World

13:15, 05-Jun-2018

Debt ease critical to Caribbean climate resilience

By Bertram Niles

When the first woman prime minister of Barbados took office at the end of last month, she expressed real concern about the fate of the country were a storm to strike during the new hurricane season which has just started.

Mia Mottley inherited an economy in dire straits and was forced to call in the International Monetary Fund (IMF) after reporting that public debt as a proportion of national income was as high as 171 percent of GDP.

This, she told the nation, is the third highest in the world behind only Japan and Greece. The fact is that Barbados is nearly broken with dwindling foreign reserves and little disposable income that could be used in the event of a 2018 repeat of hurricanes of the strength of Maria and Irma that devastated parts of the Caribbean last year.

But Barbados is not alone. Many of its neighbors are also drowning in debt and experiencing low or no growth.

When leaders of the Caribbean launched a public-private coalition to create the world's first "climate-smart zone" last December, they envisaged that debt restructuring or forgiveness would form part of the raft of measures that would help build more resilient infrastructure and communities across the region as the likelihood of future extreme weather events increases.

New Barbados Prime Minister Mia Mottley says she will seek to restructure the country's debt. /Barbados Government photo

New Barbados Prime Minister Mia Mottley says she will seek to restructure the country's debt. /Barbados Government photo

“We believe there is an absolute need, particularly for the most vulnerable countries, to reduce the debt burden that we have incurred over a period of time,” Grenada Prime Minister Keith Mitchell said last week.

Grenada, the world's second-largest exporter of nutmeg, was itself the victim of Hurricane Ivan in 2004, which damaged 90 percent of homes, forcing it into a debt restructuring program in the following two years. That still did not stop the Spice Isle, as the country is known, from defaulting on a portion of its debt in 2013 and negotiating a second refinancing.

The twin-island nation of Antigua and Barbuda was already spending some two-thirds of its tax revenues on servicing its debt when Irma slammed into Barbuda last September.

Prime Minister Gaston Browne told Reuters that getting lenders to extend the length of loans or provide interest forgiveness would free up much-needed money. “They can utilize those funds for other areas of development, even to assist with climate resilience,” he said.

Puerto Rico is another debt-ridden island. “Puerto Rico, which was already suffering from broken infrastructure & massive debt, is in deep trouble,” President Donald Trump wrote in a series of posts on Twitter after two storms hit the US territory in 2017. “Much of the Island was destroyed, with billions of dollars owed to Wall Street and the banks which, sadly, must be dealt with.”

