Business

18:27, 09-Jul-2018

CIC annual report: China’s sovereign wealth fund surpasses $941.4 bln

Updated

17:33, 12-Jul-2018

CGTN's Liu Jing

02:45

The China Investment Corporation's (CIC) overseas investments hit a record high of a 17.59 percent net return denominated in USD, according to the CIC's 2017 annual report which was released on Monday.

According to the report, by the end of 2017, CIC's overseas investments had generated a net cumulative annualized return of 5.94 percent.

The total assets of CIC, the country's sovereign wealth fund, surpassed 941.4 billion US dollars as of December 2017, which translated into a cumulative annualized growth rate of 14.51 percent for state-owned capital.

Based in Beijing, the total assets of CIC had surpassed 941.4 billion US dollars as of December 2017. /CGTN Photo

Based in Beijing, the total assets of CIC had surpassed 941.4 billion US dollars as of December 2017. /CGTN Photo

Tu Guangshao, vice Chairman and president of CIC, said that In terms of scale, it is equivalent to re-creating three CIC companies after 10 years' development.

CIC, founded in 2007 with a registered capital of 200 billion US dollars, is a wholly state-owned vehicle that helps diversify China’s foreign exchange holdings and seek maximum returns for its shareholders within an acceptable risk tolerance.

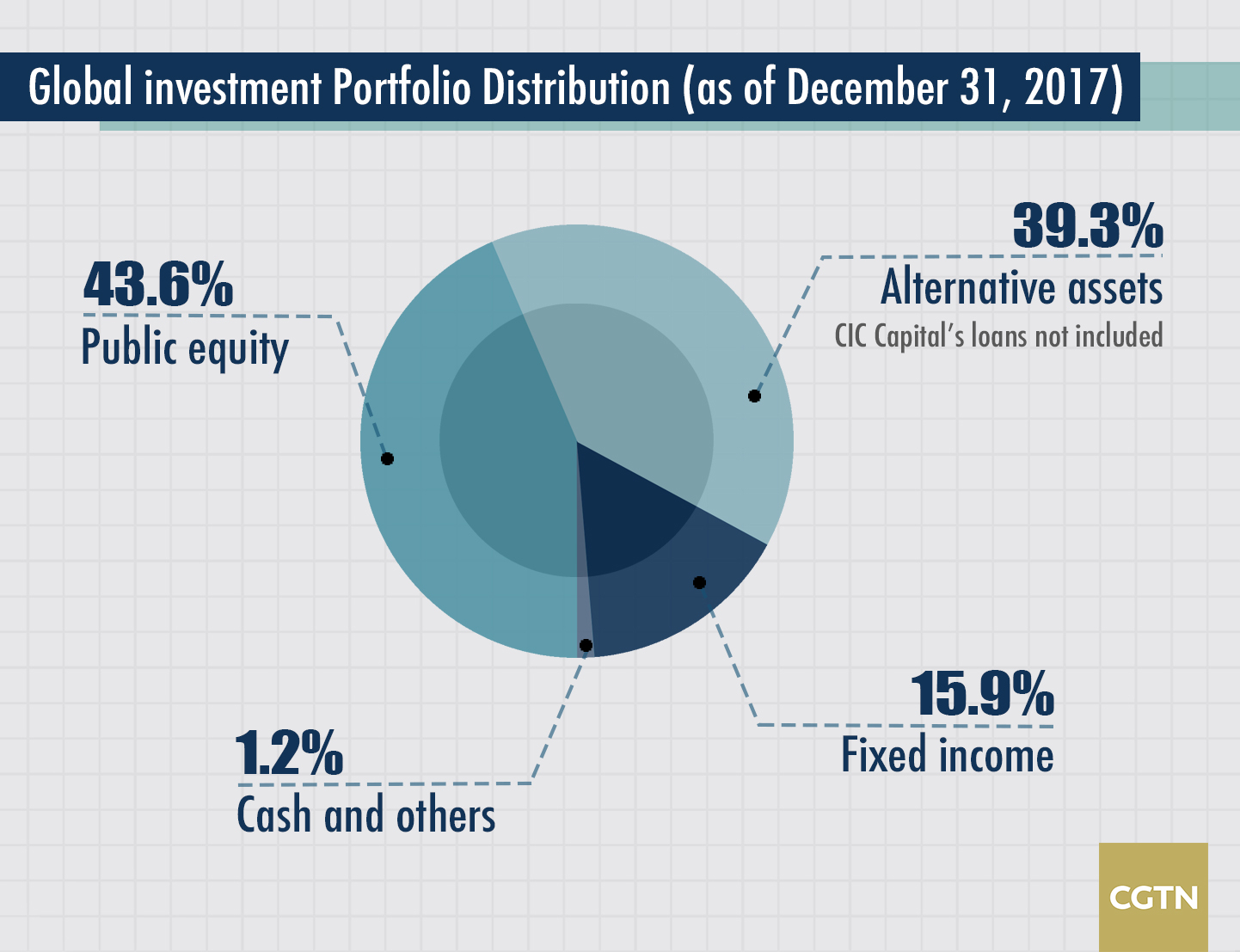

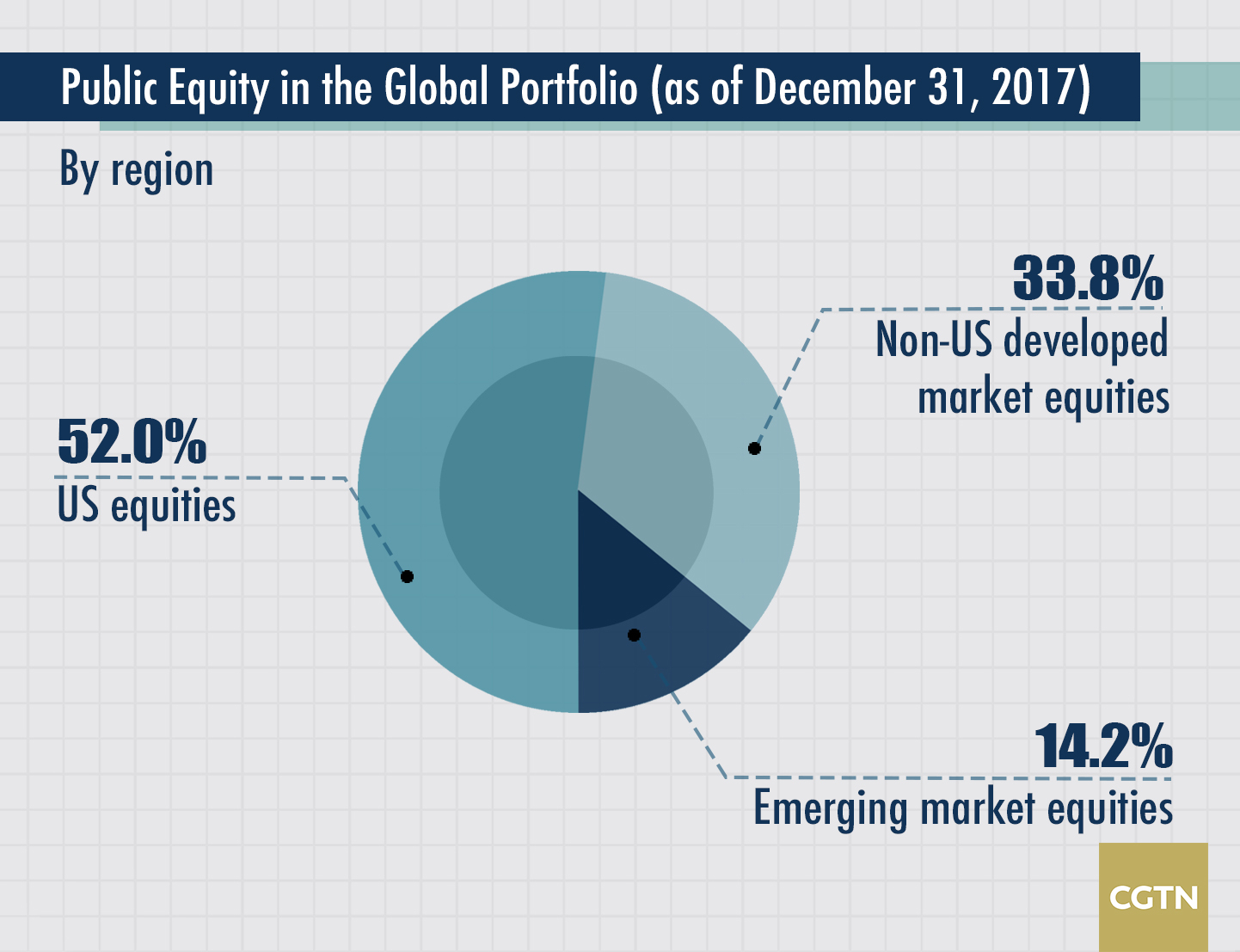

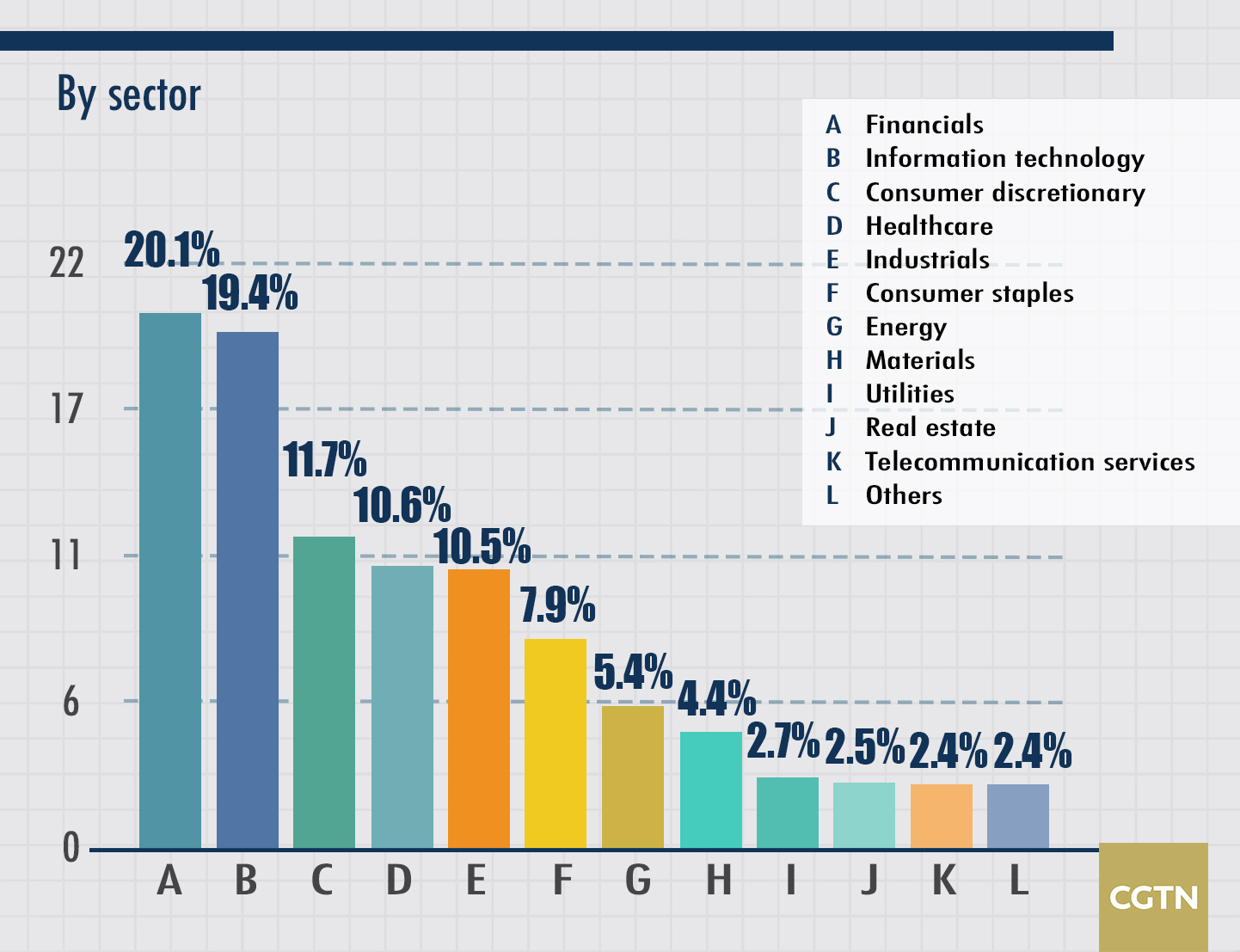

43.6 percent of CIC's overseas investment was in public equities by the end of 2017, followed by alternative assets, fixed incomes, cash and others, the report said. Around two-thirds of the investment was externally managed.

Moreover, talking about the domestic equity, CIC said that by the end of 2017, state-owned financial capital under Central Huijin's management had reached 4.1 trillion yuan (about 619 billion US dollars) and the total assets of Central Huijin's holding companies were 112 trillion yuan, representing a year-on-year growth of eight percent.

“This year marks the 40th anniversary since China embarked on its economic program of reform and opening-up. For CIC, it will be the juncture for journeying into its second decade,” Tu said.

“To thrive and prosper, CIC will advance new development plans, build institutional capacity, and implement new ways for outbound investment and state-owned financial capital management.”

(CGTN's Zheng Junfeng also contributed to this story.)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3