Business

21:47, 09-Jan-2019

China to further ease tax burdens for small businesses

Updated

20:38, 12-Jan-2019

CGTN

01:05

China will introduce a package of inclusive measures to ease the tax burdens for small and micro businesses, the State Council's executive meeting chaired by Premier Li Keqiang decided on Wednesday.

The country will further relax the standards for small businesses to enjoy preferential policies for income tax. For small firms with an annual taxable income less than one million yuan (about 146,500 U.S. dollars), and between one and three million yuan, the taxable amount will be reduced by 25 percent and 50 percent, respectively. In this case, the tax burdens will be reduced by five and 10 percent accordingly.

The preferential policy will cover more than 95 percent of corporate taxpayers, and 98 percent of them are private enterprises.

Meanwhile, local governments will be allowed to reduce local taxes like resources tax, city maintenance tax, stamp duty and urban land use tax, and education surcharge for small-scale taxpayers by no more than 50 percent.

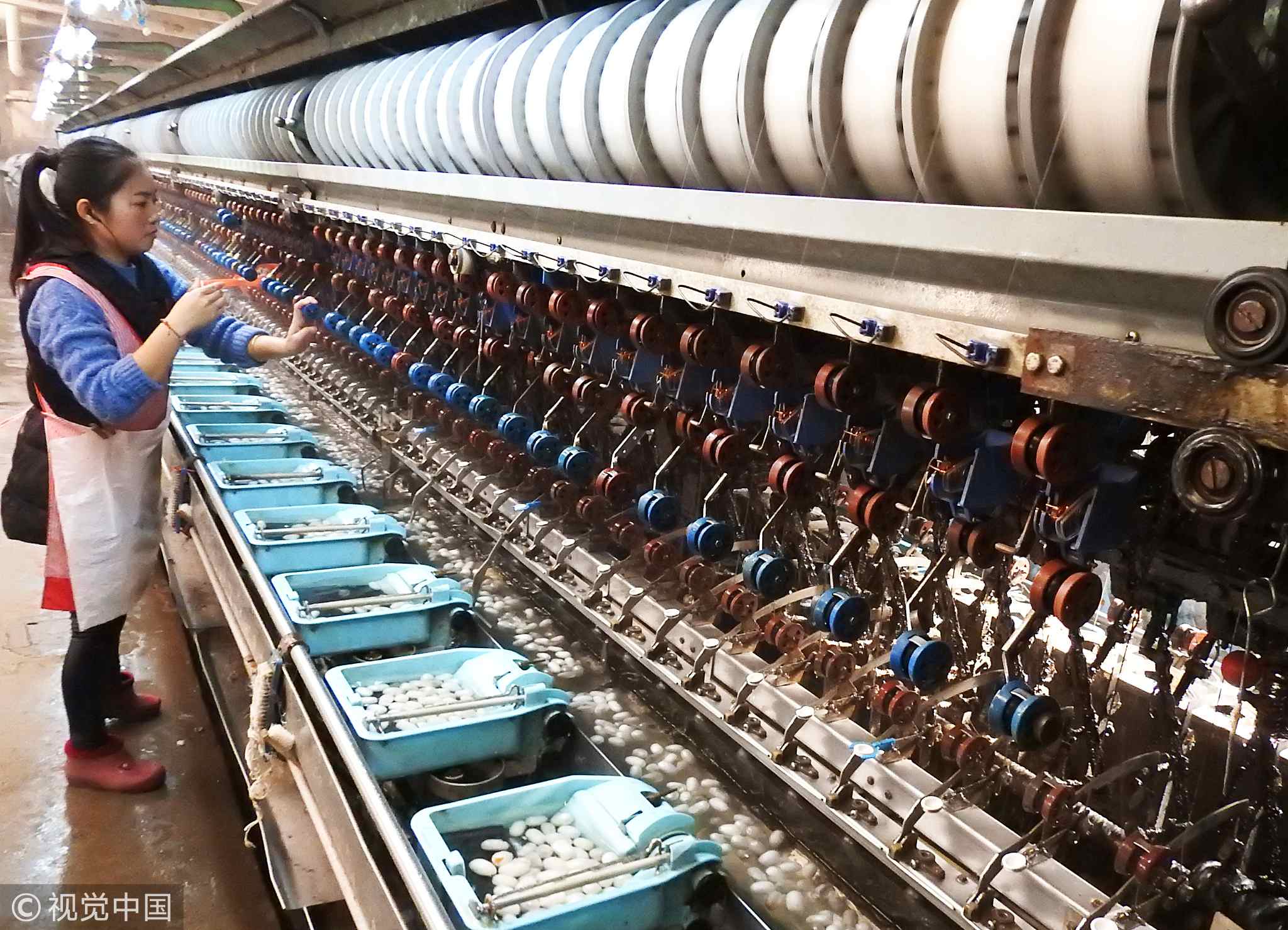

A reeling factory of a small enterprise in Lianyungang, east China's Jiangsu Province /VCG Photo

A reeling factory of a small enterprise in Lianyungang, east China's Jiangsu Province /VCG Photo

In addition, start-ups and hi-tech enterprises, as well as their venture capital investors and business angels, will have easier access to more preferential policies.

The central government, at the same time, will help fix the financial gap of local governments by further implementing general transfer payments from central to local governments.

The meeting said the above policies will be implemented in the next three years and small businesses are expected to enjoy an annual tax reduction of about 200 billion yuan.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3