Money Stories

12:00, 27-Mar-2019

Reshaping China's Economy: Is China sinking in debt?

Updated

15:12, 28-Mar-2019

Ge Yunfei

06:11

Editor's note: In the previous episode of the CGTN special series, Reshaping China's Economy, the issues of rising labor cost and economic transformation were discussed. Today, our reporter Ge Yunfei went to the northern industrial city of Tianjin, to see how the mounting debt had changed China.

China has gone crazy for skyscrapers.

Among the world's 10 tallest buildings, the country takes seven spots. Also, China boasts over 1,000 skyscrapers taller than 200 meters.

In the past decade, China's second- and third-tier cities have tried their best to catch up with the first-tier cities. For them, lifting the skylines is perhaps the best way to showcase their economic development. Along with the country's massive investment in its infrastructure comes the mounting debt.

Talking about China's economy, one of the most frequently used words is "leverage." Simply put, leverage is to borrow money to invest.

In China, the government debt ratio has stayed low for a long time because the government once objected the idea of borrowing money. However, in 2008, amid the global financial crisis, China launched a four trillion yuan economic stimulus package, kicking off the rapid expansion of debt.

China, Japan and the United States' ratios of government debt to GDP. /CGTN Photo

China, Japan and the United States' ratios of government debt to GDP. /CGTN Photo

According to the International Monetary Fund (IMF), in the past decade, the Chinese government's debt ratio increased from 27 percent to 50.1 percent, which raised lots of concerns. In the meantime, the United States' national debt-to-GDP ratio grew from 73.8 percent to 106.1 percent, and Japan's ratio increased from 183.4 percent to 238.2 percent.

Associate professor of applied economics at Peking University, Yan Se, said, "If we just think about this number, this is not worrying at all."

But numbers don't tell the whole story.

On the other side of Tianjin is one of China's versions of Manhattan, the Yujiapu Financial District. In the past decade, massive investment of 200 billion yuan (30 billion U.S. dollars) has turned the marshland into a concrete jungle of skyscrapers.

The strategy of "build-it, fill-it" worked in the era of high-speed growth. However, in a slowing economy, it's hard to fill those buildings with people and businesses.

"You've got some provinces that are heavily reliant on state-led fixed investment or a real estate market that may not have the supply and demand fundamental to build it and consume the houses that have been built," said the Chief China Economist of Standard Bank Jeremy Stevens.

The debt ratio in China's real estate sector had reached an all-time high of nearly 80 percent in 2018. Seeing the danger, Chinese President Xi Jinping warned that houses are built to be inhabited, not for speculation.

To lower the risks in the property market, the Chinese government has aggressively tried to curb the over-heated market in the past few years, with measures of putting price caps on properties. According to the chief analyst of Beike Real Estate Research Institute Xu Xiaole, the government noticeably reined in the rapidly rising property prices in big cities after this round of regulatory policies. Xu said, "The risk of rising financial leverage is gradually fading."

