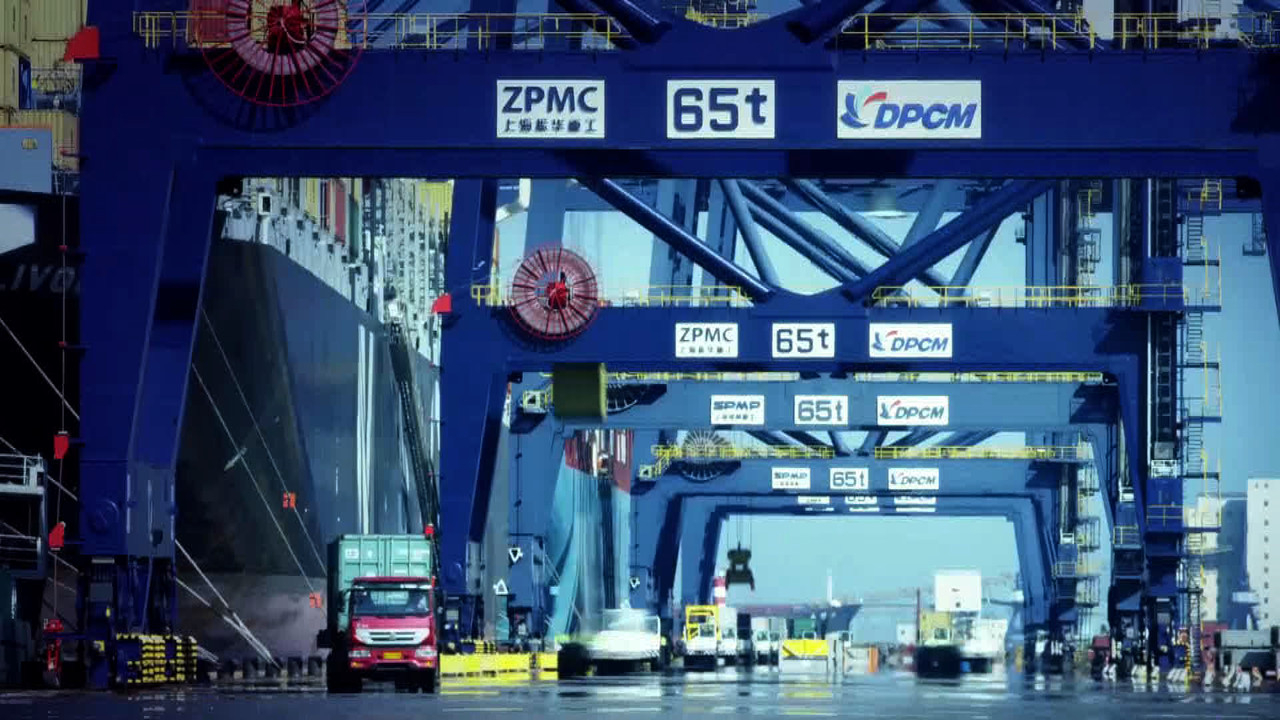

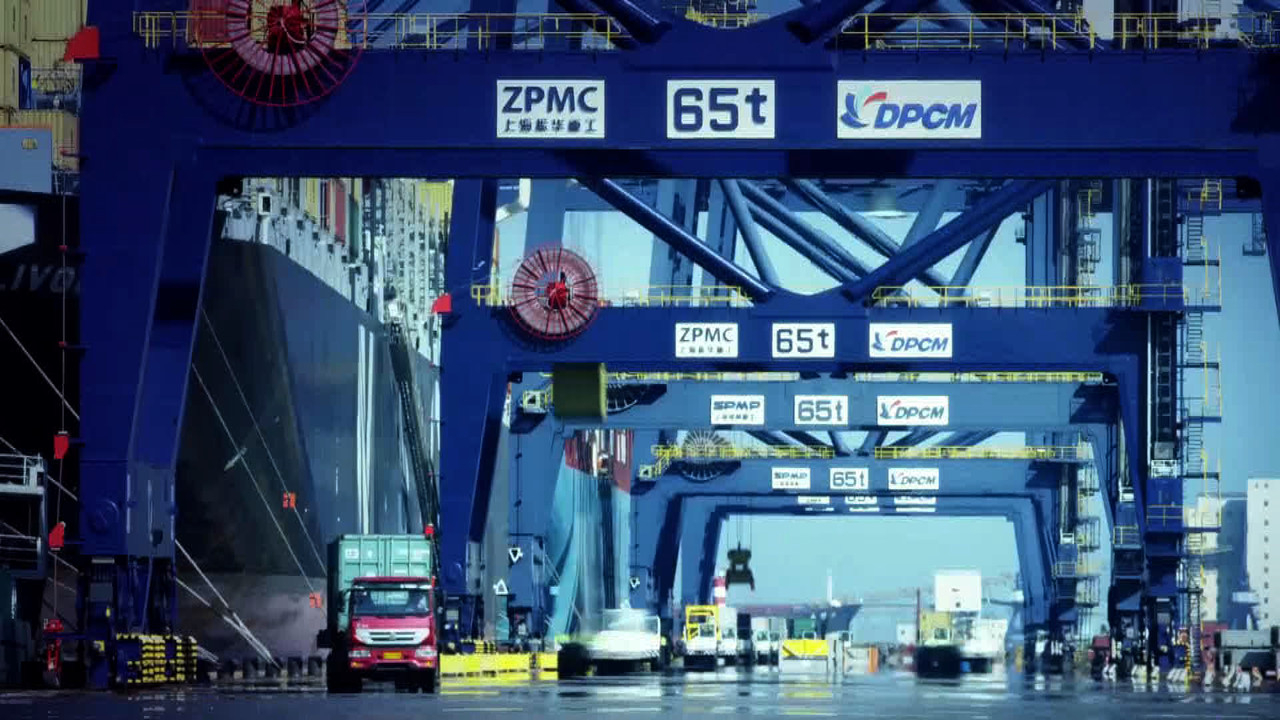

Shipping is the lifeline of global markets, and nearly 90 percent of global trade is seaborne. In China's northeast, over 99 percent of goods traded overseas move through the port of Dalian.

Earlier this year, Liaoning Province created a new company to run its ports, including Dalian, and after China Merchants Group took over a controlling stake, boosting efficiency topped the reform list.

In China's northeast, over 99 percent of goods traded overseas move through the port of Dalian. /CGTN Photo

In China's northeast, over 99 percent of goods traded overseas move through the port of Dalian. /CGTN Photo

"In the past, to offload a 200,000-ton container ship we often used six staff per freight station, now we've cut the number of workers down to two. This, together with the upgraded system of freight management, has cut costs significantly," said Yu Bing, the supervisor of container control at the Port of Dalian.

Some Western observers predict that the escalation and extension of the trade war between China and the U.S. will hamper the growth of China's container shipping business. But at northeast China's largest port, the real situation is quite the opposite.

Yu Bing, the supervisor of the container control department told CGTN that costs have been cut significantly to boost efficiency. /CGTN Photo

Yu Bing, the supervisor of the container control department told CGTN that costs have been cut significantly to boost efficiency. /CGTN Photo

The first quarter of this year saw a 13-percent growth in container volume at the Port of Dalian. In the shipping industry, container volume of any given period is a strong indicator of how current operations are going. Profits from the container service division were up by a stunning 35 percent over the same period.

