Economy

11:38, 21-Dec-2018

Don't blame Powell as curve could have inverted overnight

Updated

11:32, 24-Dec-2018

By Jimmy Zhu

Editor's note: Jimmy Zhu is chief strategist at Fullerton Markets. The article reflects the author's opinion, and not necessarily the views of CGTN.

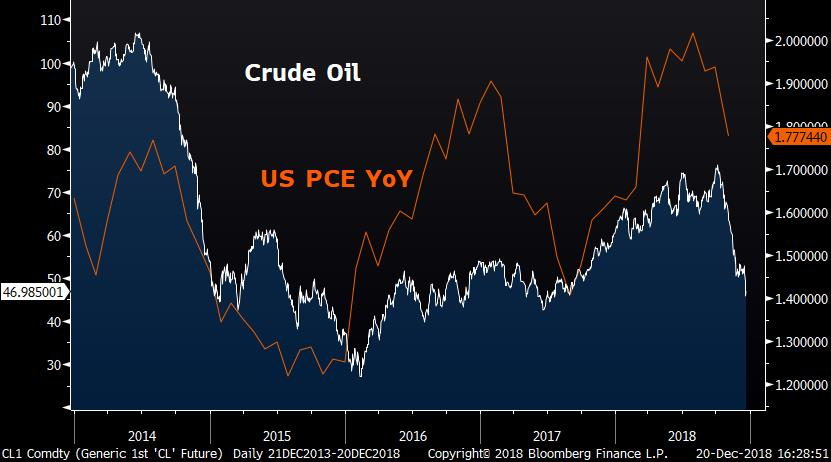

Dow slid over 300 points overnight, after rising skepticism on Federal Open Market Committee (FOMC) meeting largely ignoring the recent U.S. financial condition. Those critics obviously made a fundamental mistake – duty of buoying the market confidence never falls into a central banks’ role. In contrast, Powell may have averted a disaster in the U.S. financial market: curve inversion.

FOMC decision overnight seen as a justified move based on its dual mandate target

Fed has scaled back the pace of the rate-hike for next year, as its dot-plot now forecasts two hikes in 2019, instead of three in its forecast in September.

However, such an adjustment is not as dovish as some investors expected, traders so far only priced in one 25 bps hike for the entire 2019, and rate cuts possibility is even greater than rate hikes in 2010.

Besides that, voices calling that Fed should put stocks' performance into its policy consideration are turning louder recently.

It probably worth to highlight that Fed is a central bank, whose main objective is to achieve its dual mandate goal, not like those day traders in the Wall Street to get the signal from the capital markets.

For now, its 49-year lowest unemployment rate and average personal consumption expenditures (PCE) reading at 1.8 percent on a year-on-year basis in the past 12 months show Fed's decision was justified.