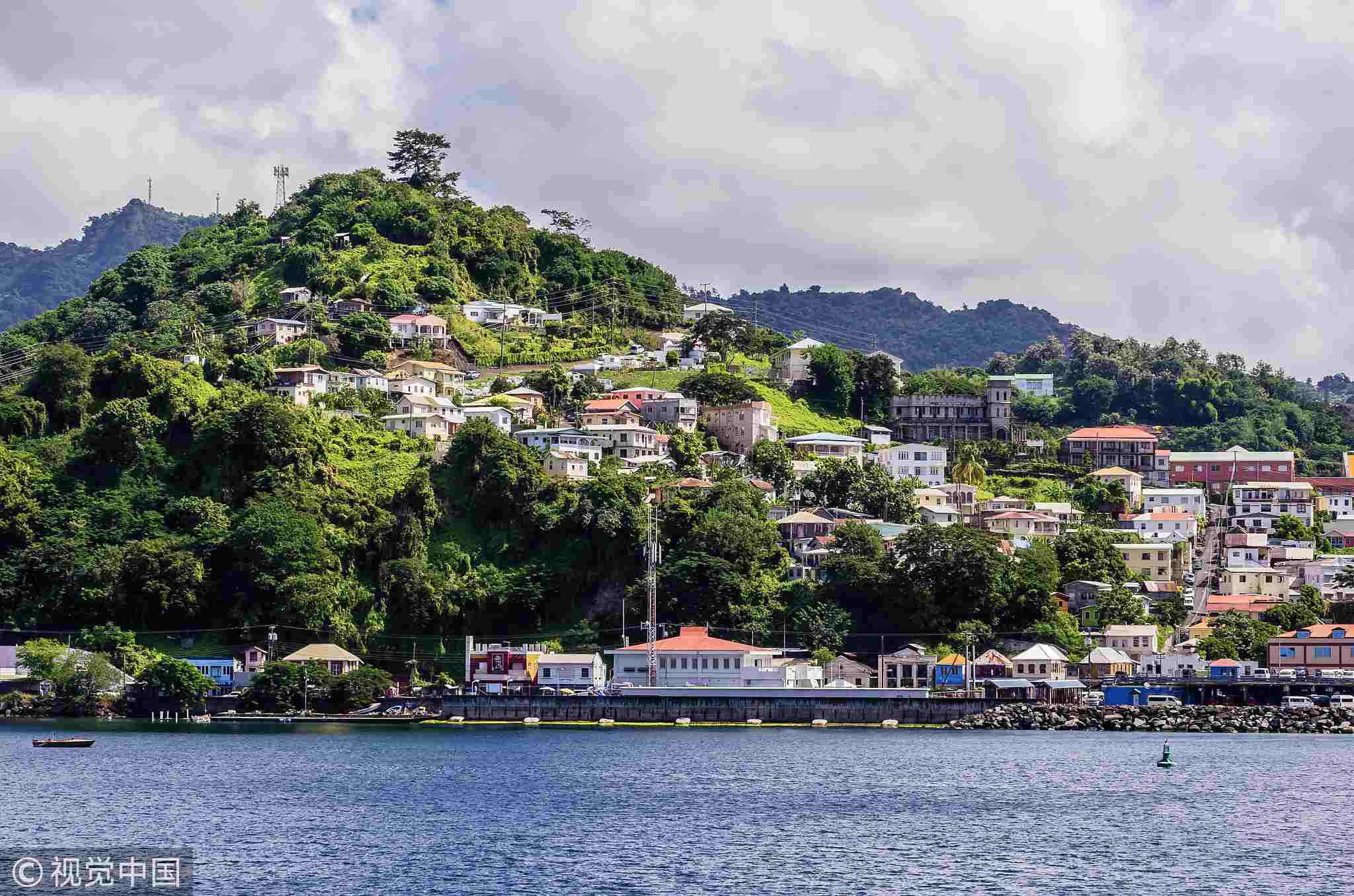

A hillside shot of St. George's, the capital of Grenada, which has had two debt restructurings this century. /VCG photo

A hillside shot of St. George's, the capital of Grenada, which has had two debt restructurings this century. /VCG photo

The region is in a race against time in a period of seemingly increasing superstorms, and in an international environment that is often unforgiving to small vulnerable economies and mistrustful of governments they feel may have mismanaged them.

As the hurricane season (June 1 to November 30) began, a new report by four climate scientists said that since 1980, the number of hurricanes with winds stronger than 200 kilometers per hour has doubled, and those with winds stronger than 250 kilometers per hour have tripled.

"The weight of the evidence suggests that the 30-year-old prediction of more intense and wetter tropical cyclones is coming to pass. This is a risk that we can no longer afford to ignore," wrote Michael Mann, director of the Earth System Science Center of Penn State University; Kerry Emanuel of the Massachusetts Institue of Technology, Stefan Rahmstorf of the Potsdam Institute for Climate Impact Research, and Jim Kossin of the US National Oceanic and Atmospheric Administration.

When the Caribbean "climate smart zone" proposal was launched in Paris, the leaders envisaged the creation of "innovative financing models such as a debt-for-resilience swap initiative in exchange for demonstrated progress on policy reforms and investments to strengthen resilience and promote climate-smart growth pathways."

VCG

VCG

Barbados has not waited until a hurricane strikes – the island has not had a direct hit since 1956 – to restructure its debt, with Mottley announcing the suspension of foreign commercial debt payments within days of her election.

“It is the worst possible time after a hurricane to be trying to restructure or renegotiate debt," noted Timothy Antoine, the governor of the Eastern Caribbean Central Bank, at a recent forum in Grenada on "Building Resilient Cities." "The precious resources in the Ministry of Finance have to be focused on rebuilding.”

He called for the introduction of “state-contingent debt instruments” to build debt resilience, according to the website of the Caribbean Development Bank, which organized the forum. The bank explained that these instruments link debt-service payments to a country’s capacity to pay, which is further linked to qualifying events such as natural disasters. In the event of a natural hazard, debt payments are automatically reduced or paused.

“For a qualifying event [or] disaster of a certain magnitude, there will be a standstill, such that it will not constitute a default," Timothy said. "And that will, of course, allow the country to have much-needed liquidity and begin the recovery process without the need for a default event.”

Mitchell remains confident that despite the buffeting, the Caribbean can recover.

“Resilience is etched in our DNAs and as such, innately, we as Caribbean people have the basics of what is required to push ahead sustainably," he said. "Therefore, with our own resolve and inherent inclination for triumph, coupled with climate-smart sustainable development policies, adequate financing, and effective partnerships, we can be well on our way towards building a truly resilient and prosperous Caribbean.”

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3