Business

12:25, 13-Sep-2018

Hurricane Florence, falling US inventories push oil past $80

Updated

11:37, 16-Sep-2018

CGTN

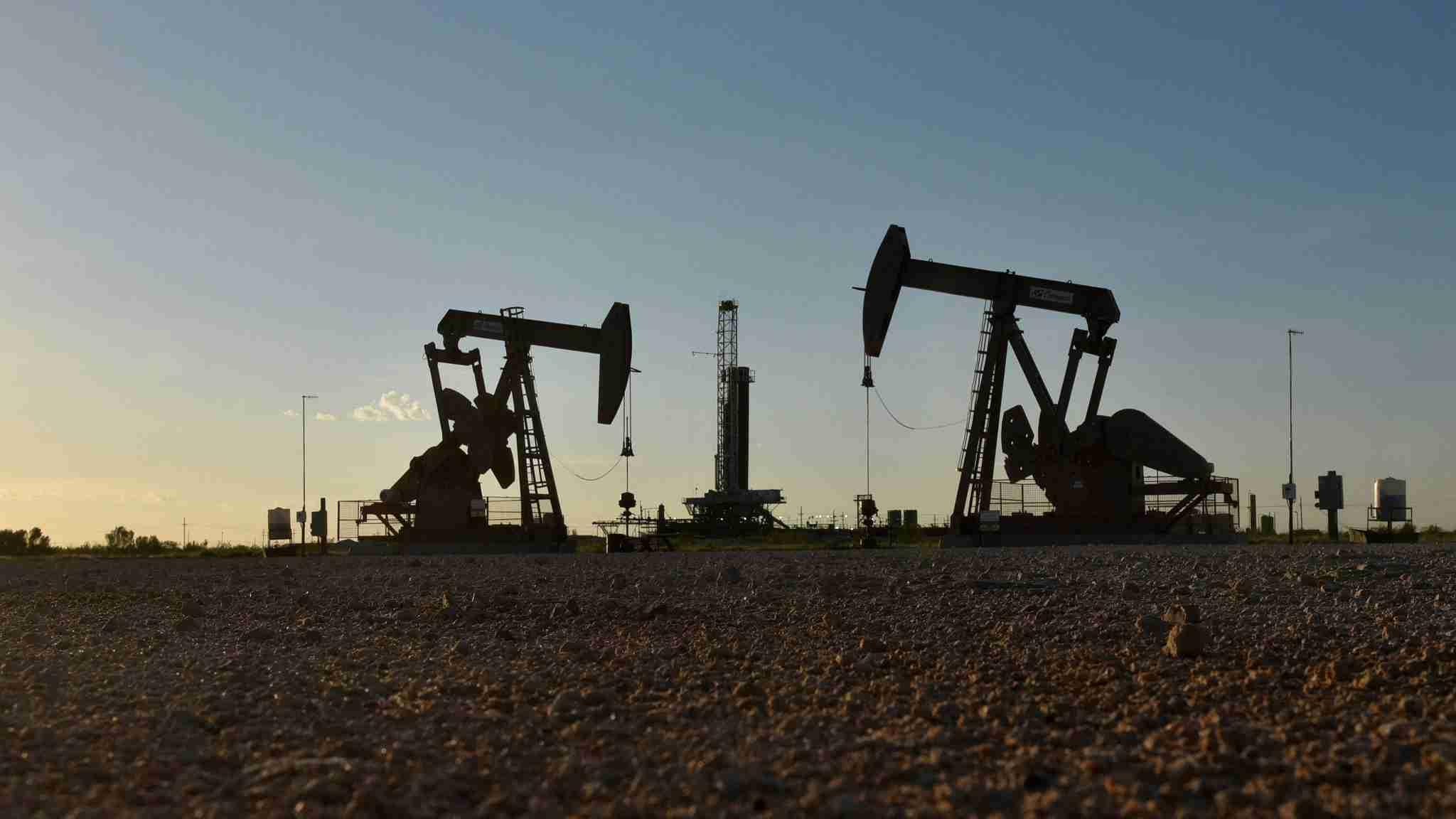

Oil prices breached 80 US dollars per barrel on Wednesday, amid a perfect storm circling falling inventories, Hurricane Florence's approach on the US east coast and the looming threat of sanctions on Iranian crude.

US Brent Crude futures were down to 79.63 US dollars per barrel on Thursday morning, after earlier hitting 80.13 US dollars on Wednesday.

Oil went up following a report from the US Energy Information Administration (EIA) on Wednesday, saying US commercial crude oil inventories decreased by 5.3 million barrels during the week ending September 7, partly due to a rise in exports.

According to Xinhua, the figure was well in excess of market expectations, and pushed US oil inventories down to their lowest level since May 2015.

Xinhua cited analysts as saying another factor in the price hike was the oncoming Hurricane Florence, which is set to hit the US oil-producing east Gulf coast on Thursday.

The threat of power outages and infrastructure damage could affect output despite the hurricane being downgraded to a category three storm on Wednesday.

In 2017, Hurricane Harvey battered US oil infrastructure, affecting almost a quarter of all output in the Gulf of Mexico.

Internationally, oil prices are increasing amid growing concerns on looming US sanctions against Iranian crude exports.

A second round of US sanctions will take effect in early November, including a total ban on Iranian oil exports and doing business with Iran's central bank.

According to Xinhua, a number of major international energy and industrial companies have quit Iran's market amid fears that they might fall prey to US punitive measures.

Xinhua reported earlier this month that European Union imports of Iranian oil had fallen by almost 50 percent in the past 18 months, despite Tehran holding talks with the EU on preserving the 2015 Iranian nuclear deal, formally known as the Joint Comprehensive Plan of Action (JCPOA), after the US withdrew from it in May.

On Wednesday, Russian Energy Minister Alexander Novak warned at the Eastern Economic Forum that there "is a huge uncertainty on the market how countries, which buy almost 2 million barrels per day of Iranian oil, will act. The situation should be closely watched, the right decisions should be taken."

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3