Opinion

12:08, 04-Apr-2019

Nascent deal under fire as China-U.S. trade talks enter ninth round

Chris Hawke

Editor's note: Chris Hawke is a graduate of the Columbia Graduate School of Journalism and a journalist who has reported for over two decades from Beijing, New York, the United Nations, Tokyo, Bangkok, Islamabad and Kabul for AP, UPI, and CBS. The article reflects the author's views, and not necessarily those of CGTN.

The U.S. and China hope to conclude trade talks by the end of this month, but are struggling with two major issues – how to enforce the agreement and how many of U.S. President Donald Trump's tariffs will be dropped.

In outlines of the deal that have been reported in different media sources, China is promising to buy hundreds of billions of dollars of U.S. goods. This will help bolster farmers and other constituencies hurt by Trump's trade war and will help his aim of reducing the trade deficit with China.

However, the deal is coming under fire in the U.S. media even before it is announced.

U.S. Trade Representative Robert Lighthizer (L) , listens to Chinese Vice Premier Liu He while they line up for a group photo at the Diaoyutai State Guesthouse in Beijing, February 15, 2019. /VCG Photo.

U.S. Trade Representative Robert Lighthizer (L) , listens to Chinese Vice Premier Liu He while they line up for a group photo at the Diaoyutai State Guesthouse in Beijing, February 15, 2019. /VCG Photo.

The criticisms take three main lines.

First, economists say that having a trade deficit per se is not problematic and therefore promises of purchasing quotas from Beijing are meaningless beyond the short-term gains to some of Trump's constituencies.

China has taken the money from its trade surpluses with the U.S. and plowed it back into the U.S. in the form of the Chinese government's purchases of U.S. Treasury bonds and direct investment from Chinese companies into the U.S. Money flowing into a country is generally considered a good thing.

Trump has come under fire for using trade deficits as shorthand for who is “winning” in trade, but no serious economist sees things that way.

From this perspective, an agreement that mainly delivers a promise from China to purchase more goods solves a problem that doesn't really exist. The U.S. business community is generally not supportive of quotas as a way to deal with trade issues with China.

The second major criticism is that a deal in which China promises to buy more goods will only reinforce the Chinese central government's command power over the economy, not reduce it, as critics want.

