Business

18:13, 29-Jun-2018

World Cup fever cools stock market trading?

Updated

18:01, 02-Jul-2018

By CGTN's Liu Jing

Winning and losing, in sport or in trade – financial investments are affected by both; they go quiet and nervy and don’t like losing.

How influential can soccer results be on markets?

As humanity’s most popular sport, the quadrennial World Cup is one of the biggest events on the global calendar, but it probably won't help your stock portfolio score gains.

Brokers are seen at work while watching a replay of the FIFA 2014 World Cup football match Germany vs Argentina at the stock exchange in Frankfurt, Germany, on July 14, 2014. /VCG Photo

Brokers are seen at work while watching a replay of the FIFA 2014 World Cup football match Germany vs Argentina at the stock exchange in Frankfurt, Germany, on July 14, 2014. /VCG Photo

During the 2010 World Cup in South Africa -- the last to have similarly timed matches to those in Russia -- stock market trading volumes dropped an average of 55 percent when the country’s teams were playing, according to an ECB study of 15 international stock exchanges. An additional 5 percent drop in trading activity was recorded when a goal was scored.

Moreover, in football-mad nations, trading fell by 75 percent in Brazil when its national team was playing and by 79 percent in Argentina.

Trading activity was already down 40 percent by the time the pre-match national anthems played and remained subdued for 45 minutes after the final whistle when a market’s own team was playing, according to the ECB study.

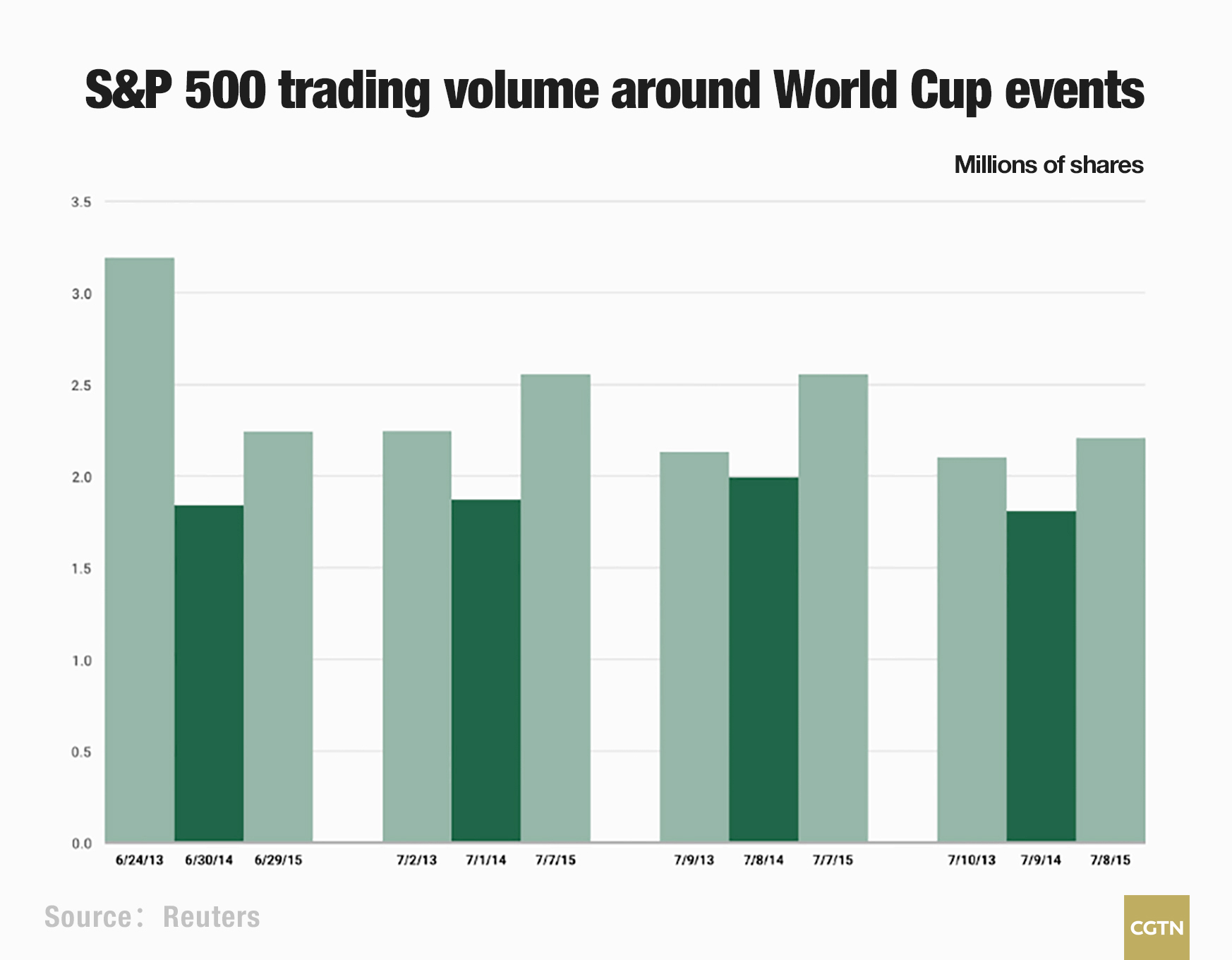

During a big 2014 World Cup game, we use the deep-green bars to represent trading volumes. The lighter bar on the left shows volume on the comparable day a year earlier and the bar on the right is a similar day a year after.

France faced Nigeria in Brazil at 1 p.m. local time on June 30. And Argentina versus Switzerland on July 1, France versus Germany on July 4, Brazil versus Germany on July 8, and the Netherlands versus Argentina on July 9. The US faced Belgium after the market closed on July 1.

Soccer results can even be influential on bond markets. German government bond trading almost halved during three of Germany’s matches in 2006 and 2010 World Cup games.

VCG Photo

VCG Photo

Excitement of victory

In October 2017, FIFA confirmed that a total of 400 million US dollars would be shared between the participants at the 2018 World Cup in the form of prize money. The winners will be paid 38 million US dollars with the runners-up getting 28 million dollars.

The prize may mean little for a country's economy. But the excitement of victory is likely to pass on to the stock market as the study from Goldman Sachs suggests. Empirical data shows the winner's stock index outperforms the global market by about 3.5 percent in the first month.

However, the excitement fades away quickly. The stock market in the winning country underperforms by around 4 on average over the year following the final. This is not good for investors in the winning nation.

Traders and workers react while watching the US 2014 World Cup soccer match against Germany on the floor of the New York Stock Exchange, June 26, 2014./ VCG Photo

Traders and workers react while watching the US 2014 World Cup soccer match against Germany on the floor of the New York Stock Exchange, June 26, 2014./ VCG Photo

Loss effect

Sports Sentiment and Stock Returns, which investigated the stock market reaction to sudden changes in investor mood, found a significant market decline after football losses. “This loss effect is stronger in small stocks and in more important games, and is robust to methodological changes.”

The researchers examined 1,100 football matches and stock returns in 39 countries, and found that a loss in the elimination stage leads to the national market falling by 0.5 percent the next day.

“It’s not that losing has especially damaging economic consequences, it simply influences investor mood.”

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3