Money Stories

11:21, 24-Jan-2019

U.S.-China trade tension shifting investor confidence to Southeast Asia

By Silkina Ahluwalia

Southeast Asia is somewhat beginning to reap the benefits from the trade disputes between the United States and China. The region has eclipsed China as the destination most likely to produce the best investment returns. This has been particularly true for countries like Indonesia and Vietnam.

A survey conducted at the Asian Financial Forum showed that around 39 percent of people saw Southeast Asia as having the most positive investment returns compared to 35 percent who voted for China and 16 percent for the U.S.

The shift of foreign direct investments is beginning to open up plenty of opportunities for the people in the region. More companies are looking into Indonesia, for example, for their supply chains and production to lower costs.

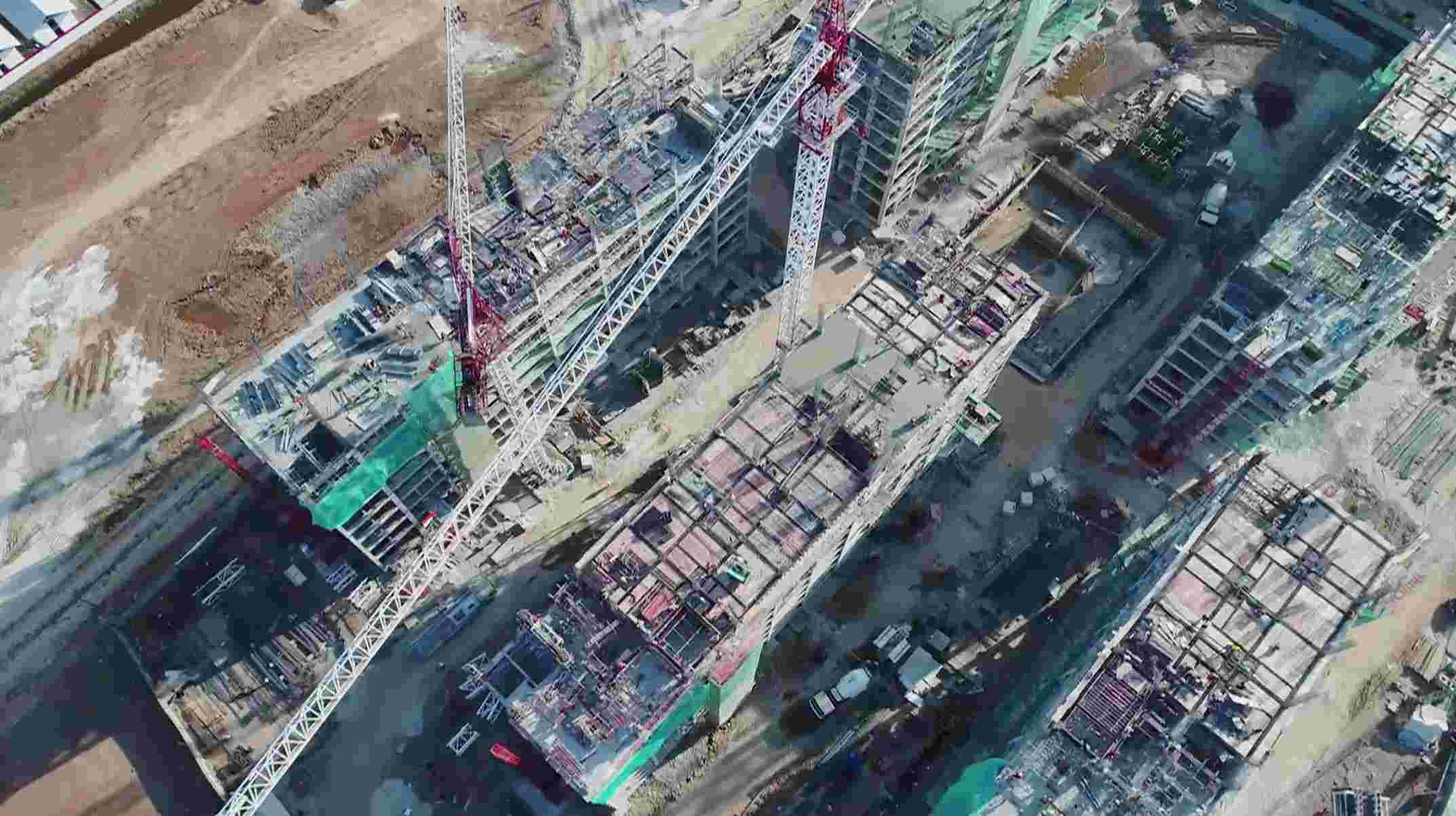

Indonesia is prioritizing infrastructure developments in the country through direct foreign investments. /CGTN Photo

Indonesia is prioritizing infrastructure developments in the country through direct foreign investments. /CGTN Photo

"We believe that Southeast Asia can promote or offer robust economic growth. IMF in 2019 expects that ASEAN 5 including Indonesia can grow to 5.1 percent basically. Southeast Asia can also offer labor force. As we know, IRO mentioned that by 2030, it can add to around 60 billion labor forces in Southeast Asia region," said economist Josua Pardede.

All of those factors in investor confidence are pouring in their money into Southeast Asia. As the region's digital economy continues to boom, research shows that Southeast Asia's internet economy is expected to exceed 240 billion U.S. dollars by 2025. Indonesia might be cashing in big on that growth seeing as many of the digital industries are thriving.

Wisnu Soedibjo from Indonesia's Investment Coordinating Board said one of the reasons investors are confident in Indonesia is the big population of the younger generation coupled with the country's good track record of having low inflation rate.

"Why Indonesia is attractive, firstly we have a very big market, 260 million people with the composition of about 44 percent the younger generation. So the younger generation which now has a better education... [and] are more computer literate. They have reconnected with information technology. Looking at the position of Indonesia among the ASEAN [countries], we are the only member who is also a G20 member so this creates good demand for digital economy," said Wisnu.

The trade dispute between U.S. and China is shifting investor confidence to Southeast Asia. /CGTN Photo

The trade dispute between U.S. and China is shifting investor confidence to Southeast Asia. /CGTN Photo

However, experts believe all the positive sentiment shouldn't distract from the negative implications that could also arise from the ongoing trade war.

"We have already experienced last year that our exports to China are weaker, and the pace of growth slower in 2018. On the other hand, the imports from China are larger and larger. It will lead to the widening of current deficit and trade balance with China, so basically we recorded that last year our trade deficit with China widened to 14 billion U.S. dollars, compared to around 11 billion U.S. dollars the previous year," said Josua.

The Indonesian government has the potential to help the country bounce back from that weak growth, Josua said, adding that by promoting upstreaming industries, that involve natural resources such as palm oil and coal, Indonesia could help boost investors' confidence and bring in an impressive amount of money into the country in 2019, which will, in turn, help the country's steady economic growth.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3