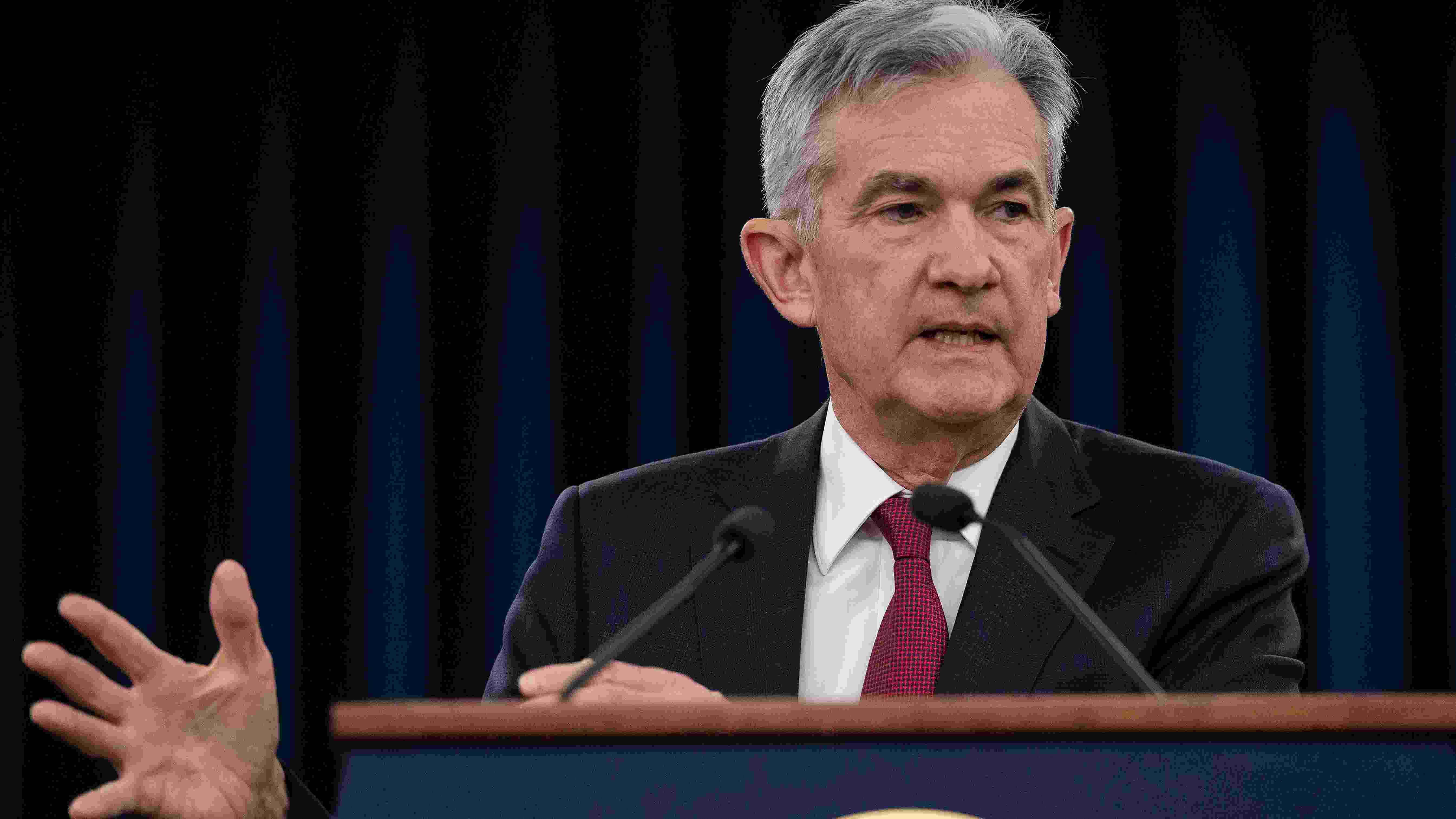

Besides that, ISM employment sub-indices for both manufacturing and service sectors remain near the highest levels in history, despite the headline numbers trending lower these month.

Source: Bloomberg

Source: Bloomberg

Powell's language overnight seen an effort to delay the curve inversion

The chart below shows that U.S. 2/10 sovereign yield spread is now less than 10 bps, not that far from a curve to inverse, which usually signaled an economic recession to arrive.

An inversion might have happened overnight if Powell had acted more dovish as a conciliatory gesture for the sake of boosting the market confidence.

Source: Bloomberg

Source: Bloomberg

Fed's policy path setting since the global financial crisis has been not only based on its complicated and comprehensive models but also tried to avoid “policy shock”. For the short-end curve, whether 25 or 50 bps rate hikes next year may not have a much different impact on the short-end curve, but not for the long-end curve.

For Fed to change the forecast to one hike next year or slow the pace of balance sheet unwinding, a substantial downgrade for both growth and inflation forecasts is also required.

Imagine if Powell's speech to stress more on the potential economic weakness and more accommodative policy to be needed, U.S. 10-year bond yield would drop much more than it does now.

If this had happened, the bonds' curve could be flattener or even with an inversion, which would further damage the investors' sentiment.

Powell may have offered a strong hint that policy to be more accommodative next year.

Markets could be overreacted on the Fed's statement.

Fed didn't intend to hint the market on any major policy shift. They have acknowledged the recent turmoil in global financial markets and promised the policy path to be more cautious and data dependent.

The market needs to pay more attention to the current economic backdrop, instead of what Powell said in the press conference.

A data-dependent Fed in 2019 means its policy to be more dovish as what various economic indicators show now.

Bloomberg U.S. economic surprise index stands at 0.037 now, heading to the biggest annual decline since 2008 when global financial crisis outbroke.

A lower reading in the index indicates that the reality of the U.S. economic activities has started to miss the markets' expectations.

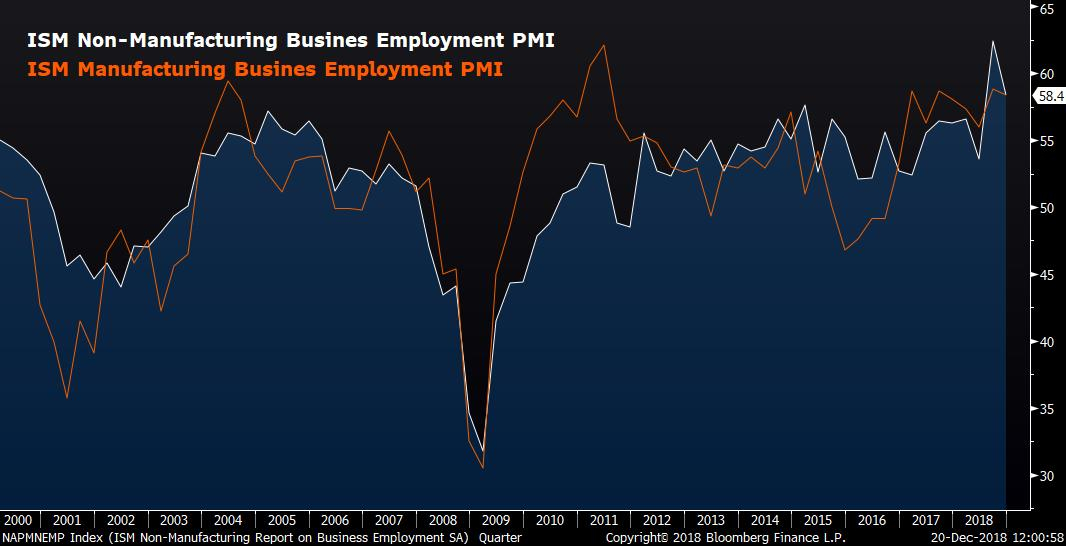

Besides the slower global demand, crude oil prices' slump posts significant risk on the inflation outlook.

The chart below shows that crude oil prices' impact on U.S. PCE, a preferred inflation gauge of the Fed, has been substantial for a long period of time

Source: Bloomberg

Source: Bloomberg

A yield curve inversion in 2019 seems not a problem of “whether”, but “when” and “how deep.”

For now, it could be more important for the U.S. central bank to anchor the confidence in the market, rather than tell the market that how dovish it will be.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3