Opinions

09:52, 18-Oct-2018

Opinion: The fallacy of currency manipulation

Updated

08:54, 21-Oct-2018

Lin Shu

Editor's note: Lin Shu is an associate professor with the Department of Economics of the Chinese University of Hong Kong. The article reflects the author's opinion, and not necessarily the views of CGTN.

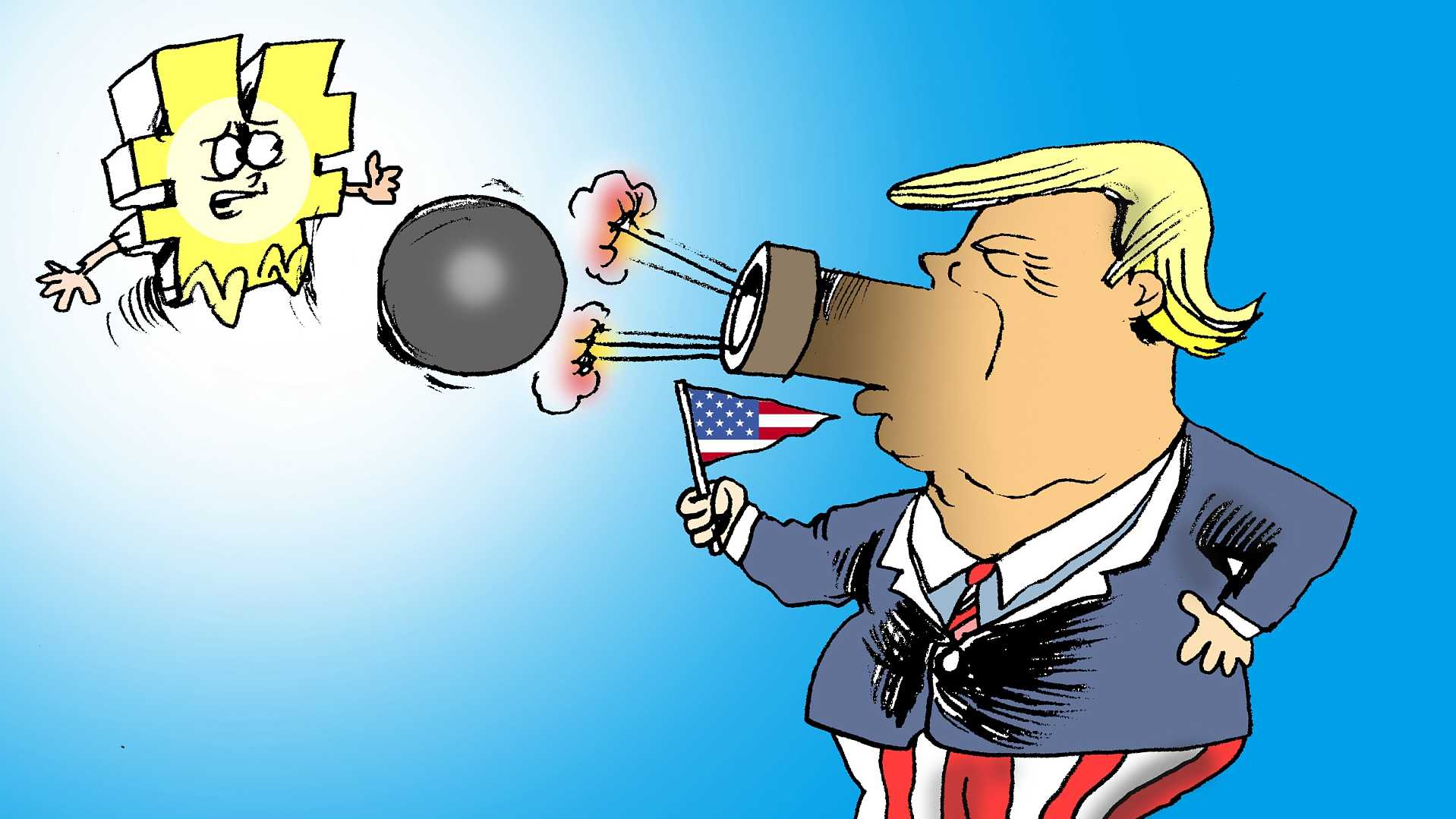

In its recent semi-annual report on foreign exchange practices, the US Treasury Department declined to name China a currency manipulator.

