13:41, 25-Aug-2017

China's Commodity Market: Steel & coal sectors see outstanding performance

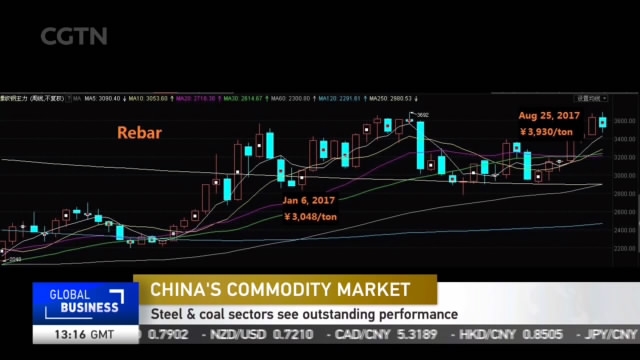

In the Chinese market, futures contracts for commodities including rebar, hard coke and coking coal also saw increases Friday, continuing their upward climbs that have lasted for several months. Chen Tong takes us to find out the driver behind the commodity price increase.

Futures contracts for hard coke on the Dalian Commodity Exchange have been rising since the beginning of June and have jumped by almost 56 percent since the beginning of the year. Rebar on the Shanghai Commodity Exchange has gone up some 29 percent since January. Listed firms in the steel and coal industries including Jizhong Energy, Lanhua Sci-tech Venture and Shanxi Coking Group have all seen profit increases in the first half. Jizhong Energy has been the best performer, with an extraordinary rise in profits of 6,128 percent. Experts say the dramatic rises in the steel and coal sectors are due to declining supply, coming in turn from the government's drive against both industrial overcapacity and polluting industries.

SUN YONGGANG, DEPARTMENT MANAGER CHAOS TERNARY FUTURES Infrastructure investments remain at a high level and manufacturing investment is also recovering. So the demand is there to support the price of industrial goods. At the same time, capacity reduction plans have pushed out many companies, and the environmental protection requirements have also cut short-term supply, which has driven up the prices. If the market continues like this, commodities price will continue to rise.

As of the close of Friday's day trading session, futures contracts for rebar had risen by 2.7 percent in Shanghai. In Dalian, hard coke had jumped by 3.9 percent and coking coal by 2.03 percent.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3