"After mergers and acquisitions among the ports in the province, the new structure enabled the management to re-organize the client base and remove vicious competition between ports. We've also dedicated all of our efforts to generate new business opportunities, like several sea routes to Southeast Asia were established," Qu Wei, the vice director of container service of Liaoning Port Group told CGTN.

The first quarter of this year saw a 13-percent growth in container volume at the Port of Dalian. /CGTN Photo

The first quarter of this year saw a 13-percent growth in container volume at the Port of Dalian. /CGTN Photo

Qu Wei, the vice director of container service of Liaoning Port Group speaks to CGTN. /CGTN Photo

Qu Wei, the vice director of container service of Liaoning Port Group speaks to CGTN. /CGTN Photo

In terms of the group's domestic operations, divisions like the auto terminal have taken full advantage of the existing sea routes: new vehicles are being shipped from the northeastern to the southern parts of the country both ways – a much cheaper option compared to land transport.

"Even with the sluggish demand in the domestic auto market, we've managed to achieve a 15-percent growth in profits during the first five months. Next, we will expand the capacity of our sea-rail combined routes: once the market bounces back, we will have the right products and services ready," Ning Jiazhen, the manager of the auto terminal at the Port of Dalian, told CGTN.

Divisions like the auto terminal at the port of Dalian have taken full advantage of the existing sea routes. /CGTN Photo

Divisions like the auto terminal at the port of Dalian have taken full advantage of the existing sea routes. /CGTN Photo

Even with the sluggish demand in the domestic auto market, the auto terminal managed to achieve a 15-percent growth in profits during the first five months. /CGTN Photo

Even with the sluggish demand in the domestic auto market, the auto terminal managed to achieve a 15-percent growth in profits during the first five months. /CGTN Photo

So how has the trade dispute affected the largest port in China's northeast? The figures from Liaoning Port Group are offering insight into the overall situation.