According to the Treasury's criteria, a country will be labeled a currency manipulator if it has: (1) a bilateral trade surplus with the US that is at least 20 billion US dollars; (2) a material current account surplus that is at least 3 percent of GDP; and (3) persistent one-sided net purchases of foreign currency in excess of 2 percent GDP. While China's total trade surplus with the US is large, it is certainly in the clear when it comes to the last two criteria.

Unjustified criteria

The above criteria adopted by the Treasury are based on the belief there is a strong co-movement of the nominal exchange rate and the terms of trade, which, unfortunately, is largely false.

The popular argument that a country can gain international competitiveness by keeping its currency undervalued through interventions ignores two important facts.

First, while a country can influence the nominal exchange rate, it has little control over what really matters for trade, the real exchange rate, especially in the long term. A nominal depreciation often leads to an increase in the domestic price level offsetting its impact on trade.

Second, even the short-term trade benefit is rather limited as international trade prices are not sticky in the producer currency but instead sticky in the US dollar. A nominal depreciation of the producer currency thus will not translate into a lower dollar price US consumers face.

As a matter of fact, existing academic studies find little correlation between bilateral exchange rates and bilateral terms of trade.

The US Treasury Department declined to name China a currency manipulator in its recent semi-annual report on foreign exchange practices. /VCG Photo

The US Treasury Department declined to name China a currency manipulator in its recent semi-annual report on foreign exchange practices. /VCG Photo

Why countries intervene

Treating foreign exchange interventions as evidence of comparative devaluations is also misleading. After all, according to IMF's recent Annual Report on Exchange Arrangements and Exchange Restrictions, only a small fraction of countries (31 out of 189) allow their exchange rates to float freely.

There are two main reasons why most countries intervene.

The first is history. Based on the US design, pegging to the dollar was a requirement for member states during the Bretton Woods Era. Only after the collapse of the system in the 1970s, a small number of developed countries started to float. For many developing countries, peacefully exiting a fixed exchange rate has remained a challenging task.

Second, pegging the nominal exchange rate to a low inflation currency offers to develop central banks a framework for the conduct of their monetary policy. Through pegging, a developing central bank can borrow credibility from the low inflation currency to contain inflation expectations.

Nonetheless, it is important to point out that even for pure floaters, central banks can still influence nominal exchange rates through other means, such as interest rate policy and quantitative easing.

The truth about the RMB exchange rate and US trade deficit

While the US Treasury report did not label China a currency manipulator, it still claimed that the RMB is undervalued. The IMF, however, concluded that the RMB is not undervalued.

While it is challenging to evaluate whether a currency is over or undervalued, there are several good reasons to believe that the RMB is not undervalued or even overvalued.

First, over the last decade, the RMB has appreciated over 35 percent against the dollar and even more in real terms.

Second, during the same period, other major currencies have experienced large depreciations against the dollar, making the appreciation of the RMB even stronger in effective terms.

An Apple iPhone XR model is on display during a launch event in Cupertino, California. The US trade deficit ballooned in August to its highest level in six months as exports of tariff-targeted goods fell while US consumers snapped up imported cars and mobile phones. /VCG Photo

An Apple iPhone XR model is on display during a launch event in Cupertino, California. The US trade deficit ballooned in August to its highest level in six months as exports of tariff-targeted goods fell while US consumers snapped up imported cars and mobile phones. /VCG Photo

As a matter of fact, even after President Donald Trump launched the trade war against China, the RMB's performance remains one of the strongest among all emerging currencies.

Finally, perhaps the most convincing evidence comes directly from the foreign exchange market. Recently, market participants had depreciation expectations of the RMB and the People's Bank of China had to intervene to stabilize the RMB/USD exchange rate.

In addition to allowing the RMB to appreciate, China has also made important progress in recent years to increase the flexibility of the RMB exchange rate and the transparency of its pricing mechanisms.

However, relying on adjustments in the RMB exchange rate or other bilateral exchange rates to reduce the US current account deficit is unrealistic.

The large US current account deficit is a result of structural differences between the US and its trading partners other than currency manipulation, including differential demand for precautionary savings, differing degrees in financial developing, differing demographics, and the special role of the dollar as an international reserve currency.

Given that Trump has posted heavy tariffs on imports from China and his threat of more future tariffs, the market forces will naturally call for a devaluation of the RMB against the dollar.

Ironically, imposing tariffs on Chinese products and forcing the RMB not to depreciate at the same time would be real currency manipulation.

(If you want to contribute, please contact us at opinions@cgtn.com.)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3