Biz Analysis

13:16, 15-Feb-2019

Bruised exporters, retailers show why U.S. needs a trade deal now

By Jimmy Zhu

Editor's Note: Jimmy Zhu is chief strategist at Fullerton Markets. The article reflects the author's opinion, and not necessarily the views of CGTN.

Chinese imports from the U.S. in January shrank to their lowest level since February 2016. Meanwhile, U.S. retail sales posted Thursday saw their biggest drop in nine years.

Both readings show that the ongoing trade dispute may have started to bite U.S. enterprises and consumers, pushing Trump harder to fix a trade deal with China.

Chinese companies only purchased 9.24 billion U.S. dollars' worth of American goods last month, contracting a record-high 41.2 percent on a year-on-year basis.

Such data contradicts the U.S. IMS manufacturing PMI, with the chart below showing consistent parallels between the two in the past few years. One explanation for the divergence last month is that an increasing number of Chinese importers are looking for substitutes from other regions, with January import data suggesting increasing purchases from Europe and ASEAN.

Source: Bloomberg

Source: Bloomberg

After this latest trade data, the U.S. negotiating team seems to have a greater incentive to reach a trade deal with China.

Trump has expressed optimism on the progress of trade talks, and while there has not yet been any mutual statement, such conditions indicate that speculation about an extension to the 90-day deadline is valid. There are still not enough clues to suggest whether or not a final deal between the two parties can be reached.

The U.S. negotiating team has certainly prepared a long list of terms to negotiate, and with Trump's unpredictable nature some people are expecting a tough road ahead before a final deal can be reached.

However, there could be some factors that pessimists may have overlooked – Trump may prefer to reach a trade deal this year as his schedule will be fully packed with preparing for next year's presidential election.

Besides that, Trump may have other reasons to urge for a trade deal with China, as macroeconomic conditions in the U.S. are deteriorating.

Trump showed less concerns about the trade war last year, as he expected the strong U.S. economy could withstand its effects. However, data this week shows that U.S. consumer confidence is deteriorating.

U.S. December CPI moderated to 1.6 percent, data on Wednesday showed. A separate data release showed that retail sales posted their biggest slide in nine years. Any additional tariffs are set to further increase production costs, which will be passed on to the consumers.

With waning consumer sentiment, the U.S. economy needs easier policies to boost confidence.

After all, while some gaps between the U.S. and China on trade are widely expected to remain, such as those concerning market reforms, that doesn't mean a final deal will only be reached when all terms and conditions satisfy both parties.

Global central banks were busy downgrading their growth outlooks last week. If the downward economic cycle is to be confirmed later on, protectionist measures such as tariffs will only harm the global economy.

Theoretically, central banks always aim to relax monetary policy amid a downturn cycle, aiming to reduce funding costs for the real economy. The effect of adding tariffs in such a cycle would only weaken the effects of a relaxed monetary policy, as protectionism increases production costs.

On the other hand, better-than-expected exports data for China cannot be taken as proof that external demand is improving. Some Chinese exporters may have started to actively seek buyers in the Eurozone or other regions, in case the U.S.-China trade environment becomes tougher later on.

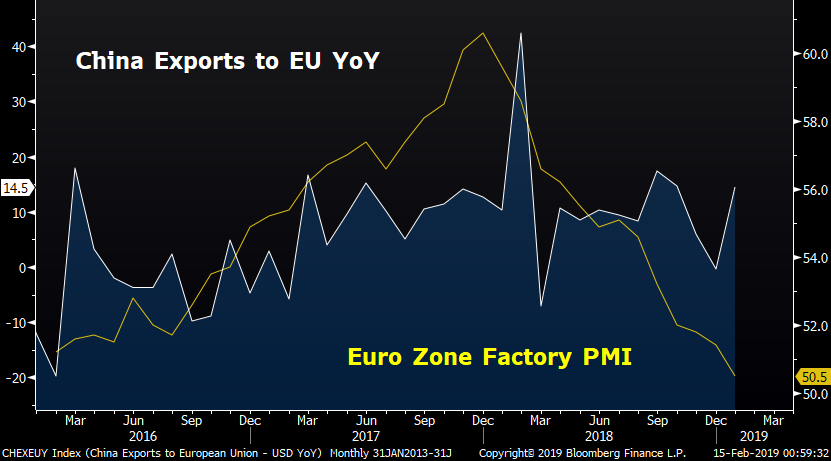

Chinese exports to the European Union returned to double-digit growth last month, but all major indicators show that economic activity in Europe is slowing. Eurozone manufacturing PMI has been falling towards the key benchmark 50-level, down from the above 60-level seen a year ago.

Source: Bloomberg

Source: Bloomberg

While narrowly avoiding recession, Germany saw no expansion at all in the fourth quarter, after the Eurozone's largest economy saw a quarterly contraction of 0.2 percent in the previous quarter.

Similar trends were seen in the ASEAN region as well. While Chinese exports to this region rose by 11.5 percent, various ASEAN central banks have downgraded their economic forecasts this month.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3