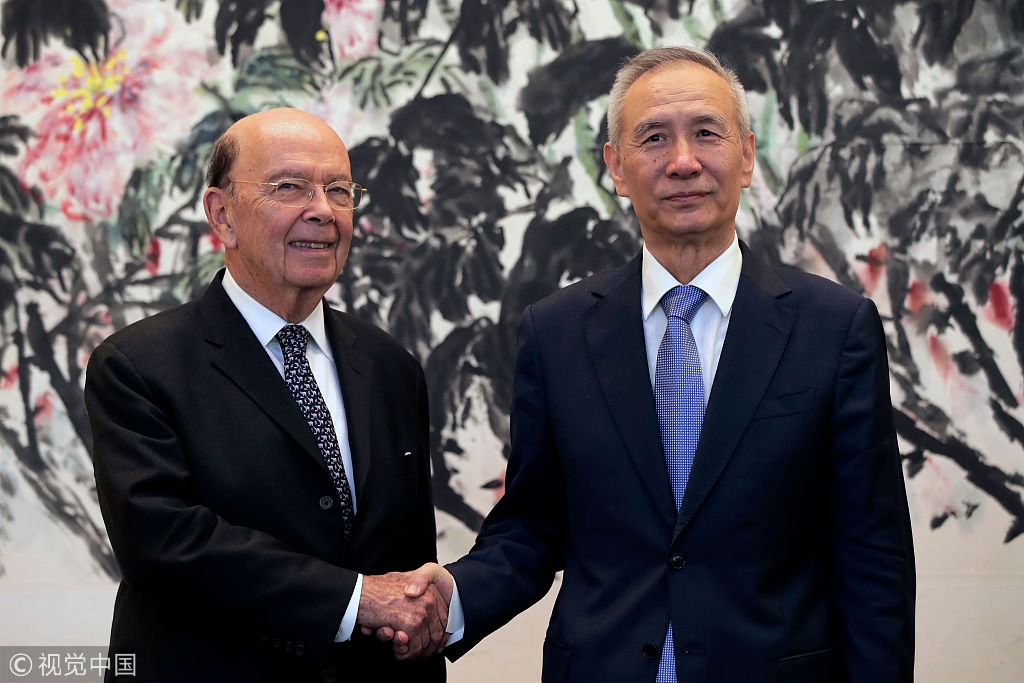

U.S. Commerce Secretary Wilbur Ross (L) shakes hands with Chinese Vice Premier Liu He as they pose for photographers after their meeting at the Diaoyutai State Guesthouse in Beijing, June 3, 2018. /VCG Photo.

U.S. Commerce Secretary Wilbur Ross (L) shakes hands with Chinese Vice Premier Liu He as they pose for photographers after their meeting at the Diaoyutai State Guesthouse in Beijing, June 3, 2018. /VCG Photo.

The U.S. economy is operating at full steam, and cannot easily ramp up to produce hundreds of billions of dollars' worth of goods. Making structural changes to do so will make the U.S. economy vulnerable, because what Beijing gives, it can take away. In the meantime, the U.S. will simply be selling goods to China it would have sold to another country, leading to no net advantage.

The third criticism is that the deal may do little or nothing to address the two main complaints from the U.S. and other countries about doing business in China.

The first complaint is that China has a “difficult, arbitrary and unfair regulatory” environment. Of particular concern are regulations which require foreign companies to partner up with Chinese companies and transfer technology and know-how to the Chinese partner.

The second complaint is that the Chinese government has a strong hand in guiding the economy, both through its policies and through the State-owned enterprises it directly controls. This may put domestic companies at an advantage.

China is already making significant and high-profile efforts to adjust its regulatory environment so foreign companies can compete on an equal footing. This can most easily be seen on China's so-called “negative list” of areas in which foreign investment is either banned or must be made through a Chinese partner. The list is becoming generally less restrictive each year.

Another example is a new rule that allows foreign enterprises to establish themselves with a single application to one government office, instead of having to go to a myriad of departments for endless approvals.

A trader works on the floor of the New York Stock Exchange (NYSE) in New York, January 22, 2019. /VCG Photo.

A trader works on the floor of the New York Stock Exchange (NYSE) in New York, January 22, 2019. /VCG Photo.

The government is also making a high profile general push to make its economy more open and rules-based to address concerns from foreign businesses. The government's high-profile celebration of the 40th anniversary of its reform and opening-up policy is a symbol of this drive to double down on economic reforms to make doing business easier and fairer for Chinese as well as foreigners.

Foreign demands that China essentially change its system of government and stop making five-year plans, stop developing its economy in a strategic and planned way, and get rid of or rein in state-owned enterprises are simply unrealistic and have no hope of getting traction. Critics who point out this puts U.S. companies at a disadvantage would get better results trying to orchestrate policy changes at home.

Having a healthy and fair long-term trade regime in place is in the best interests of China and the U.S., and both sides are reportedly angling to have a high-profile signing ceremony with President Trump and President Xi Jinping this month.

Serious observers will be looking beyond superficial purchasing quotas to see if a final deal on the one hand creates a more fair and competitive environment for U.S. companies to do business in China, while on the other hand respects the fundamentally different role the Chinese government takes in managing its economy compared to the U.S.

The current trade war has harmed both sides. Hopefully, it will end this month with a deal that addresses the legitimate concerns of both sides. A fair deal, rather than one that gives one side or the other a short-term advantage, will best serve the interests of everyone.

(If you want to contribute and have specific expertise, please contact us at opinions@cgtn.com)

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3