Economy

15:12, 01-May-2019

China PMI, Euro GDP data challenge pessimism over global growth

Jimmy Zhu

Editor's Note: Jimmy Zhu is chief strategist at Fullerton Research. The article reflects the author's opinion, and not necessarily the views of CGTN.

Chinese factory activity data for April show that domestic demand remains largely stable, while a pick-up in external demand comes as a surprise, coinciding with better-than-expected euro zone GDP data.

A slight cooling off in headline figures has also eased pressure on authorities to tighten policies, acting as a positive catalyst to the domestic capital market.

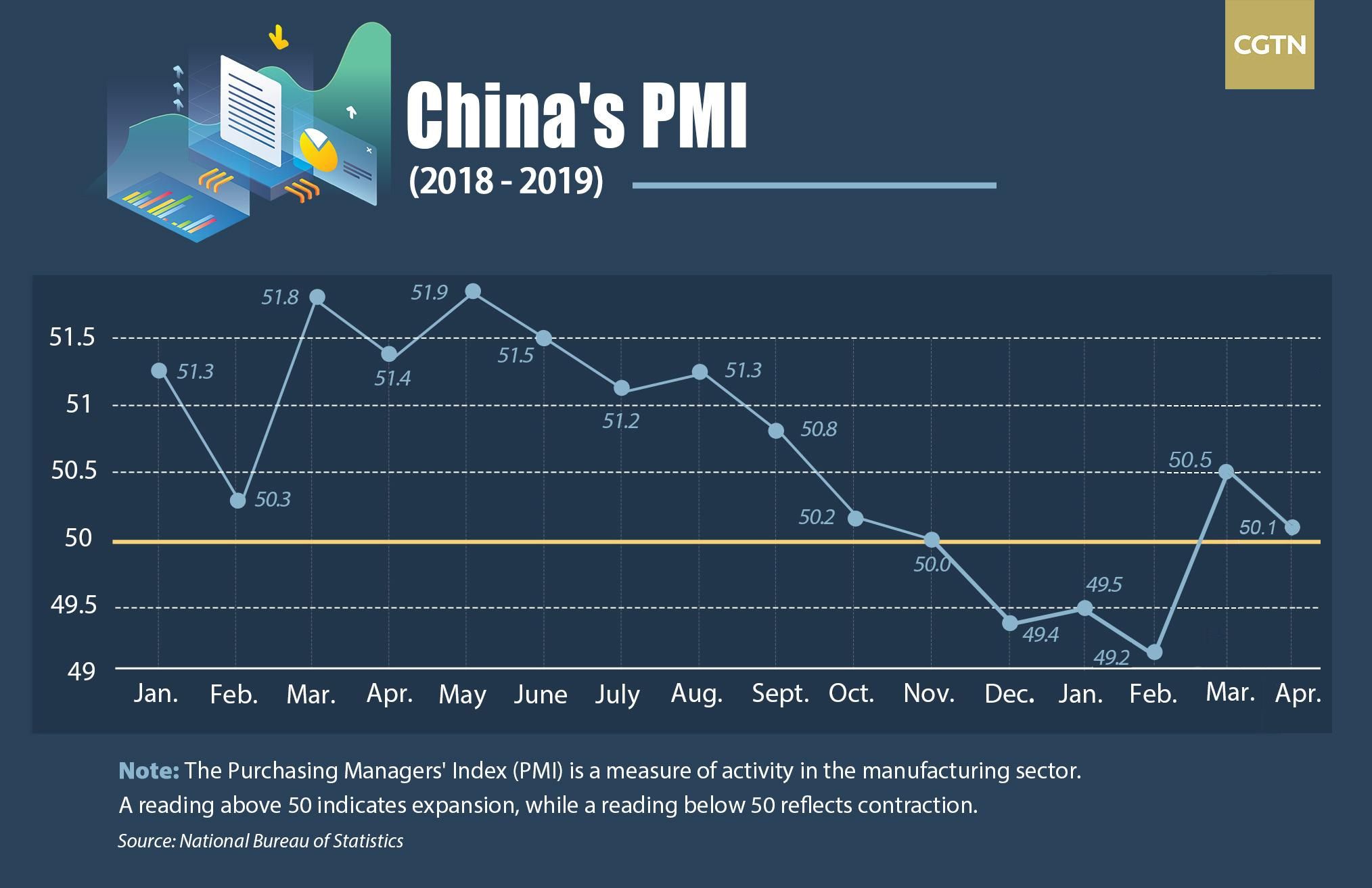

China's official manufacturing PMI data show that manufacturing PMI slightly slowed to 50.1 from 50.5, with the index remaining above the key threshold of 50. The slowdown in the headline figure raises concerns in the market that March's quick rebound in economic activity may have started to moderate.

PMI figures are generated through surveys. Therefore, when compared to other economic data such as industrial production or trade figures, surveyed data can be more or less sentimental. Shanghai stocks rallied 24 percent in the first three months of the year, marking the biggest quarterly gain since 2014, strengthening confidence on the economic outlook among business owners in different sectors. With stocks trading in a range pattern throughout April, the stock market's positive impact on PMI was mitigated.

March's economic data isn't a good benchmark for making comparisons, due to seasonally-driven volatility in the first quarter. Industrial production grew 8.5 percent in March, the highest reading since July 2014. Such a figure certainly doesn't match with current factory activity.

CGTN Image

CGTN Image

Manufacturing activity is still rising, but remains in the cycle of reaching the bottom, according to the PMI figure across a three-month average. The moving average of the PMI on a three-month rolling basis is still trending higher at this moment, suggesting the recovery is still ongoing. Still, with an average reading at 49.9 for the past three months, a sub-50 reading also indicates that the current recovery has not yet stabilized on a sustainable basis.

