Economy

22:50, 04-Jan-2019

PBOC to continue private sector support in 2019

Updated

22:30, 07-Jan-2019

CGTN

China will continue to use bonds, credit loans and equity to support financing of private and small businesses in 2019, the People's Bank of China (PBOC) said at a two-day working conference ending on Friday.

China will encourage local governments to set up financing funds, boost use of corporate bonds and equity financing, improve abilities of payment, credit and commercial bank industries to serve private sector, according to the central bank.

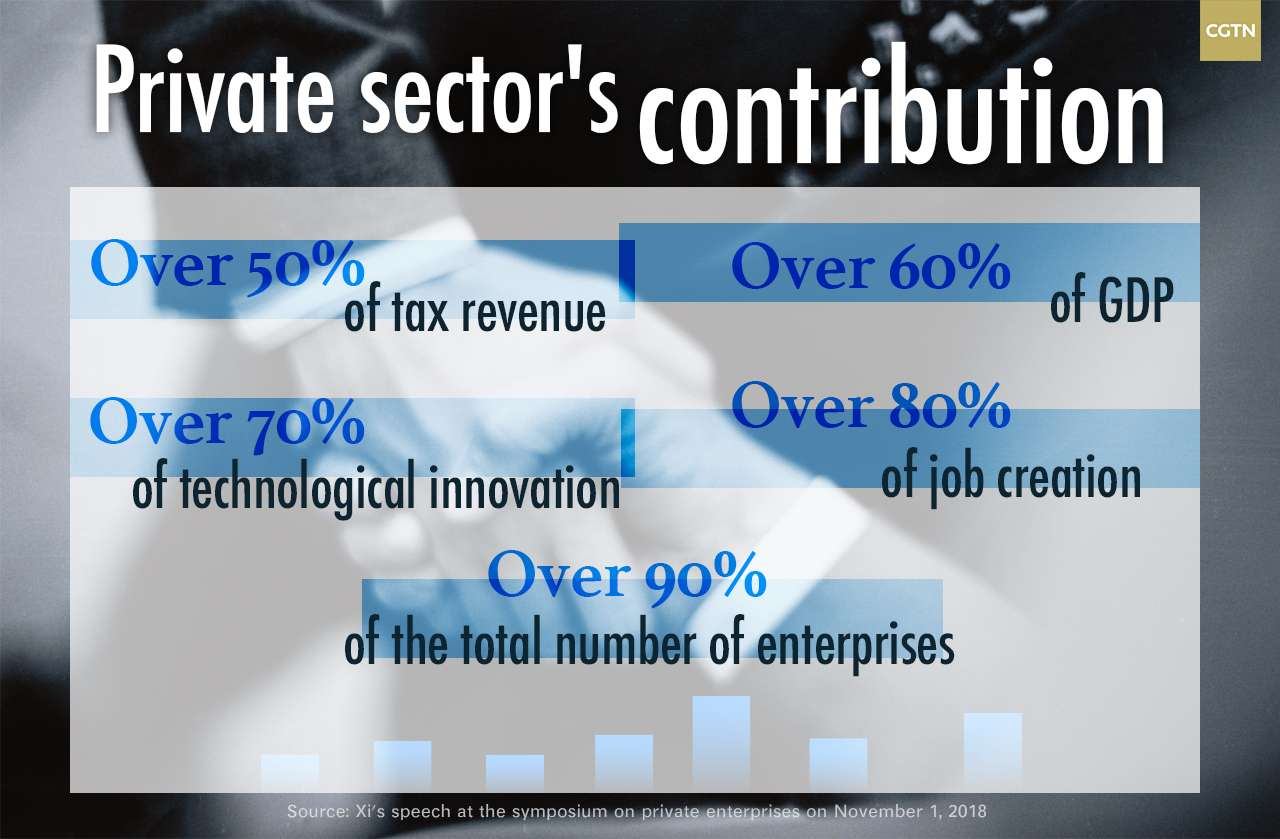

The private sector has become the main contributor to domestic job creation and technological innovation and an important source of tax revenue.

The PBOC just announced that it will cut banks' reserve requirement ratios (RRRs) by 1 percentage points, with half cuts on January 15 and January 25 respectively, to further support financing of private sector.

The central bank has cut RRRs for four times and raised cap on re-lending and rediscount for three times in the preceding year to support the real economy.

The PBOC will also continue to conduct prudent monetary policy, make more macroeconomic policy counter-cyclical adjustments, boost renminbi internationalization, and pilot foreign exchange management reform in free trade zones and ports, according to the working conference.

The PBOC's working conference is held annually to summarize last year's main work, analyze the current economic and financial situation, and make arrangements for major tasks next year.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3