Markets

12:35, 27-Feb-2019

CME Globex markets resume after nearly 3-hour glitch

Updated

15:05, 27-Feb-2019

CGTN

Chicago-based CME resumed its electronic futures and options markets at 11:45 a.m. Beijing time (9:45 p.m. U.S. central time) on Wednesday, after nearly three-hour halt to all of its Globex markets due to an unexpected technical glitch.

The outrage was a fresh reminder of the risks in electronic markets. The world's most-active financial instruments, including futures on Dow Jones Industrial Average, Nasdaq 100 and S&P 500 had not traded since 8:40 a.m. Beijing time.

It affected markets like Eurodollars, metals, grains, crude oil and natural gas. As trading resumed, the April WTI crude oil contract drop to 55.93 U.S. dollars per barrel from above 56 U.S. dollars.

"This is so annoying for our clients," Bloomberg quoted Hiroaki Kuramochi, a global sales trader and chief market analyst at Saxo Bank Securities in Tokyo.

Globex has been the backbone of CME's digital marketplace since 1992. In 2018, over 93 percent of the 4.7 billion derivatives contracts were traded electronically at the world's largest derivatives exchange.

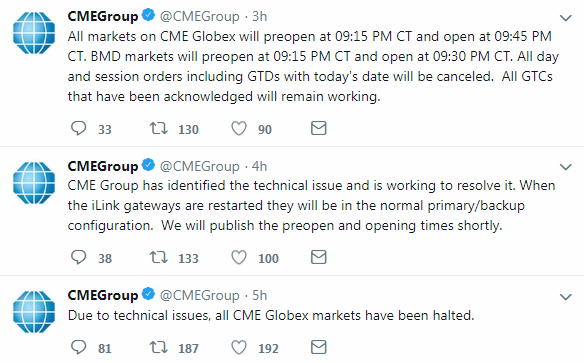

Twitter screenshot

Twitter screenshot

The bourse acknowledged on Twitter all CME Globex markets came to a halt due to technical issues. It tweeted it had identified the technical issue and was working to resolve it before trading resumed.

"All day and session orders including GTDs with today's date will be canceled. All GTCs that have been acknowledged will remain working," the bourse added on Twitter.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3