Infrastructure spending may have been one of the key drivers supporting industrial activity in recent months, and that trend is likely to continue. High-frequency industrial indicators also suggest that domestic demand is picking up. Power consumption rose 7.2 percent in March on a year-on-year basis, while steel production grew 11.4 percent and growth in cement production reached 22.2 percent during the same period.

When the People's Bank of China offered targeted medium-term loans a week ago, the stock market began a selloff, with the market considering the PBOC's move as a substitution for broad-based easing after the economy showed further signs of recovery. There is also some market speculation that a tightening cycle might not be far ahead.

A slight slowdown in headline PMI data would serve as a positive catalyst to the stock market in the near future. If PMI had trended higher after the March reading, concerns about policy tightening would only have intensified, leading to more jitters in the market in a continuation of the recent stock selloff. However, April's slightly lower reading at 50.1 signals that activity remains stabilized.

VCG Photo

VCG Photo

Another positive takeaway from April's PMI is that external demand isn't as pessimistic as markets had anticipated at the start of the year. New export orders sharply rose to 49.2 in April from a previous 47.1, with a rebound for a second consecutive month signaling a potential global recovery. US ISM manufacturing PMI rose by over one percentage point in March, while US companies' earnings reports in the first quarter have so far been, in general, better-than-expected. In the euro zone, factory PMI also staged a moderate recovery in April.

Data released on Tuesday show that euro zone GDP growth accelerated to 0.4 percent on a quarter-on-quarter basis, compared with 0.2 percent growth in the fourth quarter last year. Regarding growth in specific countries, Spain and Italy reported better-than-expected figures.

Global central banks have been busy with expressing dovish policy bias this year, with market investors starting to worry that central authorities may be aware of some negative economic events on the horizon which they don't know of yet. But China PMI and euro zone GDP data on Tuesday seem to be pointing towards a healthy recovery in the first quarter. Investors need to monitor closely whether the increasingly dovish rhetoric from global central banks is due to economic data, or the muted Federal Reserve.

SITEMAP

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3

Copyright © 2018 CGTN. Beijing ICP prepared NO.16065310-3