Tech & Sci

12:28, 17-Aug-2018

Tech giants vie for HK's digital payment market

Updated

12:18, 20-Aug-2018

CGTN

Hong Kong’s shopping districts are well known for their fierce competition. Now, a new battleground is forming as the digital payments firms fight for retailers and shoppers.

Chinese tech giants like Tencent and Alibaba are bringing their payment platforms to the city that has long thrived on cash and credit cards, putting them into competition with the likes of Google, Apple, and Samsung, as well as local players like HSBC.

“Hong Kong is probably a little behind other places when it comes to digital payments, so we are seeing a rush to establish a first-mover advantage,” said Fergus Gordon, who leads Accenture’s Asia-Pacific banking practice.

The city has become an important testing ground for Tencent’s WeChat Pay, and Alibaba’s Alipay, dominant rivals in the Chinese mainland, as they look to establish themselves overseas.

AlipayHK, a joint venture between Ant Financial, Alibaba’s payments arm, and the Hong Kong conglomerate CK Hutchison, says the number of its users have jumped 50 percent to 1.5 million since March. WeChat Pay does not disclose its user numbers in Hong Kong.

Why does mobile payment in HK lag behind the Chinese mainland?

Octopus card /Photo via the Octopus

Octopus card /Photo via the Octopus

Hong Kong has been slow to embrace mobile payments partly because of the ubiquity of Octopus, a once ground-breaking stored-value card that is accepted by 22,000 businesses like convenience stores and small restaurants and is widely used on public transport.

Despite the growth of mobile payments, current spending habits will be hard to change.

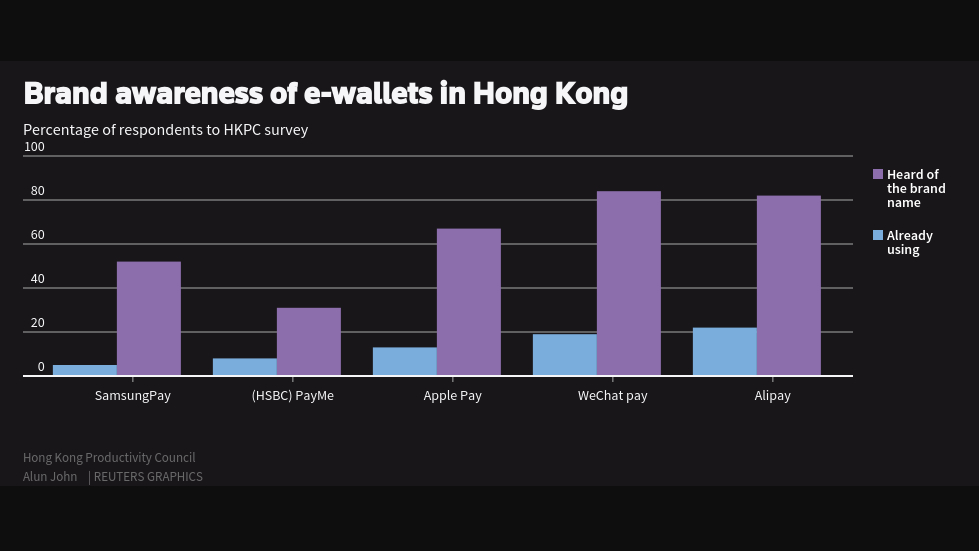

A Hong Kong Productivity Council survey published in July found that the most widely used mobile payment methods were Alipay and WeChat Pay, but they were used by just 22 percent and 19 percent of respondents respectively.

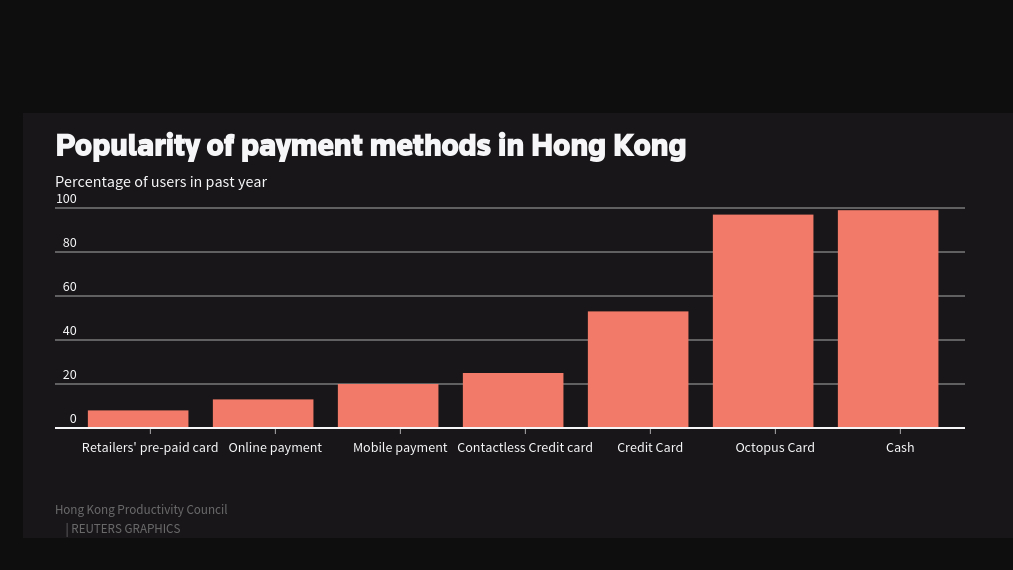

The popularity of payment methods in Hong Kong /Photo via Reuters

The popularity of payment methods in Hong Kong /Photo via Reuters

However, 97 percent of respondents said they used Octopus cards.

Hong Kong payment habits /Photo via Reuters

Hong Kong payment habits /Photo via Reuters

Lack of familiarity and worries about data leakage were the most common reasons given for not adopting the new mobile payment systems.

Twenty years since Octopus cards were first launched, there are now 34.4 million cards in circulation - almost 5 per Hong Kong resident, according to the company.

But net profit falling by one-third in 2017 had forced Octopus to start to take the heat into consideration.

However, Sunny Cheung, Octopus’ chief executive, told Reuters that the numbers were a one-off since the company had been spending heavily, particularly on technology and cybersecurity.

He added that the company still had an edge over the newcomers, particularly with small businesses long used to Octopus payments. “Acceptance is key, especially in the ‘mom and pop’ shops.”

An AlipayHK spokeswoman said the company was trying to attract users by offering special discounts.

“At the same time, we are seeking cooperation with various merchants to increase the penetration of AlipayHK to change consumers’ habits little by little,” she said.

Source(s): Reuters

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3