Business

16:04, 09-Jun-2018

Switzerland is poised to vote on radical ‘Vollgeld’

CGTN

Swiss voters are expected to go to polls on Sunday for a referendum on whether Switzerland should radically switch to a sovereign money system called Vollgeld, which would strip commercial banks of the power to create money through lending.

Switzerland, despite its small size, has an outsized financial sector and is the world’s biggest center for managing cross border wealth. Its referendum is attracting international interest as Vollgeld’s basic idea is to abolish “fractional reserve banking” – the basis for financial systems around the world.

What is the Vollgeld initiative?

The movement calling for sovereign money, or Vollgeld in German, gained 100,000 signatures, the number required under Swiss law to put the proposal to a vote.

Under Vollgeld, banks could lend only the money they administer in savings accounts, or what they get from relatively expensive money markets and the Swiss central bank, and instead, money will be exclusively created by the central bank.

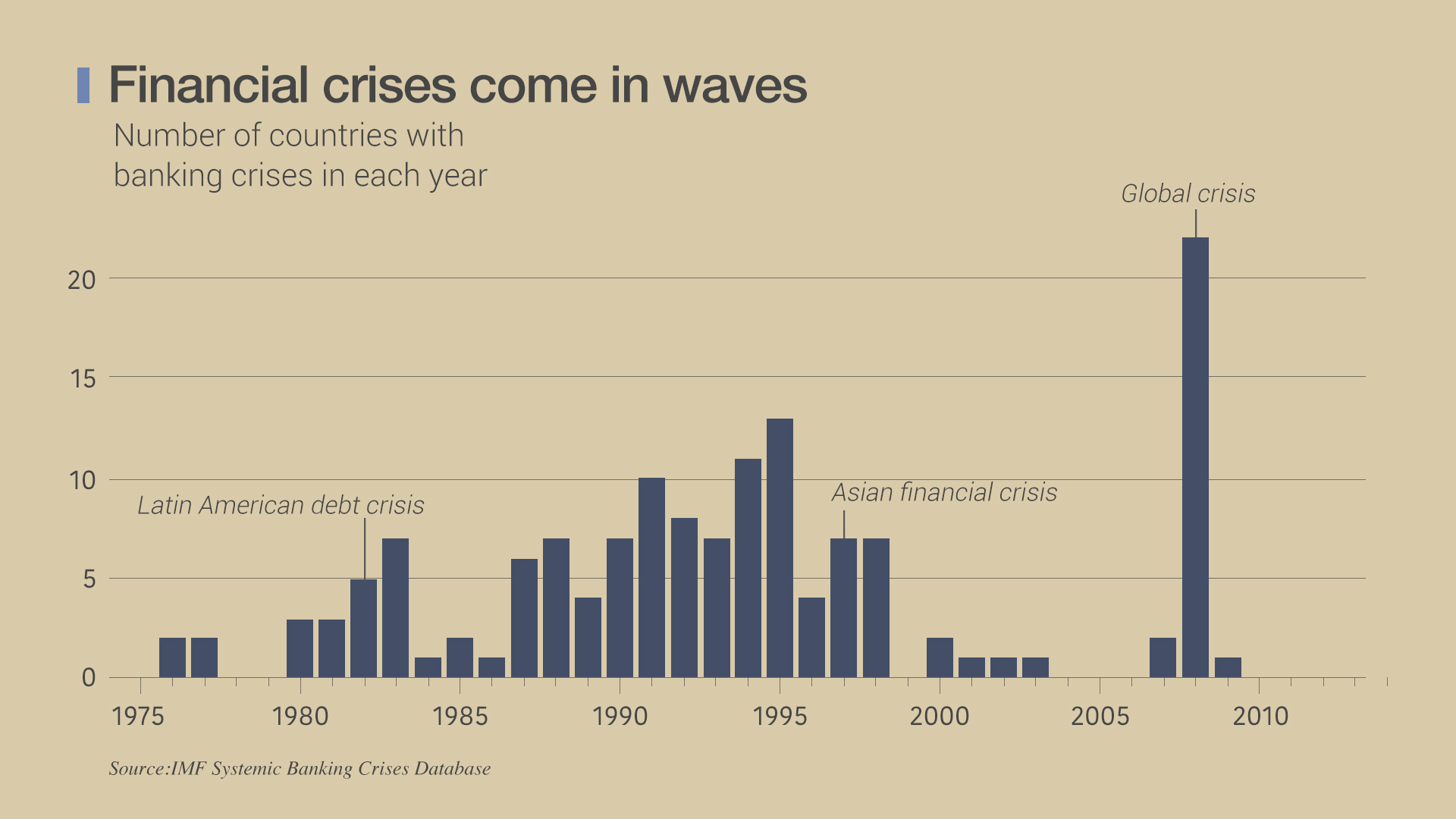

Supporters say the privilege of creating new money is often abused by banks, who are lending far too much money, leading to inflated debt bubbles, financial crises and consequent taxpayer bailout for banks “too big to fail.”

They argue that the initiative would prevent banks from fueling boom and bust cycles and make the financial system safer.

A “Yes” vote would mean less power to commercial banks and more power to the central bank.

Still the Swiss National Bank (SNB) is opposed to the proposal.

Why is the SNB opposed to getting this new power?

“Adoption of the initiative would represent a tectonic shift in our proven monetary and economic system, which has developed over a period of many years. Sovereign monetary system is an unnecessary and dangerous experiment which would inflict great damage on our country,” said the bank's chairman Thomas Jordan in a statement on the SNB website.

Thomas Jordan, president of the Swiss National Bank (SNB), pauses during the bank's annual general meeting in Bern, Switzerland, on April 27, 2018. /VCG Photo

Thomas Jordan, president of the Swiss National Bank (SNB), pauses during the bank's annual general meeting in Bern, Switzerland, on April 27, 2018. /VCG Photo

The SNB reckons that Vollgeld would crimp its ability to intervene in the foreign exchange markets.

The central bank’s efforts to prevent the Swiss franc from becoming vastly more expensive during the global and eurozone financial crises of the past decade have resulted in the world’s lowest interest rates at minus 0.75 percent.

Jordan said a “Yes” vote would make forex interventions more complicated, as the current system under which the SNB sells francs in exchange for foreign currency assets from banks could be viewed as violating the Vollgeld stipulation that money issued by the SNB must be “debt free.”

Another concern is that Vollgeld would require the government’s approval about the purpose for which new money would be created, and in this sense politicize the SNB and foster “central planning.”

Will the proposal pass?

Opinion polls indicate the initiative won’t pass – only a third of voters currently back the plan. But with a tenth of voters still undecided, fears of a Brexit-style shock remain.

Switzerland’s system allows referendums when just 100,000 signatures are collected. That often makes it a testing ground for radical ideas.

In the past year, the Swiss have also voted on plans to abolish TV licensing fees and introduce a universal “basic income” for all citizens. Both ideas were rejected decisively.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3