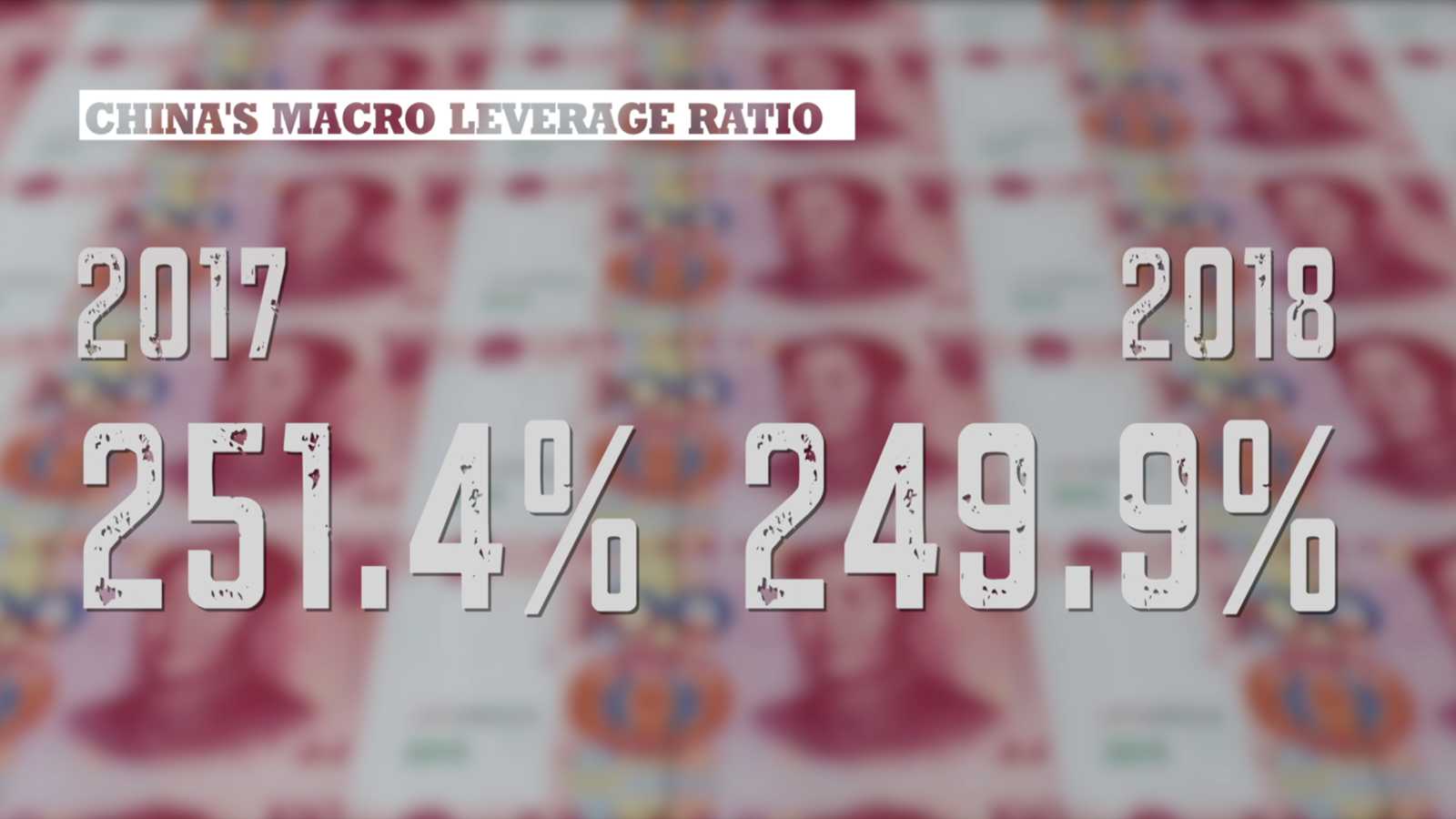

Curbing housing prices is part of the grand national deleveraging efforts. China's macro leverage ratio peaked in 2017 but decreased by 1.5 percentage points in 2018, marking the first drop in a decade.

"I think that that's something that the foreign community hasn't recognized, that sea-change in China over the last three years and how decisions are made," Stevens said.

Yan said that China's political system would give the country a unique strength in dealing with financial risks. "The Chinese government has a powerful coordination capacity. So they can mobilize resources to deal with any potential debt crisis."

In 2018, China's leverage ratio decreased for the first time in a decade. /CGTN Photo

In 2018, China's leverage ratio decreased for the first time in a decade. /CGTN Photo

As the financial risks come down, China still needs to find a new driving force to boost its economy.

The answer lies in the world's largest middle class, and their stunning consuming power. In the next episode, CGTN's Ge Yunfei will go to the world's smartest supermarket, and talk to the new forces in China's car manufacturing sector to check what leverage China has to win the future.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3