Biz Analysis

12:26, 20-May-2019

PBOC favors targeted measures amid return to deleveraging, yuan moves

Updated

14:07, 20-May-2019

Jimmy Zhu

Editor's note: Jimmy Zhu is the chief economist at Fullerton Research. The article reflects the author's opinion, and not necessarily the views of CGTN.

The People's Bank of China's quarterly monetary policy report, released May 17, may dampen expectations for policy easing on a larger scale, with China's central bank maintaining its policy of targeted stimulus. Meanwhile, structural deleveraging remains a key policy objective, even as external uncertainties intensify.

The PBOC in its report recognized how trade tensions and uncertainties overseas could impact global supply chains, with the central bank noting, in particular, the risks of increasing inflation, falling household and corporate confidence leading to potential financial market turbulence. However, it is still sticking to targeted stimulus measures, with no hint of “opening the floodgates” for a liquidity injection. The PBOC confirmed in its report that it aims to keep the nation's nominal GDP, M2 money supply and social financing at a similar pace.

VCG Photo

VCG Photo

Average growth rates for nominal GDP, M2 money supply and social financing stood at 10.3 percent, 8.1 percent and 11.6 percent respectively over the past two years, with their growth rates generally maintaining a consistent pace. However, differences between the three perfectly explain why some degree of structural deleveraging is still much needed to prevent the financial risks mentioned in the report, as well as improving the monetary transmission mechanism. Therefore, the central bank is expected to use more targeted tools such as targeted RRR cuts and other less aggressive moves to support economic growth.

The PBOC said in its report that it will further reform the yuan market and stabilize FX markets' expectations to keep the yuan's fluctuations within a reasonable equilibrium. Besides that, the central bank will further promote cross-border yuan usage, and continue comparing the benchmark yuan with a basket of currencies to adjust and manage the floating exchange rate system.

In our opinion, this sends out a few messages:

If the Chinese currency strengthens or weakens due to fair fundamental reasons, the central bank is likely to allow it to do so without much intervention. Based on the dollar index at 98.02 on May 17, the U.S dollar/Chinese yuan should be trading at a level near 6.86 according to our regression analysis, versus the actual 6.9188. If the analysis is accurate, it suggests the current yuan rate is weaker than its fair value, possibly caused by recent “herd behavior” in the currency exchange market. That will likely make the PBOC adopt the “counter-cyclical factor” in its yuan fixings.

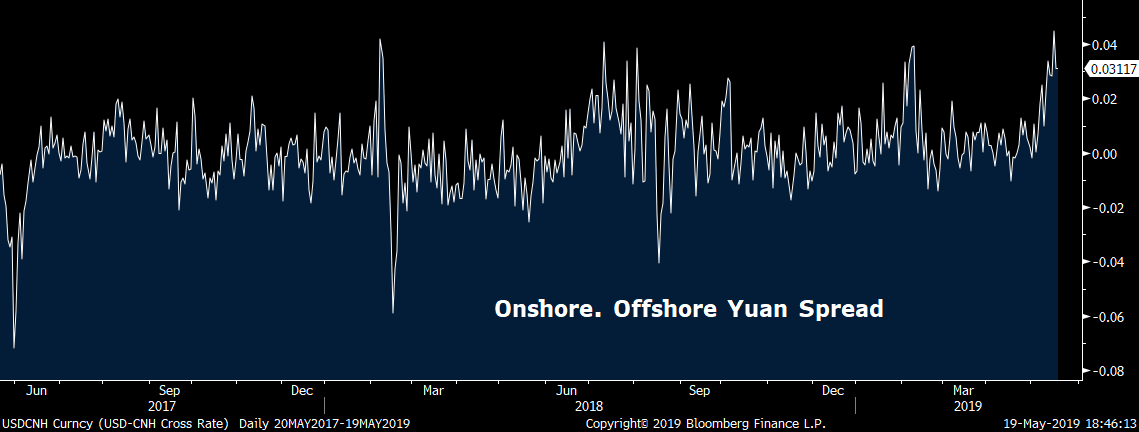

Further promoting cross-border usage of the yuan requires the onshore and offshore yuan to be traded at similar levels. Otherwise, some foreign fund managers could find it difficult to hedge against currency risks. The chart below shows that the current onshore and offshore yuan gap stood at 311 pips on May 17, one of the biggest gaps seen in the past three years.

Source: Bloomberg

Source: Bloomberg

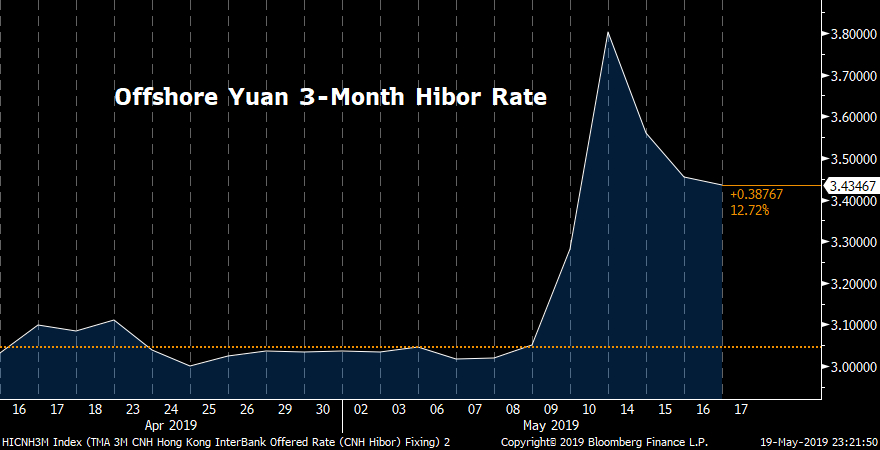

The offshore yuan three-month interbank rates in Hong Kong suddenly spiked over 700 bps on May 10 and 13, an unwelcome move for traders shorting the offshore yuan, as borrowing costs surged. Moving forward, if the spread between CNY-CNH persistently stays above 150 pips, the central bank is likely to hike the CNH Hibor rates by draining liquidity in the offshore yuan market.

Source: Bloomberg

Source: Bloomberg

Shanghai stocks surged almost two percent on May 15, despite that day coinciding with weaker-than-expected economic data, as expectations intensified that the PBOC would increase policy easing. However, the PBOC's monetary report only focused on its determination to lower borrowing costs for SMEs in the private sector and push forward structural deleveraging. Such comments put the possibility of rate cuts close to zero in the near term. On the other hand, interest rate cuts would have a side-effect on the yuan exchange rate. Given that the onshore yuan has dropped over 2.7 percent since the end of April, maintaining currency stability could be one of the PBOC's key objectives at this moment.

Shanghai stocks surged almost two percent

on May 15, despite that day coinciding with weaker-than-expected economic data,

as expectations intensified that the PBOC would increase policy easing.

However, the PBOC’s monetary report only focused on its determination to lower

borrowing costs for SMEs in the private sector and push forward structural

deleveraging. Such comments put the possibility of rate cuts close to zero in the

near term. On the other hand, interest rate cuts would have a side-effect on

the yuan exchange rate. Given that the onshore yuan has dropped over 2.7

percent since the end of April, maintaining currency stability could be one of

the PBOC’s key objectives at this moment.

April’s economic data alone is not enough

to justify any reaction from the PBOC for now, as there were some front-loading

activities in March. Regarding the impact of escalating trade tensions in the

coming months, authorities could wait for a slew of upcoming economic data

before any decision is made.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3