Business

19:20, 25-Jun-2018

Open Policies Mid-Year Report: How will a more open auto market redefine competition in China?

By CGTN’s Xia Cheng

03:18

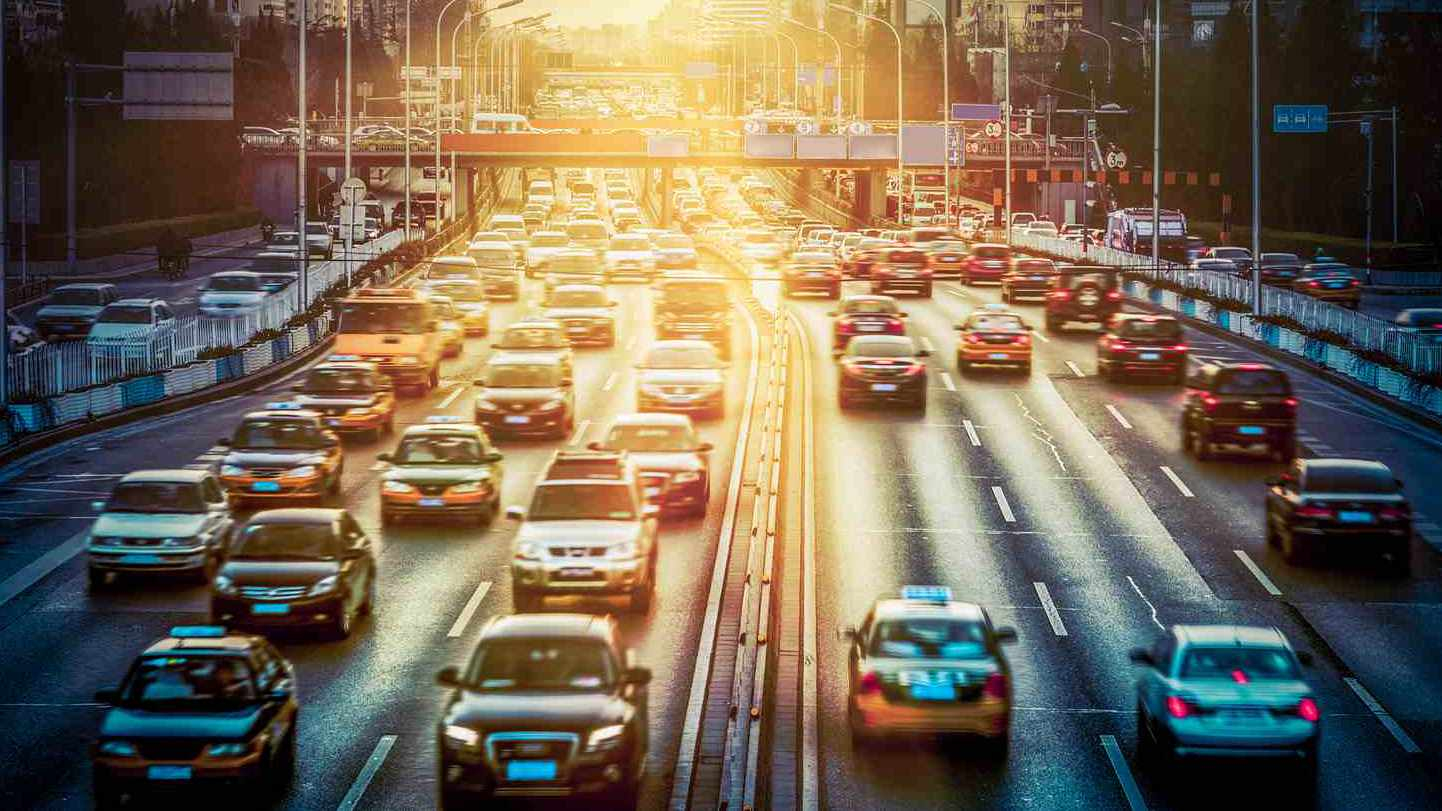

There's never been a more interesting time for China's auto market. China will phase out joint-venture (JV) restrictions for foreign automakers in five years, and import tariffs are cut. Experts believed that it would redefine competition in the world's largest auto market.

When full ownership is no longer a no-go for foreign auto brands in China, the question is whether to go solo or expand partnerships. Alex Xie, partner and managing director for the Boston Consulting Group, raising Tesla as an example, noted that foreign automakers that haven’t debuted in China, would have a chance to go solo.

VCG Photo

VCG Photo

But that's not what the majority of foreign auto brands are doing in China. “All big and strong guys (distributors) have already partnered with JVs (in China) right now. It’s difficult for foreign guys to go alone and try to build up a new distribution (network).” Alex explained.

The bottom line is not to lose market share to new competition, for example, the new breed of automakers. Those newcomers are claiming their Internet mindset helps capture the digital generation.

To win the tech race, Jaguar Land Rover, the UK's largest car manufacturer, is teaming up with five Chinese companies in fields like telecom, mapping, and autonomous driving. And Chinese tech giant Alibaba plays a role in US automaker Ford's plan to reverse declining sales in China.

But not all automakers would move in the direction of getting more JVs on board.

Doug Betts, senior VP of Global Automotive for J.D. Power, thinks that foreign automakers do need the support of local partners for understanding the domestic market, setting the dealer network and dealing with governments. They need to know if they can do it on their own now before making decisions whether to go solo.

VCG Photo

VCG Photo

Changes would come in 2030, when most auto JV contracts in China expire. But at that time, JVs’ survival still depends on their performance and value created, according to Xie.

For now, the bulk of the China revenues for global auto brands still comes from locally made cars, while auto imports and exports are only a fraction of total sales. And Xie believes that China’s manufacturing space is already quite open, but more foreign players in the Chinese market would provide more help for domestic suppliers to strengthen their supply chains and capabilities.

The pressure on Chinese auto brands is real. But if competition drives better quality of products and diversity gets consumers' adrenaline running, a more mature Chinese auto market would move to the inside track of mobility.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3