Business

15:58, 04-May-2018

China updated rules on RMB outbound investment scheme

CGTN

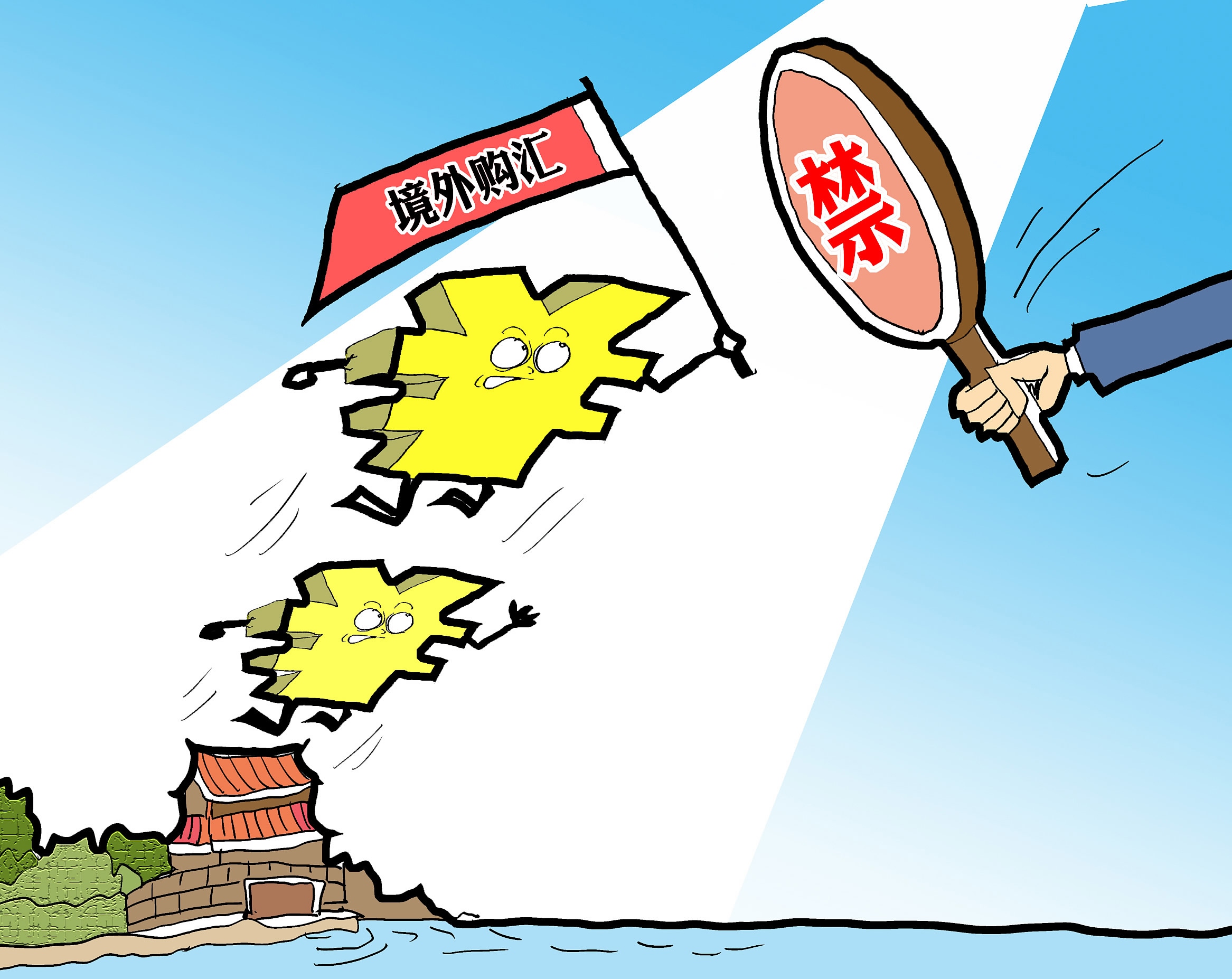

China’s central bank updated rules on the RMB Qualified Domestic Institutional Investors (RQDII) scheme that allows investors to buy yuan-denominated products in overseas markets. But the yuan must not be converted into foreign currencies under the scheme for overseas investment.

The People’s Bank of China (PBOC) published the notice on its website on Thursday mentioning that the RQDII investors to report basic information including the source and scale of yuan funds, investment plans and their overseas positions to the bank's Shanghai headquarters.

The PBOC also said that the overseas investment activities will be subject to the central bank's macro-prudential regulation based on factors such as cross-border capital flows, liquidity in the offshore RMB market and the development of yuan products.

VCG Photo

VCG Photo

China has yet to fully liberalize its capital account, with programs such as QDII and Qualified Foreign Institutional Investors (QFII) providing financial institutions with quotas in outbound and inbound investments, respectively.

What is QDII and QFII in China?

The PBOC’s notice, came after China last month resumed QDII scheme, which allows Chinese investors to convert yuan into foreign currencies to buy overseas securities.

Contrary to QFII by which China permits qualified foreign institutional investors to invest in listed domestic securities denominated in local currency, QDII stands for Qualified Domestic Institutional Investors. And domestic institutional investors authorized by the government could invest in the overseas capital markets under the foreign exchange control system in China.

VCG Photo

VCG Photo

To gradually open the capital account, the government introduced the QFII and RMB Qualified Foreign Institutional Investors (RQFII) programs in 2003 and 2011 respectively. They give foreign investors the right to move money into the account to encourage controlled flows.

The RQFII program is currently open to countries and regions including Britain, Singapore, France, the Republic of Korea, Germany, Qatar, Canada, Australia, Luxembourg and China's Hong Kong Special Administrative Region.

The opening up of the financial sector should go together with reform of the exchange rate formation mechanism and the process of advancing capital account convertibility, according to central bank governor Yi Gang.

(with input from Xinhua)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3