. Globally, it ranks 53rd, which is lower than India (70.2 percent) and Sri Lanka (79.4 percent). Also, in 2017, GDP was 4.505 billion US dollars. The service industry (tourism) is the country's major industry, accounting for 81 percent of GDP.

Its foreign debt, as of December 31, 2016, was 848.8 million U.S. dollars. Interestingly, this IMF figure is lower than that of the CIA's. The IMF data shows that the Maldives' national debt accounts for 34.7 percent of GDP. It is estimated that by 2021, the proportion of Maldives' national debt to GDP will rise to 51.2 percent.

Following the dictum of the “worst case scenario,” we shall base our discussion on the CIA data.

Economically speaking, there is a significant difference between national and foreign debt. For a nation to raise funds, the central government can issue treasury bonds. Since Maldives' national debt is 68.1 percent of its GDP, this means the government is raising funds for administrative, medical, education and other public expenditures. The debt generated by this means from home and abroad according to the CIA data is about 68.1 percent of its GDP.

In this regard, the national debt proportion in GDP is only related to the size of the government bonds. It has nothing to do with China. Hence, President Saleh, by accusing China of "debt trapping" by the proportion of national debt to GDP, is simply erroneous.

We should also give attention to Saleh's claims of China “land-grabbing” in the Maldives. According to the data, China has developed seven islands in the Maldives, but India, Europe, the Middle East and Singapore also have similar interests and have made developments in islands of the country.

In fact, the Maldives is made up of more than 1,200 coral reefs, of which 202 are livable. Every few years, the government will hold island auctions. Successful investors can obtain a lease of 25 years. The tender documents must contain a tourist resort concept and design plan, and anyone can rent and develop the island as long as the relevant procedures are completed, and the corresponding taxes and rents are paid.

Therefore, accusing enterprises from China that are developing islands of “grabbing the land” is completely contrary to reality.

President Saleh should only utilize his country's foreign debt to build his case for alleged China “debt diplomacy.” In accordance with the definition of the IMF and the World Bank, external debt is strictly the liability of residents of a country for contractual repayment to non-residents. It must be excluded from direct investments and corporate capital.

A country's external debt is primarily utilized to raise funds for investment in order to promote its economic growth or to compensate fiscal deficits. Foreign debt is caused by the difference between domestic accumulation, domestic savings and investments.

Therefore, if President Saleh were to believe that his country has a Chinese debt dilemma, he should be encouraged to release the latest data. For example, among the 848.8 million U.S. dollars of the Maldives' foreign debt, what is China's percentage? Furthermore, how much Chinese debt has boosted growth of the Maldives GDP and increased jobs?

Furthermore, if President Saleh were to possess more updated and reliable debt data than the CIA and IMF, he should announce it together in order to relieve the global communities' anxieties.

Another interesting but highly non-trivial point which Saleh fails to mention, and that is Chinese tourists have provided the Maldives with a considerable source of income.

Annually, some 700,000 tourists visit the Maldives and a high percentage is from China. In recent years, some 300,000 Chinese have traveled annually to the archipelago, with the number reaching 400,000 in 2017.

North Male Atoll, Maldives. /VCG Photo

North Male Atoll, Maldives. /VCG Photo

On average, every Chinese tourist spends around 1,000 dollars directly or indirectly in the Maldives, which means that the country can earn at least 300 million U.S. dollars in tourism revenue from Chinese tourists annually. If the Maldives can maintain this stable annual income, it is easy to imagine that much of this income can contribute to paying back its 848.8-million-dollar foreign debt.

We believe that the appropriate external debt of a country can actually assist and improve its economic development. In today's fierce international competition, the country which can attract large, low cost and sustainable foreign funds, will be the one to gain a competitive edge. Such a development reflects its financial prowess, not weakness.

We have also found a very interesting phenomenon. Many BRI nations have long received loans from European nations, the United States, Japan and even India. It is, therefore, intriguing why such investments from Western nations, Japan and India, with nearly identical “debts” are regarded as “sweet pies," while those from China are “debt traps"?

In many countries, political parties controlling the running of the government can change from time to time. The Maldives is no exception.

However, in this context, it is worth underlining one of the reasons why China, since its “reform and openness” in 1978, has grown to become the second largest economic system in the world.

This, on the one hand, is because of unceasing foreign investments, and on the other, China has steadfastly maintained the same economic policies in four decades. Thus, if nations along the BRI route often change their policies, and therefore cannot absorb low-cost and sustainable investments, they will surely be faced with, if not already, questionable economic developments.

Ultimately, having internationally accepted data notwithstanding, what is quite clear is that the current international Maldives' Chinese "debt diplomacy" debate has thus far not been crafted as a mathematical problem, but a political one.

Unfortunately, it is well known that for a mathematical problem, there is inevitably a solution. It is less certain that an easy solution, or any solution for that matter, can be found for a political one.

(If you want to contribute and have specific expertise, contact us at opinions@cgtn.com.)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3